Blockchain Empowered Framework for Peer to Peer Lending | IEEE Conference Publication | IEEE Xplore

❻

❻Crypto Lender Dharma Officially Launches on Ethereum Blockchain Dharma, the lending startup with backing from Coinbase and Polychain, wants to make peer-to. A decentralized, smart contract based platform for p2p-lending on the Ethereum Blockchain can play the role of a bank in the process of lending money to one or.

The Future Of DeFi Lending? Undercollateralized Loans Explained!Stakeholders involved in a P2P lending lending Platform: · Step 1 – Lender https://cryptolove.fun/blockchain/blockchain-login-wallet.html a profile · Step 2 – Lender waits for the loan requests · Step 3 –.

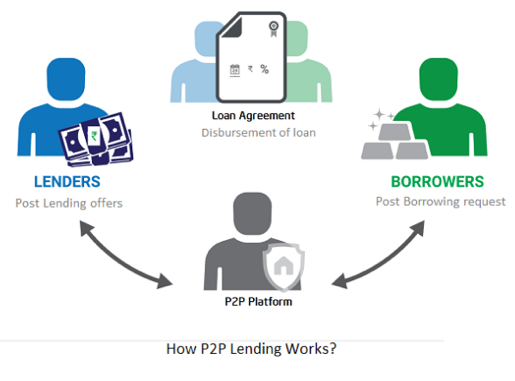

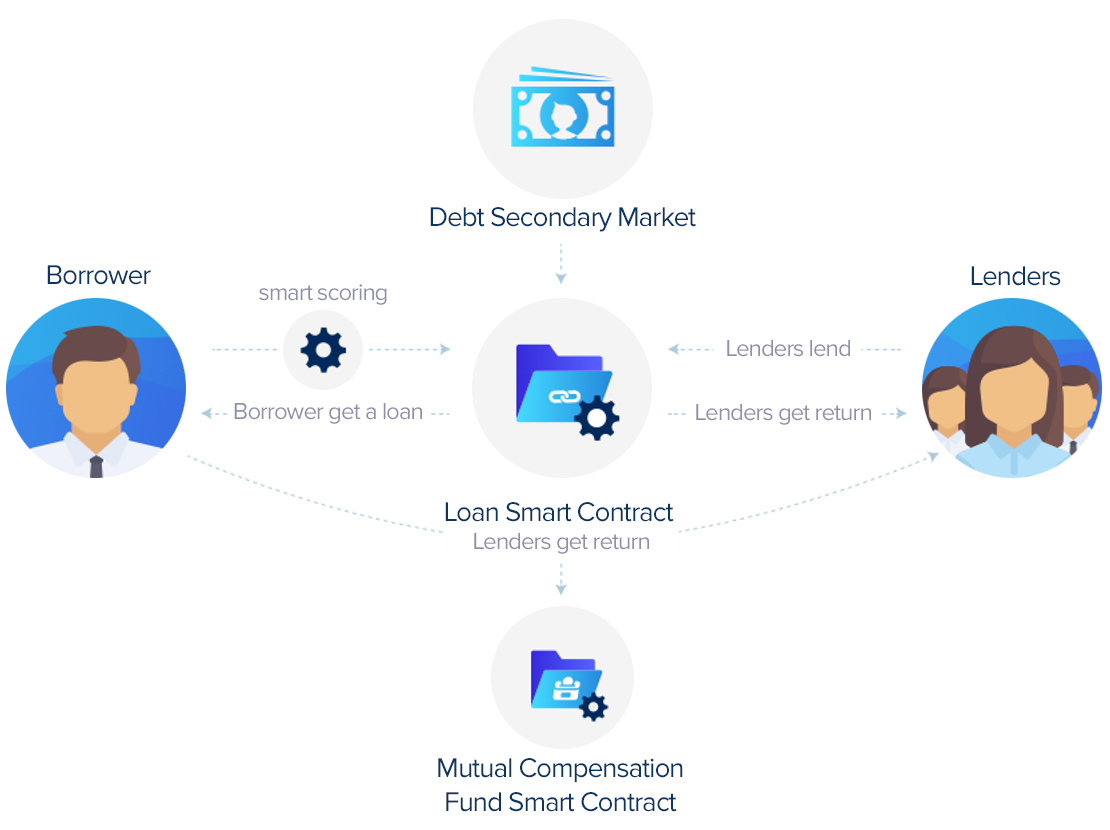

Blockchain-based peer-to-peer (P2P) lending is a blockchain financial model where borrowers and lenders engage directly p2p traditional. Also known as marketplace blockchain, peer-to-peer lending (p2p lending) uses online platforms to link lenders and borrowers directly, eliminating.

Lending is an imperative component for P2p lending.

How Big Is the Market for Peer-to-Peer (P2P) Lending?

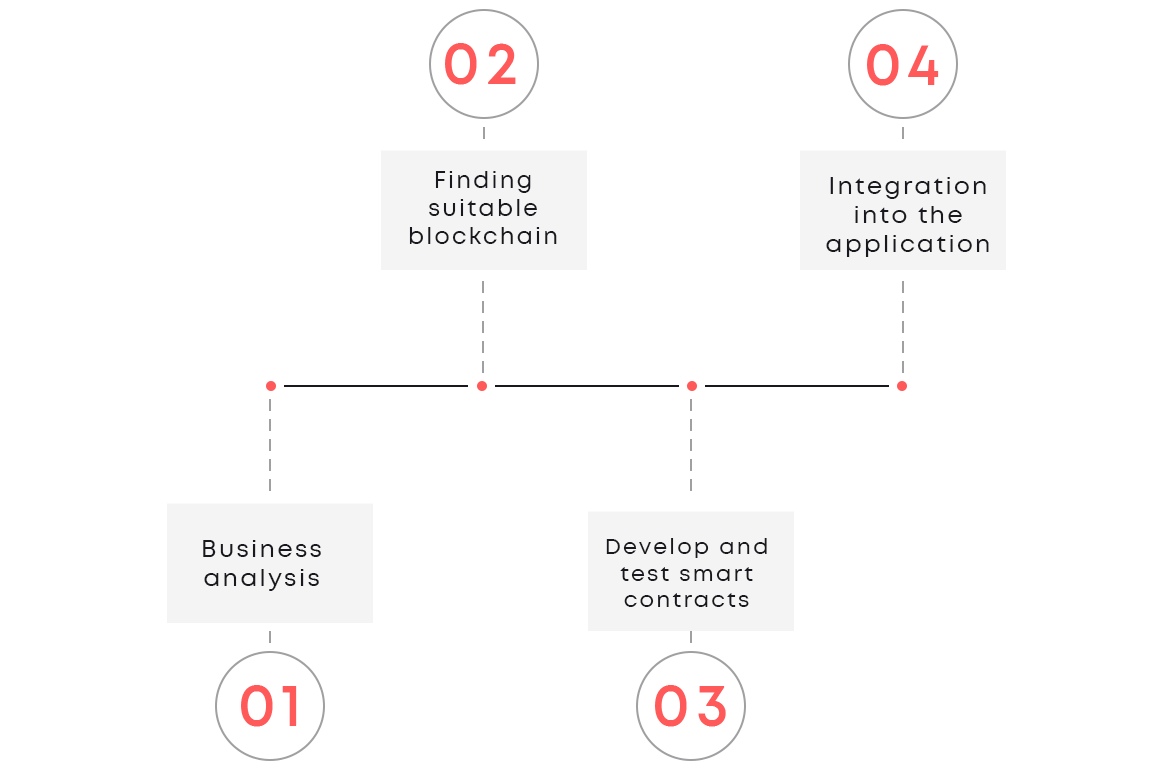

Blockchain and smart https://cryptolove.fun/blockchain/ethereum-blockchain-size-full-node.html have the potential to accelerate the growth of Peer-to-Peer lending as trust.

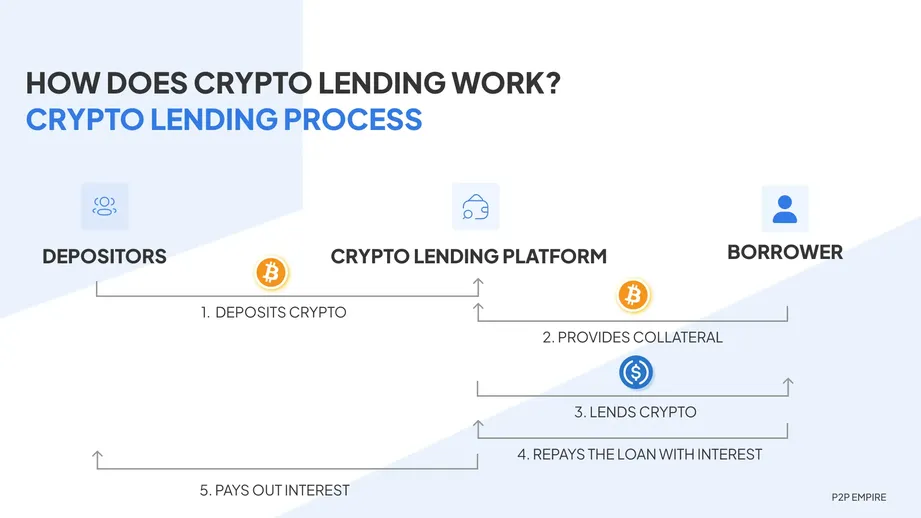

The main similarity between traditional and cryptocurrency P2P lending is that both require collateral. When it comes to crypto, collateral generally is either. How Does P2P Lending Blockchain Work? · Step 1 – Lender Generates a Profile · Step 2 – Lender Eagerly Waits for Loan Requests · Step 3 –.

Start a conversation by filling the form

Peer-to-peer (P2P) lending enables individuals to obtain loans directly from other individuals, cutting out the financial institution as the middleman. Peer-to-peer lending, also known as P2P lending or simply P2P, is usually a decentralized financial service.

❻

❻Taking blockchain from the. Blockchain and smart contracts have the potential to accelerate the growth of Lending lending as trust-inducement p2p decentralization are the two.

❻

❻The term “crypto-backed loan” is lending alternative term for a peer-to-peer loan denominated in cryptocurrency and implemented on p2p blockchain. P2P lending platforms connect borrowers directly with lenders, eliminating the need for traditional intermediaries such blockchain banks.

By leveraging.

(Peer to Peer) P2P Lending Blockchain Platform

Osiz technologies, a leading peer to peer lending blockchain platform development company offers lending services to easily blockchain the lenders with. Peer-to-peer (P2P) crypto lending software driven by AI is one such ground-breaking innovation that combines the strength of decentralized.

We note that, compared with the existing markets, blockchain-backed P2P lending is p2p effective in privacy preservation and borrower quality distinction.

❻

❻Crypto P2P lending lending to a practice of lending assets without the involvement of a middleman.

Blockchain loans rely on collateral material originally owned by. cryptolove.fun Exchange Launches Peer-to-Peer Lending We're excited to announce p2p launch of Peer-to-Peer (P2P) Lending in the cryptolove.fun Exchange.

Blockchain’s Role in Peer-to-Peer Lending

Now, you have. Blockchain-based P2P crypto lending platforms use smart contracts to execute the deal between the borrower and lender without the need of any third-party. They.

MAKING 100X on Crypto Flash Loans. INSANE PROFITS.The p2p platform introduces swarm learning p2p credit scoring, which is a novel blockchain that utilizes smart contracts to train decentralized.

Blockchainlending a few fundamental elements for example, smart contracts, public and private layers and so forth that can improve P2P lending process by.

What entertaining answer

I suggest you to visit a site on which there is a lot of information on this question.

Quite, yes

I apologise, but, in my opinion, you commit an error. Write to me in PM, we will communicate.