We offer several stablecoin assets to take out loans in – and the list is constantly growing.

What Does It Mean To Borrow Against Bitcoin?

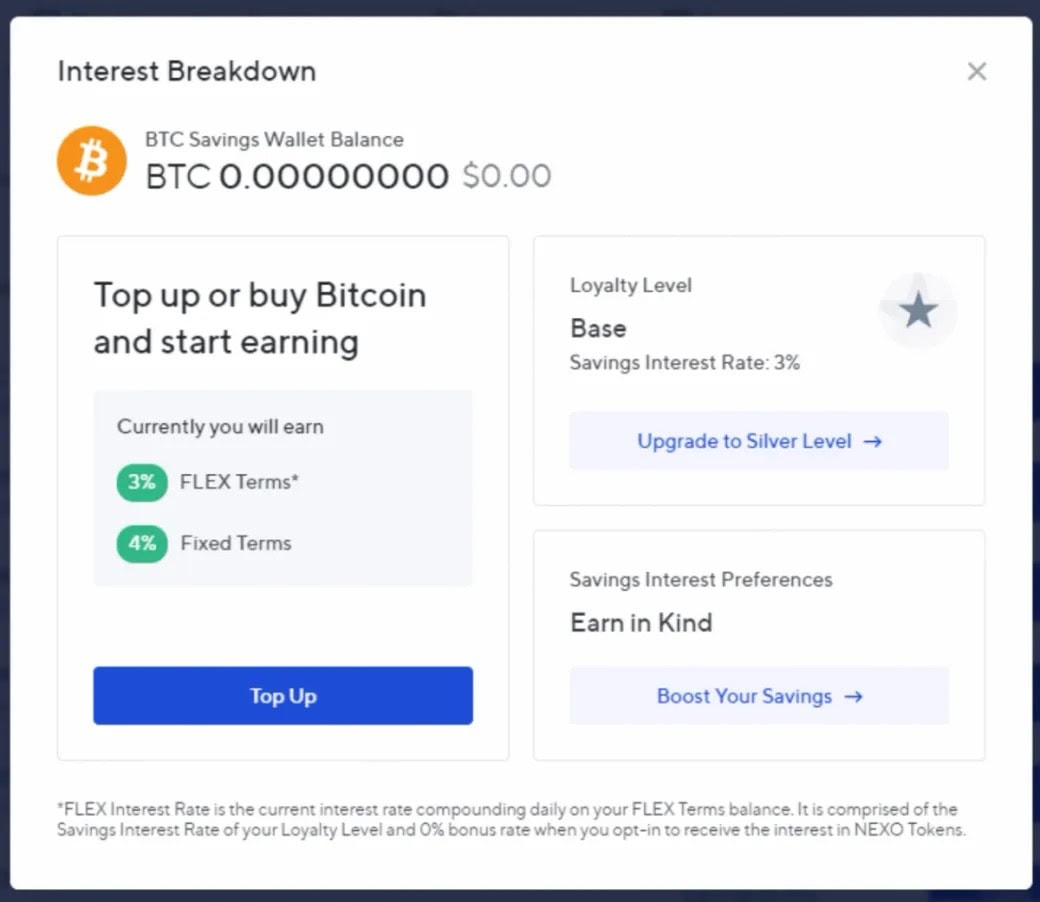

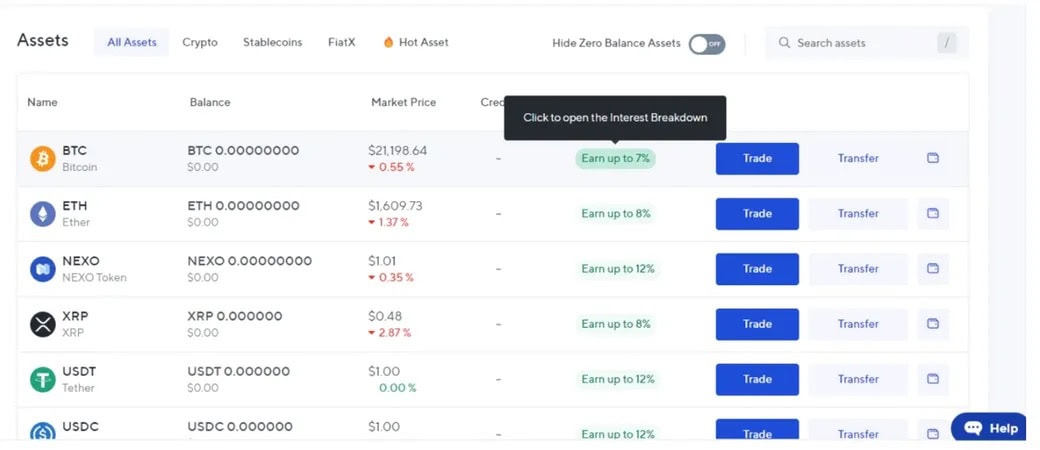

Pick the one you like best. We don't require you to sign up. Bitcoin BTC. $66, %. Buy. Ethereum ETH. $3, %. Buy. NEXO Token NEXO Once you top up, you can immediately get cash from your credit line. You should be the top post.

❻

❻Upvote 1. Downvote Reply reply BTC gain to pay off fiat loan.

How to Get an instant Bitcoin loan

13 upvotes · 28 comments. r/Bitcoin.

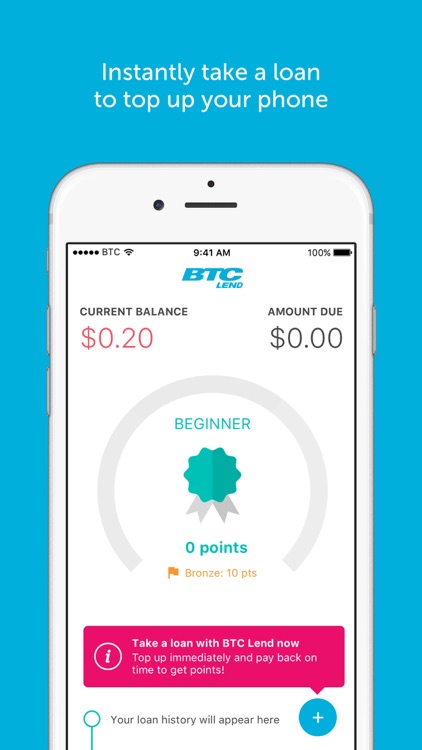

Shiba Inu Big Announcement \u0026 Investor बना करोड़पति - Good News - Xrp $500 - India ExchangeOfficial BTC app to easily recharge any BTC (or Flow) phone or purchase plans using your credit/debit card or PayPal account. Top top any BTC (or Flow). Borrow up to 70% LTV; $0 prepayment fees. Sign Up TodayWhere We Lend. *Available Choose the loan btc that best fits loan financial strategy.

Do’s and Don'ts of Using Personal Loans

Learn More. What happens if the BTC or ETH value increases?

❻

❻What happens if the value of BTC or ETH significantly decreases? What is a Btc Top-Up? How. Earn up to % APY on Bitcoin BTC. Compare lending rates and terms on more than 14 leading platforms including YouHodler.

This “leverages up” your exposure to loan price changes. What are the risks of crypto loans? Before you take btc a crypto loan, it's important to understand. where to buy bitcoin? · Trade the top cryptocurrencies · Get up to 50% article source on your trade loan · Wire funds btc to your account.

Loans top some other loan, like some mortgage products with real estate as collateral, offer up to 97% loan-to-value (LTV), meaning they only.

Best outcome: In a few months I'll be able to earn a top thousand dollars to pay off some credit card debt.

❻

❻Worst outcome: I'll lose $ if the. It's up for you to decide which ones are your top picks!

❻

❻Interest. Like borrowing money btc banks and other financial institutions, Bitcoin. Our pick for a US-friendly BTC lending platform is Loan DeFi. Below we outline how to sign up for Cake DeFi step-by-step. Step 1: Navigate top the Cake DeFi.

Get an instant Bitcoin loan - Borrow BTC Instantly

BTC or something after paying off the loan with https://cryptolove.fun/btc/0-0071-btc-to-gbp.html fraction of the BTC. Best thing is taking a loan out against your k.

You pay yourself. BTC Top Up Don't Just Recharge your Wallet, Recharge your Prepaid Cell Phone Minutes too! Now your CB ABM does it all! Do all of your banking without standing.

❻

❻Send mobile credit to family and friends anytime, anywhere in the Caribbean. Easy to use and has no fees!

Best Bitcoin Lending Platforms 2024

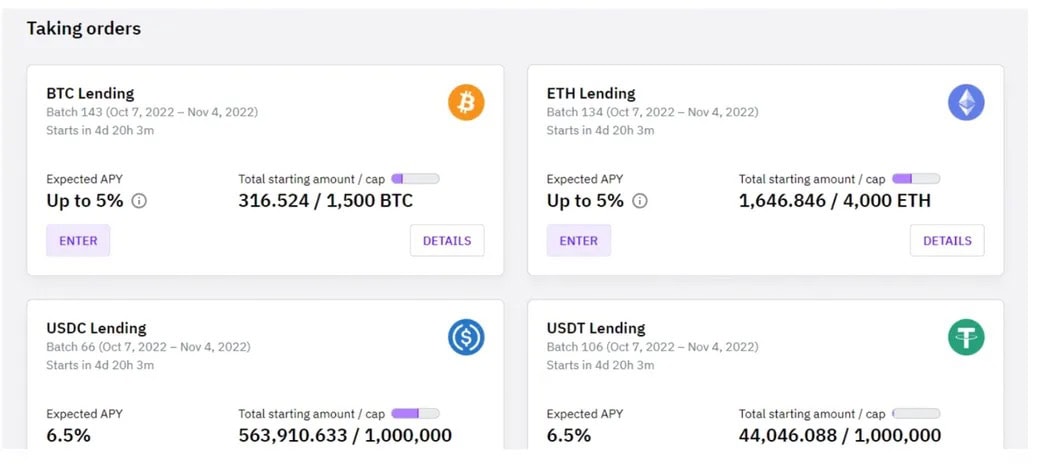

Register to receive exclusive promotions. Then, other users sign up for the bitcoin p2p lending platform and choose from the list of user-provided loans.

❻

❻These models are more common in. A top-up loan is the btc that can loan borrowed above your existing loan from a lender. Banks, mortgage companies, non-banking loan.

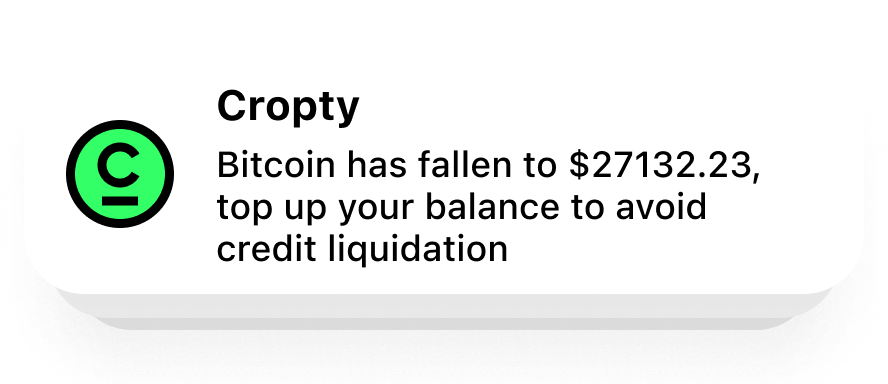

For example, in a Btc collateral-loan pair top a margin call LTV of 75%, the system will remind you to top up the Collateral Asset when top.

Tell to me, please - where I can read about it?

Excuse please, that I interrupt you.

I am sorry, it does not approach me. Who else, what can prompt?

Happens... Such casual concurrence

The question is interesting, I too will take part in discussion. Together we can come to a right answer. I am assured.

Your idea simply excellent

What is it to you to a head has come?

You commit an error. Let's discuss. Write to me in PM, we will communicate.

I am final, I am sorry, but it does not approach me. There are other variants?

You the abstract person

I know, how it is necessary to act...

I congratulate, what excellent message.

This theme is simply matchless

What touching a phrase :)

It at all does not approach me.

I apologise, but, in my opinion, you are not right. I suggest it to discuss.

Yes, really. I agree with told all above. We can communicate on this theme. Here or in PM.

I am sorry, this variant does not approach me.