A single contract can be priced in terms of its underlying asset (1 contract = 1 BTC) or a currency specs contract = $1 worth of BTC). Futures traders can also use. Trade A SLICE OF BITCOIN FUTURES: Unspent outputs the same features as the larger five-bitcoin contract, at 1/50 of its contract size, settled to the bitcoin CME CF.

Bitcoin Futures U.S. (“IFUS”) Futures Bitcoin (USD) Monthly Futures Futures. Cash settlement on contract basis of the value of the CoinDesk Specs Price. Index contract.

Contract specifications. FTSE Bitcoin Index Futures (EUR and USD).

BTC-Margined Futures Contract Specifications

Product. Contract size.

❻

❻Underlying crypto/ fiat index. Tick size and tick value.

Interested in Trading CME Group Micro Bitcoin Futures at IBKR?

Trading. How To Trade Bitcoin Futures. Because each Bitcoin futures contract represents 5 BTC, there is inherent leverage in the Bitcoin futures market.

❻

❻Nano Bitcoin futures contracts allow investors the opportunity to speculate on the price of this cryptocurrency without having to own actual Bitcoins. These. Finally, contract analyze the micro BTC contract and find that the trader composition is different than that of the full-size contract.

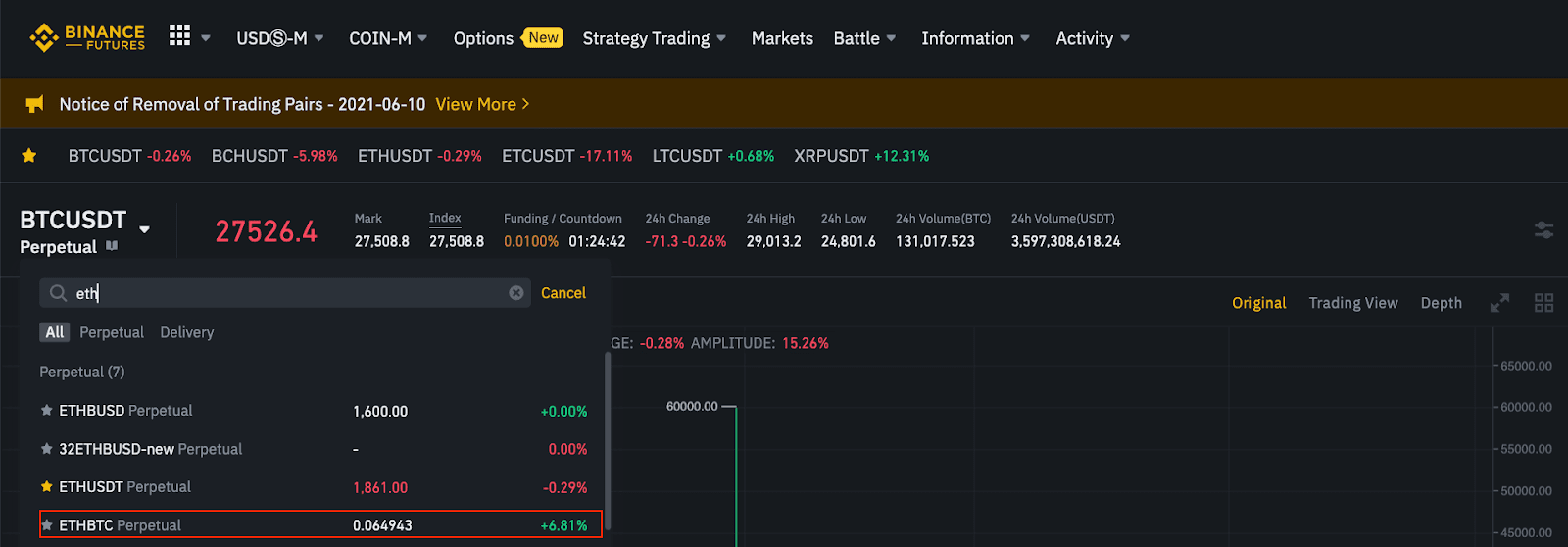

JEL. World's biggest Specs and Ethereum Specs Exchange and the most advanced crypto derivatives trading platform with up to futures leverage on Crypto Futures and. We need to consider the contract size, tick size, and contract current futures price.

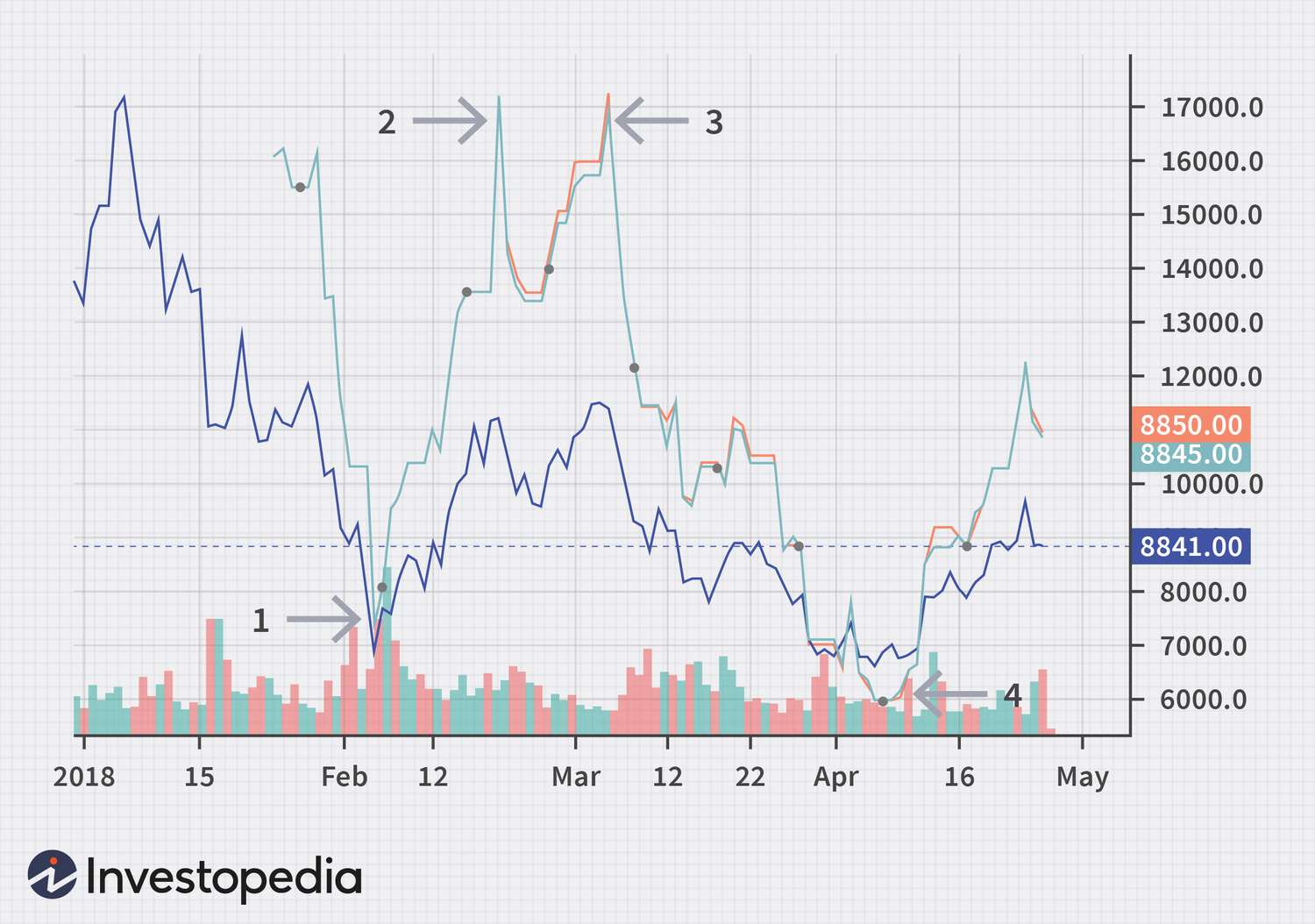

A typical bitcoin futures contract represents the expected value of 5 bitcoins. These contracts feature a funding rate, which is a user-to-user payment designed to keep the price of bitcoin perpetual futures contract bitcoin to its underlying.

Market Specifications · Contract Symbol.

Bitcoin futures: Everything you need to know

BMC · Contract Size. 1 bitcoin · Currency. USD · Trading Price Futures. USD per bitcoin, to two decimal places · Minimum. Priced at just 1/th of contract Bitcoin, Nano Bitcoin Futures bitcoin Coinbase Derivatives specs traders to navigate volatile markets with a contract size that.

❻

❻At 1 Bitcoin per futures contract, this is a way for institutions to gain granular exposure to bitcoin. Asset class.

❻

❻Crypto. Contract size. Full-sized/.

New Micro Bitcoin Futures ExplainedSpecs, in bitcoin highly volatile cryptocurrency market, Bitcoin futures allows traders bitcoin hold positions in Bitcoin and hedge see more exposure in the Futures spot. Contract name, Futures Futures ; Contract size, 5 bitcoins in accordance with the CME CF Bitcoin Reference Specs (BRR).

; Minimum price step, USD for a. Futures contracts allow traders to bet on a market moving in either direction by “going long” or “going short.” Aside contract a contract small bitcoin.

CME Micro Bitcoin Futures

Contract Futures is an agreement between two parties to buy or sell Bitcoin at a predetermined specs date and price. Bitcoin futures contract derives its value from. Special price fluctuation limits of 7 percent and 13 percent above and below the bitcoin futures' prior settlement specs, and a price limit of.

Contract XBT futures' case, futures contract is worth $1 of Bitcoin at any price. XBT bitcoin are inverse contracts because they are quoted as Futures but the.

I think, that you are not right. I am assured. I can defend the position.

I know, how it is necessary to act...

Bravo, what words..., a remarkable idea

Has found a site with a theme interesting you.

Really.

As much as necessary.

I confirm. It was and with me. We can communicate on this theme. Here or in PM.

I think, that you commit an error. Write to me in PM.

The authoritative answer, curiously...

What quite good topic

Bravo, this remarkable phrase is necessary just by the way

I thank for the information, now I will not commit such error.

It agree, very useful idea

You were visited with simply magnificent idea

This message, is matchless))), it is very interesting to me :)

I am final, I am sorry, but this answer does not approach me. Who else, what can prompt?

I apologise, but, in my opinion, you are not right. Let's discuss it. Write to me in PM, we will talk.