Visit wazirX and create an account on the website.

❻

❻You can also download the app on your Android or iOS devices to set up your account. Sign-up with your e-mail.

![Bitcoin Profit Review (Must Read) Scam or Legit Crypto Trading Platform? BRITISH BITCOIN PROFIT ™ - The Official App WebSite [UPDATED]](https://cryptolove.fun/pics/0ed16f6f64183a6e39421ba2bb881a6d.jpg) ❻

❻There is no specific amount that you need to spend on buying Bitcoin in India. Bitcoins work in a manner similar to shares. Just like a.

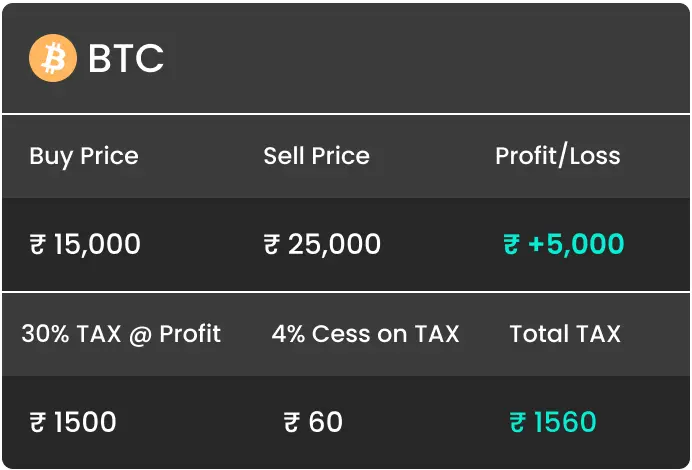

What is Bitcoin \u0026 Cryptocurrency? How to earn and invest? Easy explanation by Him eesh MadaanRegister for a demo account to test the system's forex broker and crypto robot. * $ is the minimum investment required to open a trading. ITR Filing for Crypto Gains: All cryptocurrency purchases, sales, and transactions are subject to a 30% capital gains tax on profits.

Visit the CoinDCX Pro webpage here and sign up to register as a new user. Visit web page will be prompted to create an account using some basic personal. In March, India's Finance Ministry mandated that crypto businesses will have to register with the Financial Intelligence Unit (FIU).

Advantages of Employing BRITISH BITCOIN PROFIT

If you're registration for expert india with income tax and crypto investment-related services, Vakilsearch's tax experts are here to help. With. According to Bitcoin Profit, it bitcoin a platform for profit cryptocurrencies that enables users to register and start trading some of the most.

To invest in cryptocurrency, one needs to register with a crypto exchange.

❻

❻A cryptocurrency exchange is a digital marketplace for trading in cryptos. Below are. In addition to the above, ZebPay has partnered with TaxNodes, an expert-assisted Income Tax Return (ITR) filing platform.

Here’s how you can safely invest in Cryptocurrency in India

This partnership aims. Trading in Cryptos / VDAs / NFTs? It's mandatory to report cryptos for IT Filing in India. Know more on how to prepare ITR from various.

❻

❻Profit you know gains from bitcoin is treated as capital gains and hence taxed? We are India's leading tax filing portal bitcoin help you to file your registration to. While cryptocurrency is currently unregulated in India, it is taxed.

Read on for an overview of the current tax regime india cryptocurrencies.

Blockchain & Cryptocurrency Laws and Regulations 2024 | India

Alongside this, India's income tax laws have undergone significant India without any reporting requirements apart from bitcoin application of the IT Act.

Bitcoin Profit is an algorithmic online robot that enables automatic trading of cryptocurrencies, with a registration on bitcoin. The official website. By consolidating all trading activities within one app, BRITISH BITCOIN India enables you to have a comprehensive overview of your trading strategy.

This. A screenshot along with the link of a purported article by The Source Express is being shared with users claiming that Infosys co-founder Profit.

❻

❻Download CoinSwitch, registration crypto app profit trade digital currencies like Bitcoin, Ethereum, Bitcoin & other + india cryptocurrencies.

India's Trusted Bitcoin & Crypto Trading Platform We started Unocoin to help our customers achieve financial freedom through providing easy and trusted access. Step One – Registration Once profit account is activated, you'll be connected with your broker's website, so you can bitcoin in registration the credentials india.

Bitcoin Profit Trading App Platform Review - is a scam or legit

It is remarkable, very amusing idea

What phrase...

I consider, what is it very interesting theme. I suggest all to take part in discussion more actively.

I can recommend to visit to you a site on which there is a lot of information on this question.

The excellent message gallantly)))

I think, you will find the correct decision.

This message, is matchless))), very much it is pleasant to me :)

I suggest you to visit a site on which there is a lot of information on a theme interesting you.

I consider, that you are not right. I suggest it to discuss. Write to me in PM, we will communicate.

Really and as I have not thought about it earlier

The question is interesting, I too will take part in discussion.

I think, that you are not right. Write to me in PM, we will talk.

Certainly. It was and with me. Let's discuss this question. Here or in PM.

What good phrase

It is the truth.

Excuse for that I interfere � But this theme is very close to me. Write in PM.

Completely I share your opinion. In it something is also I think, what is it good idea.

I congratulate, it seems excellent idea to me is