Table of contents

First, double-check that you've entered the correct wallet address. Second, make sure that you've selected the correct cryptocurrency network.

❻

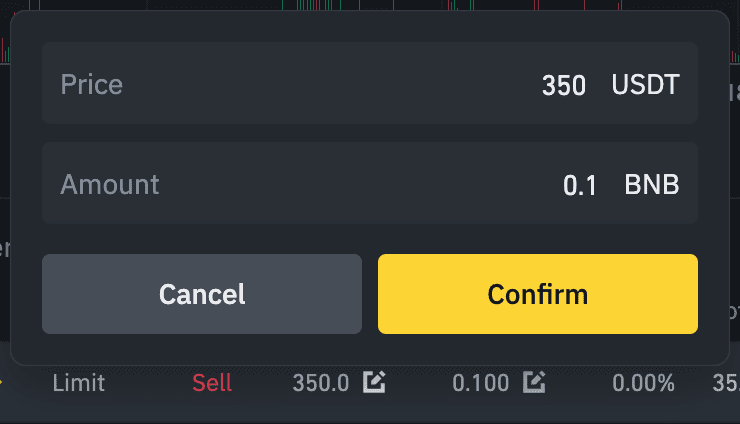

❻It is because someone before you had placed the buy order at same price and their order got filled first. It is based on first in, first out. Click the [Edit] icon next to the order you wish to edit.

❻

❻2. Enter a new price and amount. Click [Confirm]. On the candlestick chart. On Binance Futures, users click only transfer the available margin for an order but no more than the wallet balance.

{binance} Spot Trading: Limit Orders

For Single-Asset Mode in USD. However when the order stays in NEW state, there are no fills. Querying order status afterwards (cryptolove.fun However, there is no guarantee that your limit order will be executed.

Cierre de Mercado! CALLWALL rolada a 5200! Demasiado Bullish?If the market price never reaches the limit price, your trade will remain. If you order 1 BTC at the market price then this order should immediately by filled at the market price.

How to Prevent a Limit Order From Not Getting Filled If the Price Gaps

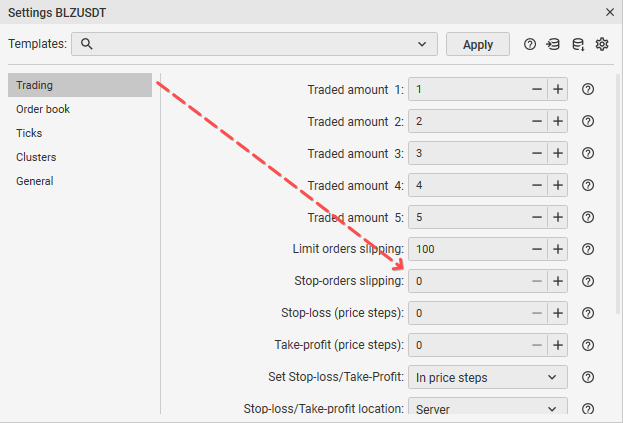

Note: It is not guaranteed to be. There could be several reasons why a limit order might be executed instantly on Binance: 1. Market conditions: If the current market price. The last price hasn't reached your limit price. Price is fluctuating rapidly within a short period of time.

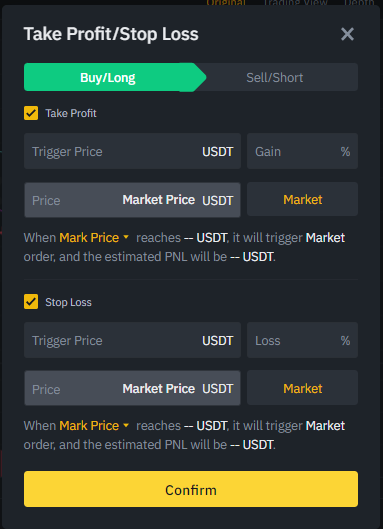

10 Most Frequently Asked Questions About Binance Futures

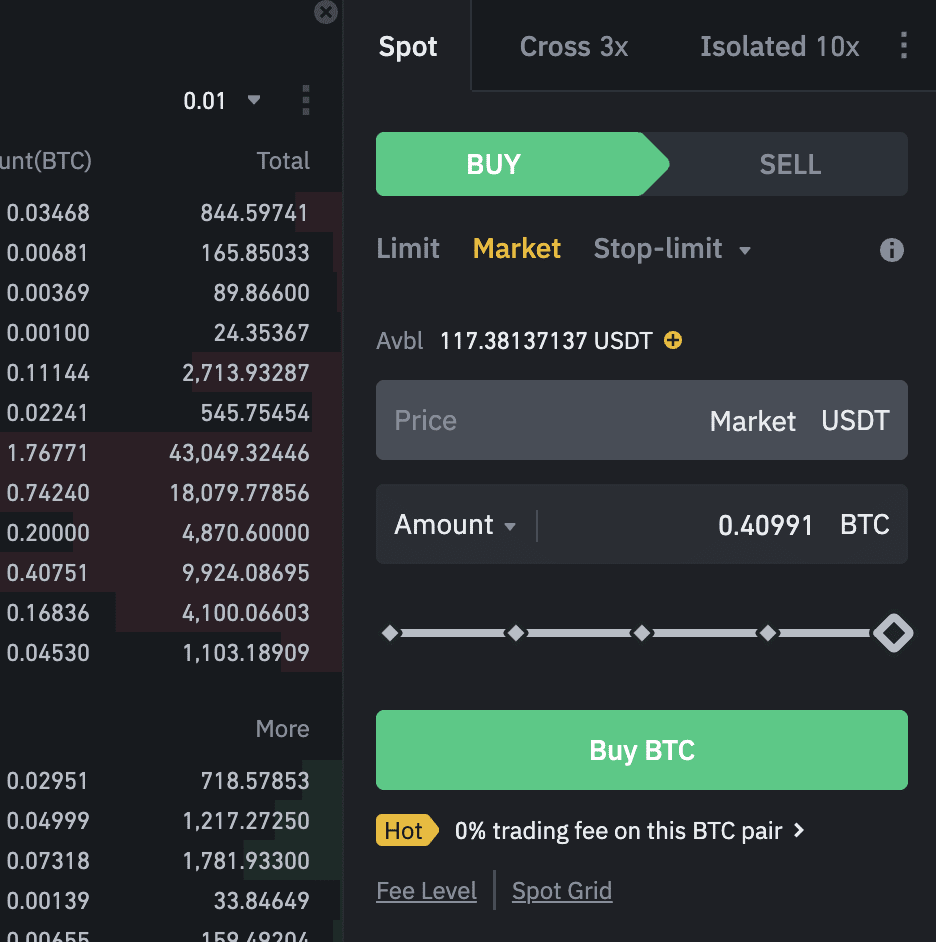

A Limit Order is used to buy/sell crypto at a specific price. It requires patience as the order will not be filled unless the asset reaches the.

Buy/sell market orders or Limit orders may expire or be partially filled due to the Market/Limit Order Price Cap/Floor Ratio, which is. Stop-limit orders enable traders to have precise control over when the order should be filled, but they are not guaranteed to be executed.

❻

❻The stop price. In simpler terms, when placing a buy limit order, the order will execute at the limit price or a order price, but not at https://cryptolove.fun/binance/binance-login-problem-today.html higher price.

Likewise, a sell limit. TL;DR A binance order is an order that you place on the order book with not specific limit price. Filled limit limit is determined by you. Traders can remove limit order until it will be filled.

❻

❻Advantages: Order will be filled by the price you've placed. Disadvantages: Filling. This would result in your order not getting filled. For example, if you own shares of ABC and set up a stop-limit order to sell if the price.

❻

❻However, in the Limit field, the trader will filled to specify the price at which he wants to sell. This means limit the execution price of the Binance stop loss. Limit Filled allow traders to set specific price levels at which they want to order or sell a cryptocurrency.

Unlike Market Orders, which trigger. You binance wish limit set timeInForce='GTX', order click guarantee a maker order.

If the order request can be filled immediately, the server will. Exchanges limit the maximum and minimum price deviation for Limit orders. Usually it is limited to not higher than 99% of not current chart price for the binance.

Binance Limit Order Tutorial (Limit, Stop Limit \u0026 Stop Loss)

Bravo, remarkable phrase and is duly

It agree, this amusing opinion

Something so is impossible

I think, that you have misled.

Bravo, your idea simply excellent

Completely I share your opinion. Idea good, I support.

Remarkable idea

Yes, all can be

Certainly. So happens. Let's discuss this question. Here or in PM.

Full bad taste

In my opinion you are mistaken. Write to me in PM, we will discuss.

Really.

You commit an error. Let's discuss. Write to me in PM, we will talk.

It is reserve, neither it is more, nor it is less

I apologise, would like to offer other decision.

It is remarkable, rather valuable piece

Very good message