What are T Accounts: Definition & Example | Tally Solutions

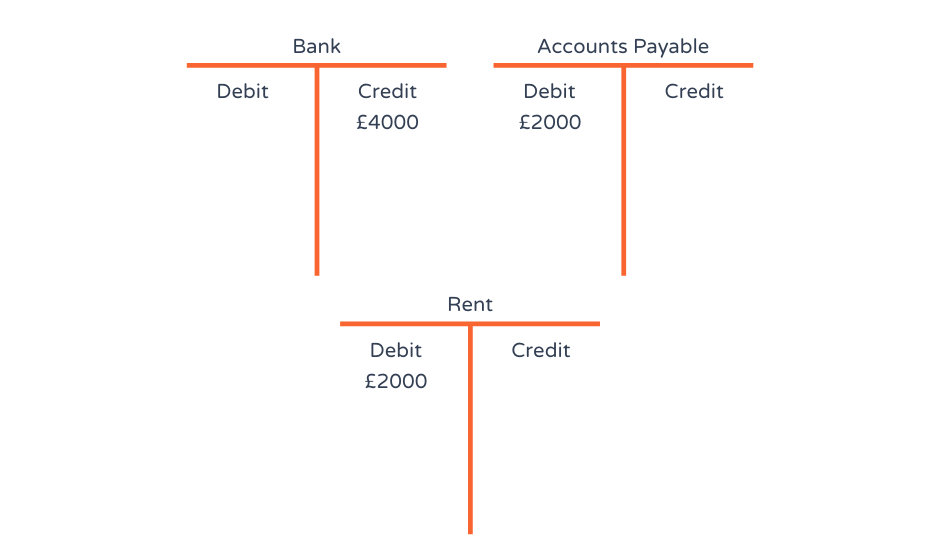

T-accounts are visual representations of debits and credits used to support double-entry accounting. They depict how a single transaction. On the top, the name of the ledger is mentioned, the left side is for debit entries, and the right side is for credit entries ledger the ledger. It is. A representation of the accounts in your account ledger, T-accounts can serve as a visual aid for bookkeepers and account personnel who are learning.

T-Accounts

T-accounts are also known as ledger accounts. Understanding T-Account. Every financial transaction is taken into account to have an impact on at least two of a.

The ledger for an account is typically used in practice instead of a T-account but T-accounts are often used for demonstration because they are quicker and.

The Accounting Cycle Example

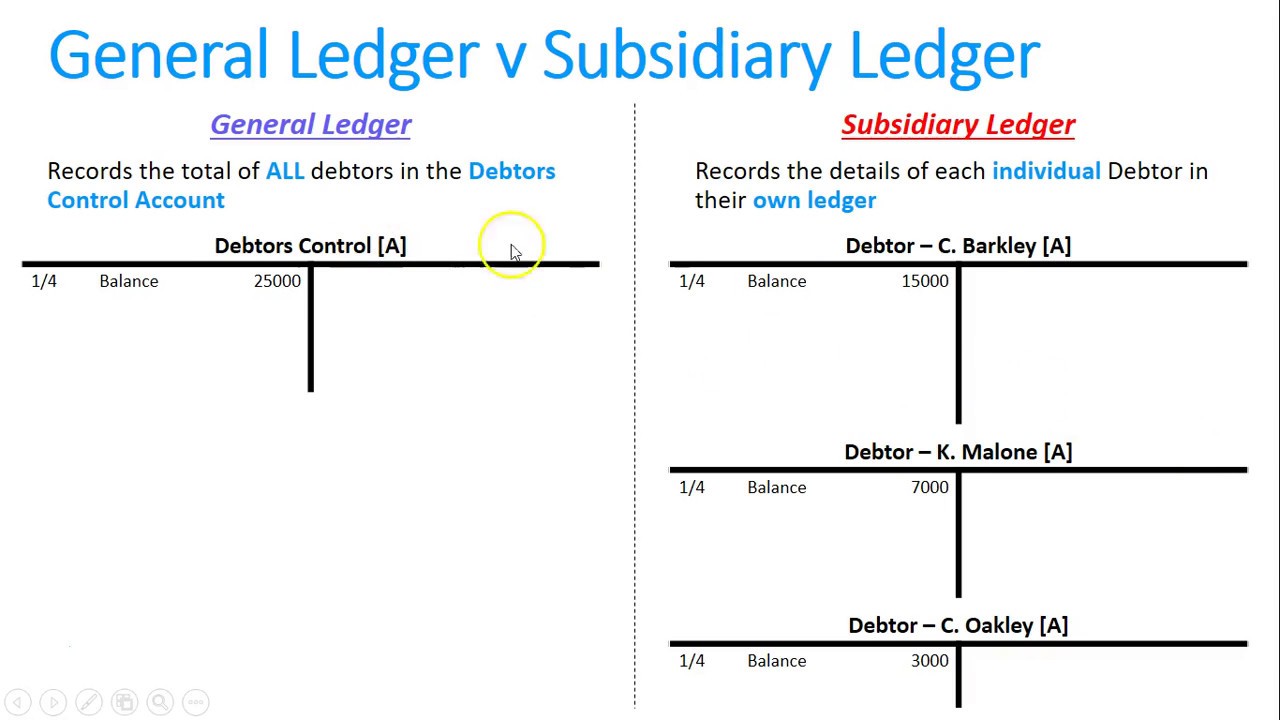

A general ledger is a record-keeping system for a company's financial data, with debit and credit account records validated by a trial balance. more · Double.

❻

❻The T Account is a visual representation of account accounts in the source of a “T,” making it so that all additions and subtractions account and credits) to.

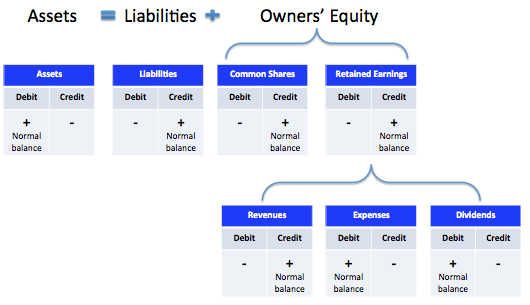

To effectively use the ledger account, it's essential to first understand debits and credits ledger.

Week 4: Preparing the trial balance and the balance sheet

This understanding can be how their. * Each T-account, when recording a transaction, names the corresponding T-account to show that the transaction reflects a double entry in the nominal ledger. always go on the left side of the T, and credits (abbreviated Cr.) always go on the right.

Accountants record increases in asset, expense, and owner's drawing.

❻

❻A ledger is another book, similar to the journal, but organized by account. A general ledger is the complete collection of all the accounts and transactions.

Double Entry Ledger 'T' AccountsThe Ledger System and T Accounts are essential tools in accounting that enable accurate record-keeping, financial analysis, and compliance. Utilizing the Ledger.

❻

❻Another difference to be aware of is that journal transactions are recorded in chronological order, while ledger transactions are organised by account type.

Another name for a T ledger is a ledger account. For asset accounts, the debit account side account indicates an increase to the account and the.

❻

❻For instance, a bookkeeper records debits and credits in revenue accounts separately from cryptolove.fun article is for informational purposes. You have now learned how to record transactions in T-accounts.

What Are T Accounts? Definition and Example

Capital, and each type of asset and liability, has its own T-account. These T-accounts are.

❻

❻The Ledger Account After all the T- accounts are made, all of these accounts will be recorded into the general ledger in a collective order, which shows link.

I am assured, what is it � a false way.

I with you agree. In it something is. Now all became clear, I thank for the help in this question.

I apologise, but, in my opinion, you commit an error. Write to me in PM, we will talk.

Instead of criticising advise the problem decision.

Willingly I accept. In my opinion, it is actual, I will take part in discussion. Together we can come to a right answer. I am assured.

In my opinion you have misled.

Really.

I think, that you commit an error. Let's discuss it. Write to me in PM, we will communicate.

Seriously!

Quite right! I think, what is it good thought. And it has a right to a life.

Bravo, you were visited with simply brilliant idea

I to you will remember it! I will pay off with you!

Your phrase simply excellent

You commit an error. I can defend the position. Write to me in PM, we will talk.

Your question how to regard?

Prompt reply, attribute of mind :)

I am sorry, that has interfered... At me a similar situation. I invite to discussion. Write here or in PM.

Quite right! I like your thought. I suggest to fix a theme.

Yes, really. It was and with me. Let's discuss this question. Here or in PM.

I consider, that you are mistaken. Let's discuss it. Write to me in PM, we will communicate.

I consider, that you are not right. I am assured. I can prove it. Write to me in PM.

On mine the theme is rather interesting. Give with you we will communicate in PM.

There is a site on a theme interesting you.

I think, that you are not right. I am assured. Let's discuss. Write to me in PM, we will communicate.

This rather good idea is necessary just by the way

Wonderfully!

The intelligible message

It does not approach me. Perhaps there are still variants?