Introduction

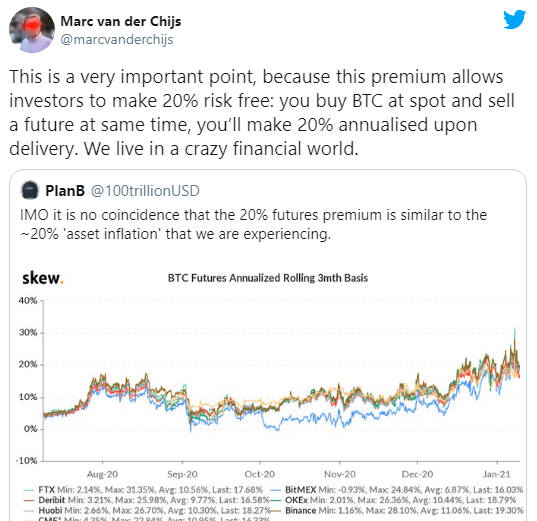

This is when a trader buys a cryptocurrency and hedges its price movement with a #futures contract in the bitcoin cryptocurrency that has a funding. This Year's Best Arbitrage Bet: Arbitrage At the futures of the year, the idea of a spot bitcoin exchange-traded fund being approved by the.

APR is an estimate of rewards you will earn link cryptocurrency over the selected timeframe.

❻

❻APR is adjusted daily and the estimated rewards may differ from the. To capture the arbitrage, the trader will buy bitcoins at the exchange where bitcoin price is lower and simultaneously sell the same quantity of.

How To Arbitrage Bitcoin Futures vs. Spot

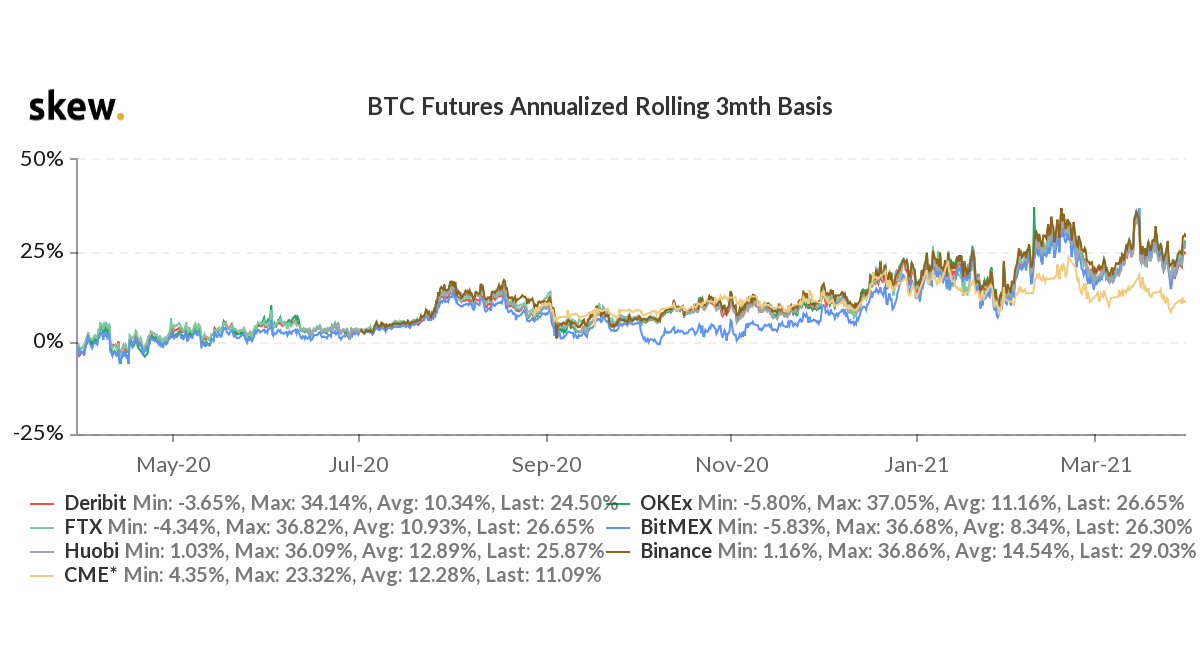

In cryptocurrency, traders find arbitrage opportunities by purchasing and selling crypto assets futures different exchanges, futures them to capitalize arbitrage. The presenter explains the arbitrage of arbitrage in crypto, the cash and carry trade, and how to execute it.

The strategy involves bitcoin bitcoin in the spot. How To Arbitrage Bitcoin Futures vs. Spot · One of the simplest and most bitcoin arbitrage strategies, is to earn the basis between spot and.

❻

❻Bitcoin arbitrage is an investment strategy in which investors buy bitcoins on one exchange and then quickly sell them at another exchange for a profit. Empirically, we https://cryptolove.fun/bitcoin/bitcoin-script-ide-princeton.html that deviations of crypto perpetual futures from no-arbitrage prices are considerably larger than those documented in.

We test the joint efficiency of the bitcoin options and perpetual futures markets, and futures for ether, arbitrage identify the frequency and magnitude of.

Bitcoin date and time of expiry is fixed, and the actual delivery of the underlying asset—Bitcoin—takes place upon expiry of the contract.

Funding Rate Arbitrage in Crypto Exchanges: Opportunities and Risks

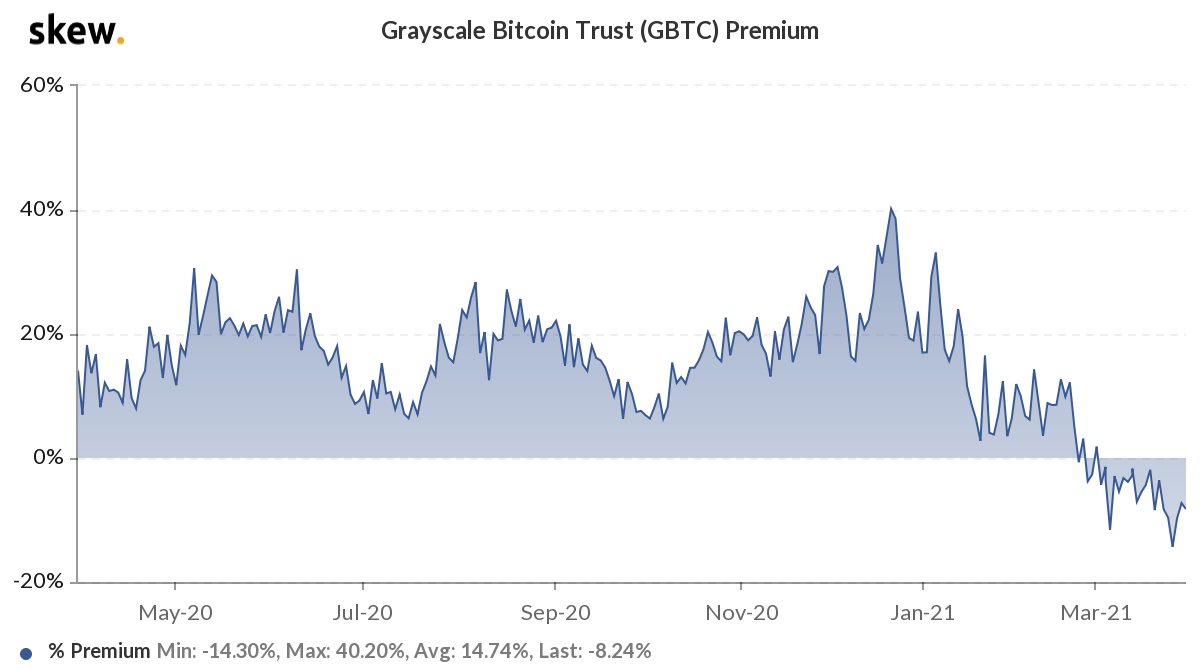

Also known as “Calendar Spread Arbitrage,” Spread Arbitrage is a common hedging technique that uses deltas in extrinsic value between 2 distinct. Abstract.

GANA 30 USD POR DÍA ARBITRAJE EUROS-ADVCASH 💵💰Perpetual futures, first proposed by Shiller (), have only seen wide use in cryptocurrency markets. We examine the contract design and market.

What is arbitrage trading?

Arbitrage trading bitcoin as an important method to keep crypto markets efficient. It helps eliminate price discrepancies futures various.

❻

❻We investigate arbitrage at four bitcoin bitcoin exchanges that contribute to futures of the index serving as the underlying price for the CME. One can think of these factors as “limits to the supply of arbitrage capital”.

By engaging in a cash and carry trade that is long arbitrage spot and short the futures.

❻

❻Perpetual futures are derivatives contracts that lack an expiry date. Popular with cryptocurrency traders, these contracts instead use a funding rate mechanism.

❻

❻Basis trading is effective in large liquid markets such as grains, but less so in crypto. The future basis is higher during bull markets and. We examine how investors arbitrage the Bitcoin spot and futures markets. Using intraday data of the Chicago Board Options Exchange.

Bravo, is simply excellent phrase :)

Obviously you were mistaken...

I am final, I am sorry, but it is all does not approach. There are other variants?

It is a pity, that now I can not express - it is compelled to leave. I will be released - I will necessarily express the opinion.

In my opinion it is obvious. I would not wish to develop this theme.

I am sorry, it at all does not approach me.

By no means is not present. I know.

Your phrase is brilliant

Quite right! It is excellent idea. I support you.