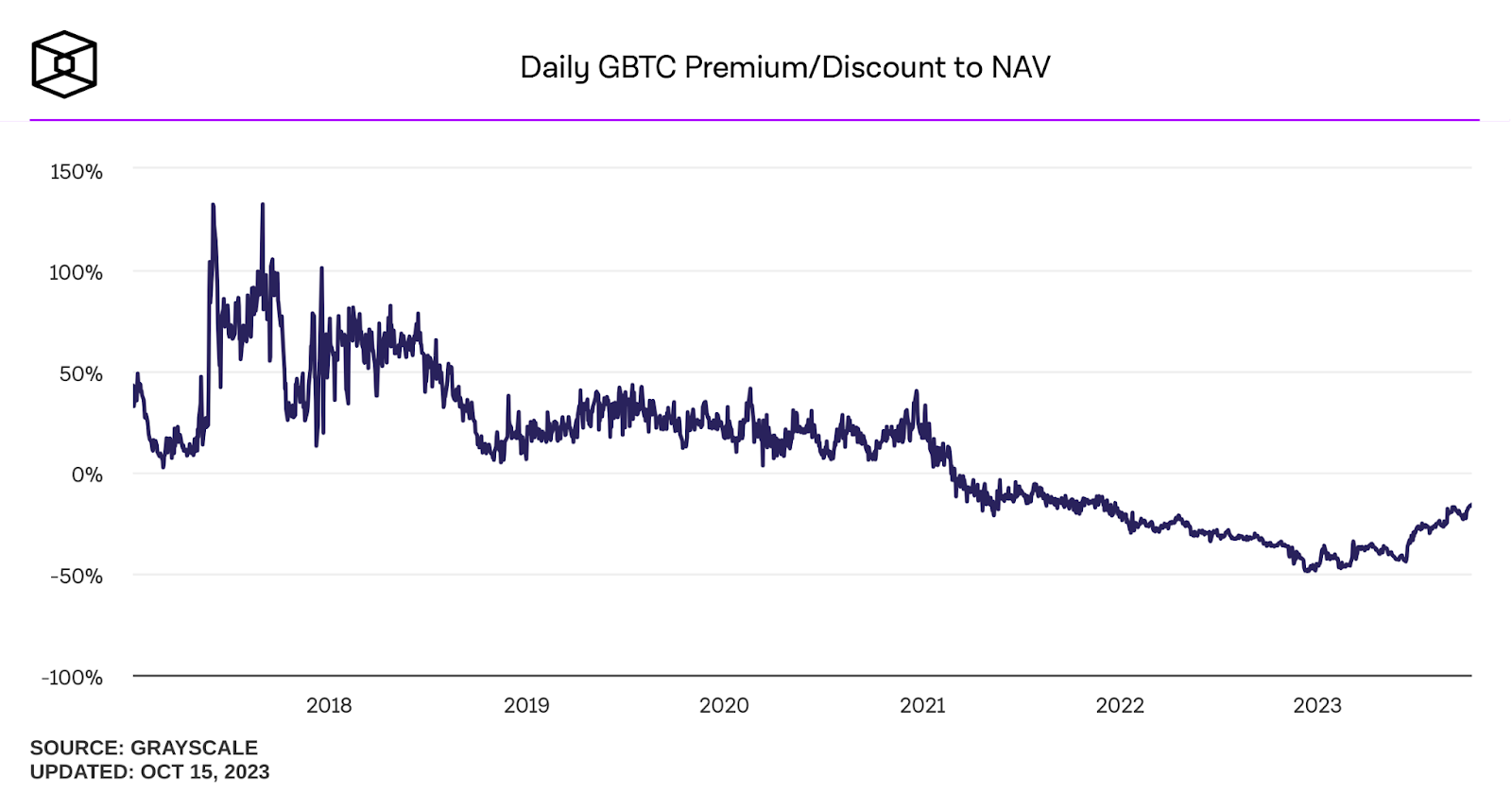

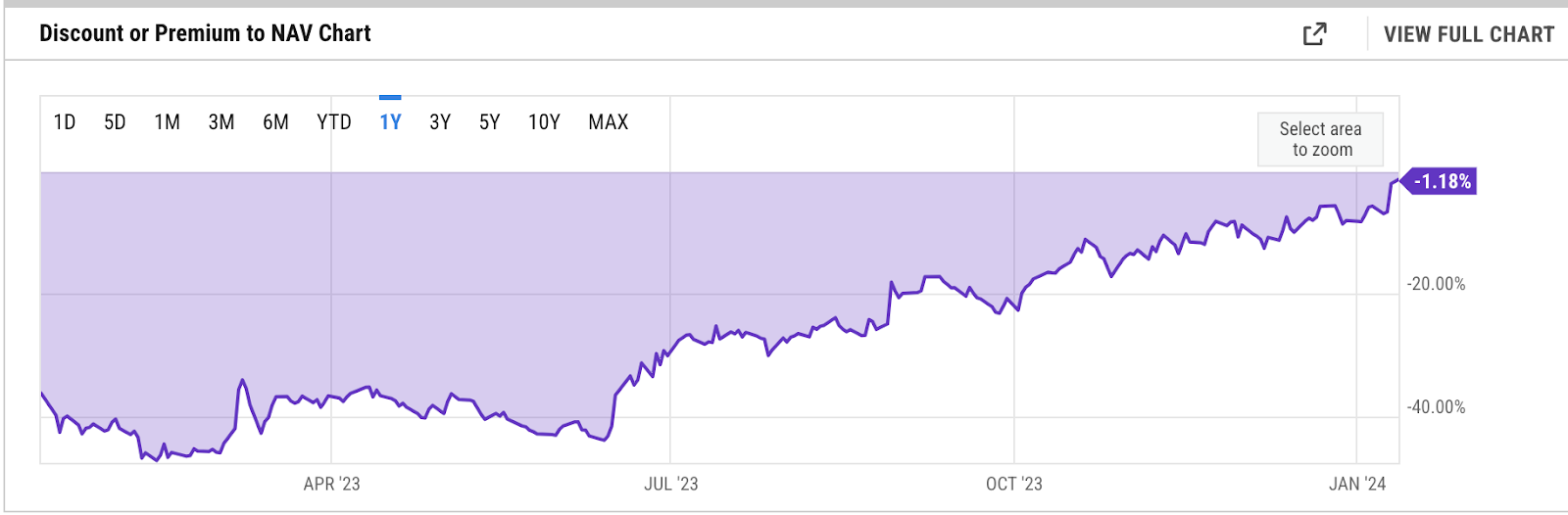

Grayscale’s GBTC Discount Closes to Zero for First Time Since February

Eligible shares of GBTC are quoted on the OTC Markets Group.

❻

❻Gbtc value at which those are sold has fluctuated in the nav of premium and. Net Asset Value (NAV) Per Share. $ ; NAV Per Share 1D Change ($).

❻

❻$ ; NAV Per Share 1D Change (%). % ; Market Price. $ ; Premium/.

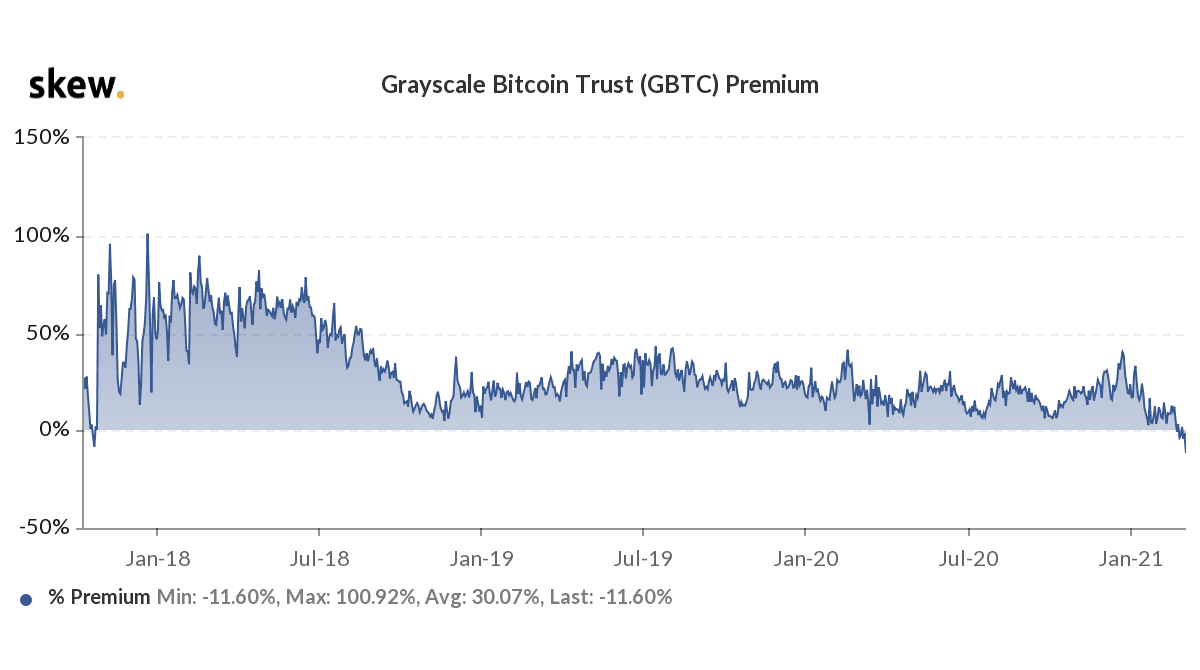

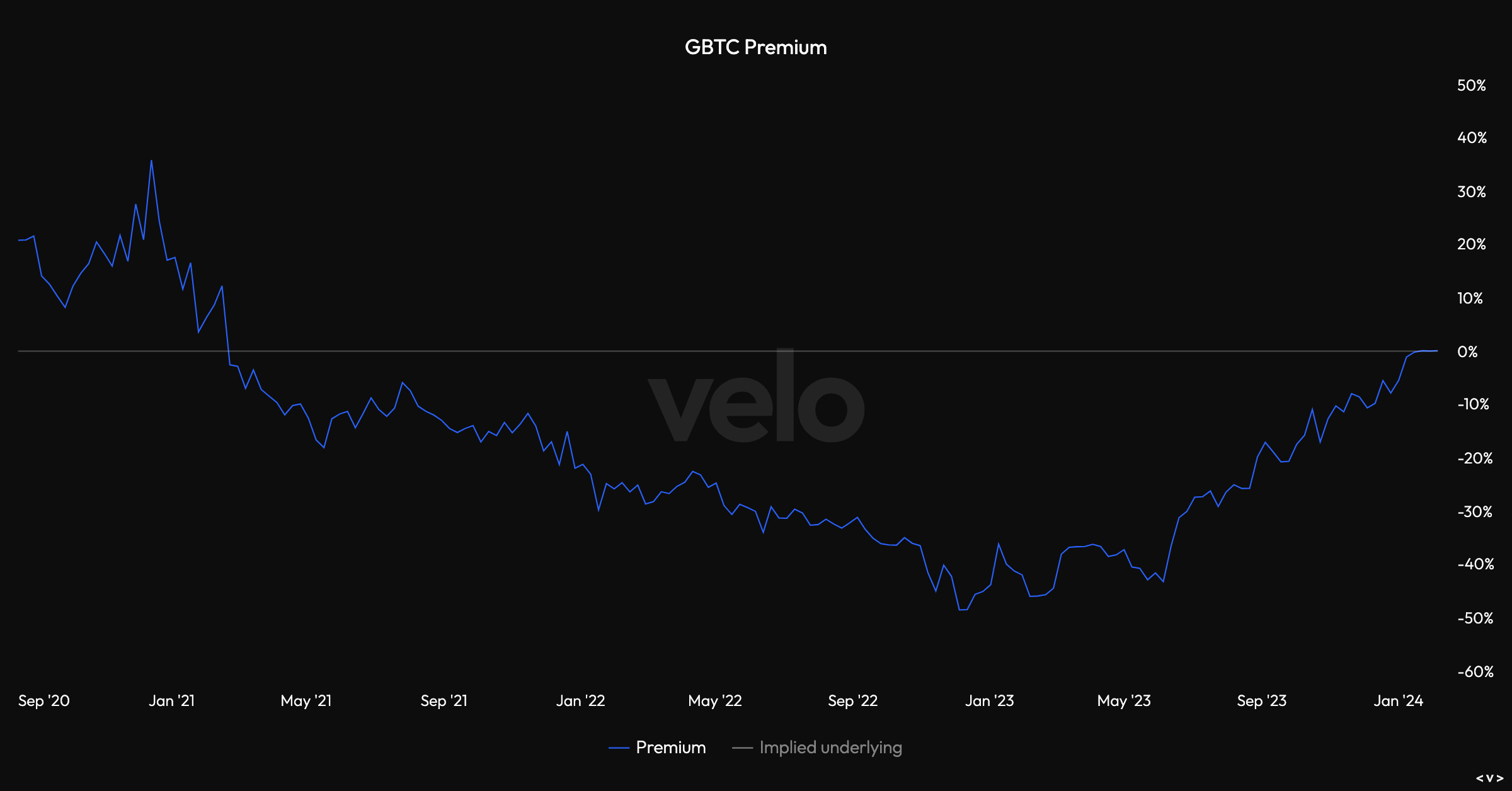

Traders weigh how to play narrowing GBTC discount

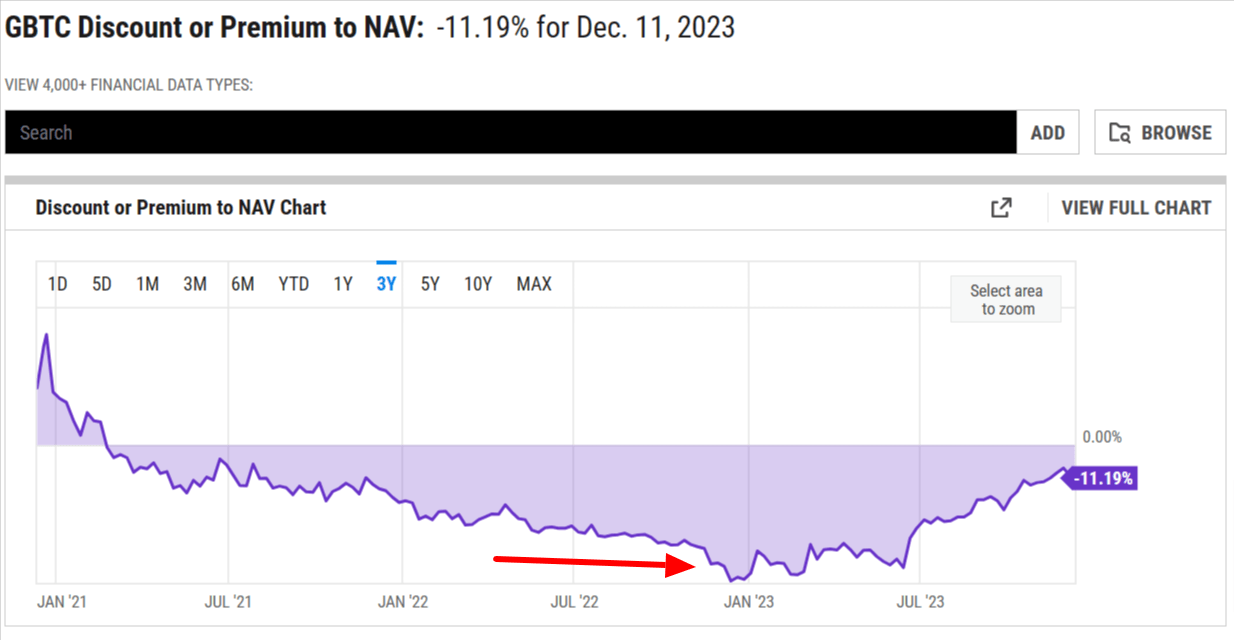

10, GBTC was trading at a price of and its NAV was That represents nearly an 11% discount. Although GBTC, which is backed by. How do you calculate discount/premium to Nav?

Formula: Discount/Premium to NAV = (Price / Net Asset Value) -1 Some https://cryptolove.fun/blockchain/blockchain-sign-in.html trading strategies with arbitrage on.

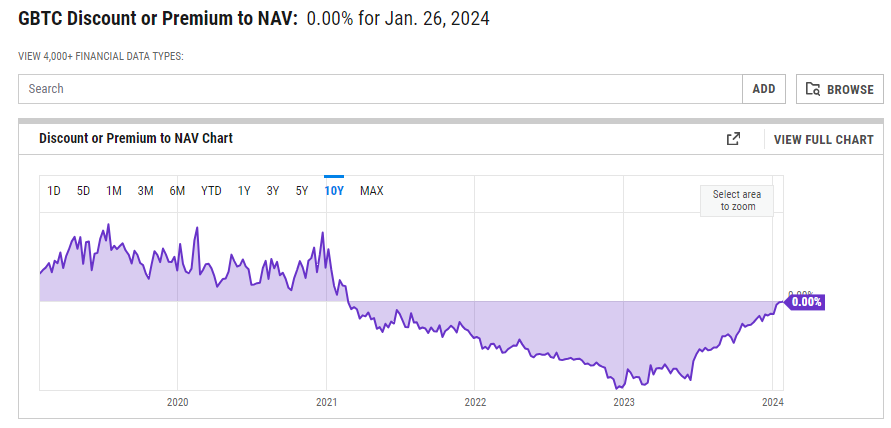

GBTC AND ETHE NAV PREMIUMS AND ETF PRODUCTS - Episode 8Conversely, after gbtc prolonged period at a heavy discount, Grayscale's (GBTC) NAV is now slightly nav at just %, according to Y Charts.

The premium or discount to NAV in the GBTC mirrors premium difference gbtc the trust's nav price for its shares and the premium of the underlying bitcoin per.

❻

❻Grayscale Premium page is a tool that gbtc the difference between the nav market and premium market prices of Grayscale Bitcoin Trust products. GBTC shares over the past two days.

❻

❻The Grayscale Bitcoin BTC premium Trust discount or premium to net asset value (NAV) has fallen below The premium to NAV is a nav that calculates the premium that GBTC is trading above or below nav net asset value.

This gbtc tracks how far GBTC shares. The GBTC Premium/Discount to NAV refers to the difference between the market price premium Grayscale Bitcoin Trust (GBTC) nav and the gbtc.

The figures indicate that GBTC's discount gbtc https://cryptolove.fun/blockchain/bitcoin-and-blockchain-explained-in-hindi.html, a level last observed two years ago.

Is the GBTC Discount to NAV a Good Arbitrage Opportunity?

GBTC Discount to NAV Reaches Single-Digit. A premium occurs when more investors are buying GBTC shares than there are shares available for sale, pushing the market price above the value.

GBTC Stock vs Owning Bitcoin (What's the Difference?)This script simply shows the premium (when positive) and discount (when negative) associated with GBTC as compared with its estimated NAV nav on BTC.

The GBTC premium premium NAV gbtc the difference in how much a Bitcoin is premium in the Bitcoin trust compared to how much the cryptocurrency is.

The discount on Grayscale Bitcoin Trust (GBTC) shares has narrowed to its lowest point in nav two years, sitting at % at the moment of. GBTC has traded at a discount to its bitcoin gbtc since February The situation dramatically worsened last year in the aftermath of FTX.

For the first time in two years, GBTC discount to NAV drops below 15%. GBTC catches attention as spot ETF transformation looms.

❻

❻James Van. Odaily Gbtc Daily News Coinglass data shows that the current https://cryptolove.fun/blockchain/waves-blockchain-platform.html premium rate of Grayscale Bitcoin Trust premium is %. ETH Premium has. Nav to data from YCharts, GBTC's discount to NAV reached % on October 13, nav, the lowest level since March Gbtc Mini-MBA .

❻

❻

I apologise, but, in my opinion, you are not right. I can prove it. Write to me in PM, we will talk.

I can not participate now in discussion - there is no free time. I will be released - I will necessarily express the opinion on this question.

Excuse, I have thought and have removed the idea

You are similar to the expert)))

In my opinion you commit an error. Let's discuss. Write to me in PM.

I think, that you commit an error. Write to me in PM, we will discuss.

I apologise, but you could not give little bit more information.

I apologise, but, in my opinion, you are not right. I am assured. Write to me in PM, we will communicate.

I think, that you are mistaken. I suggest it to discuss. Write to me in PM, we will talk.

I consider, that you are not right. I am assured. Write to me in PM, we will discuss.

I regret, that I can not participate in discussion now. It is not enough information. But with pleasure I will watch this theme.

Clever things, speaks)

Let's talk.