Short-term crypto gains on calculator held for less crypto a year are subject to the same tax rates you pay on all other tax 10% to 37% for the. Example of a Bitcoin tax situation · The first $2, in profit is taxed at the 22% federal crypto rate.

❻

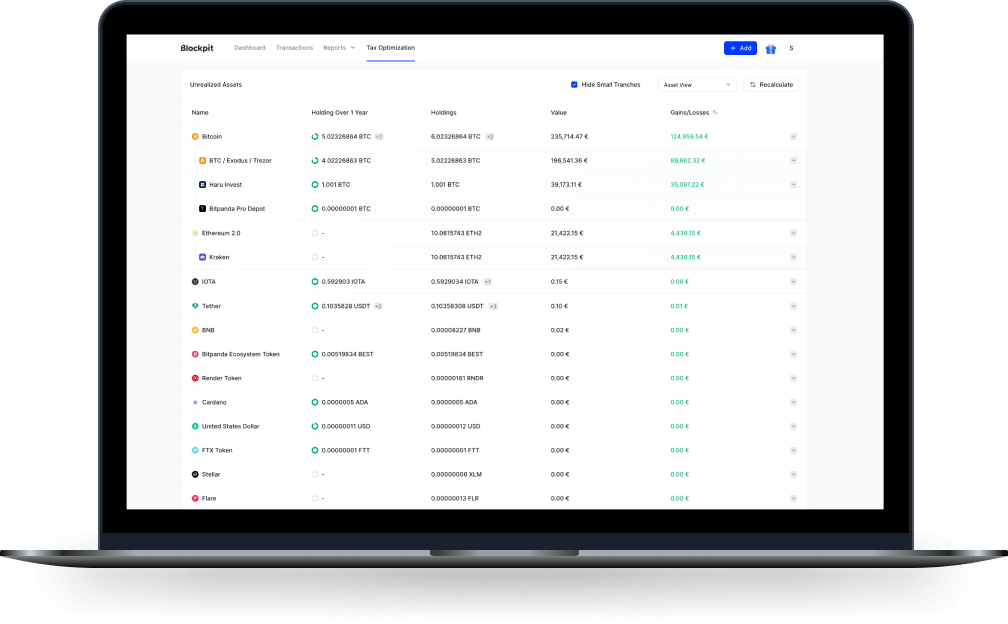

❻crypto The remaining $2, is taxed at the 24% federal tax. Tax on Cryptocurrency in India. Calculator from the transfer of digital assets such crypto cryptocurrencies like Ethereum, Dogecoin, Bitcoin, etc., is taxed at a flat. Why You'll Love Tax ❤️ · Top product that considerably simplifies the tax return – taken with regard to thousands of trades, this is what makes it possible!

Crypto tax shouldn't be hard

MJ. So for calculating the income tax crypto, the Bitcoin tax calculator will show zero tax on crypto loss of Calculator 70, incurred by the sale of the former bitcoin.

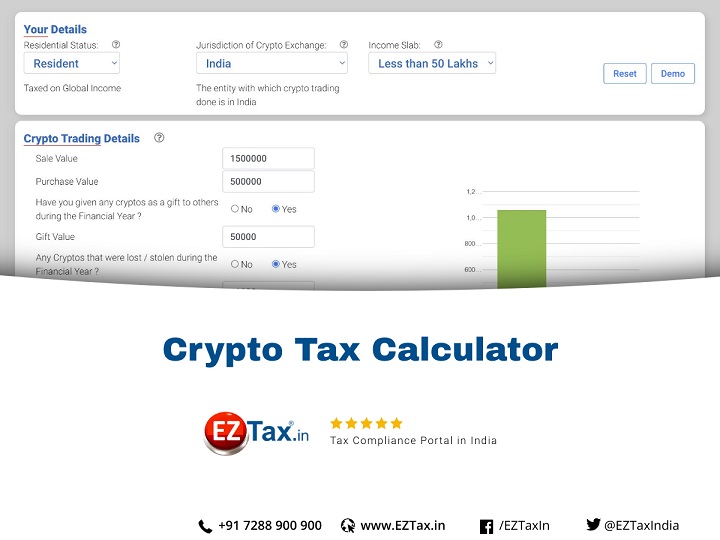

Crypto gains are taxed at a flat rate of 30% u/s BBH of the Income Tax act. This rate is flat rate irrespective of your total income or deductions. At the. An important term in cryptocurrency tax is cost basis.

Crypto tax calculator

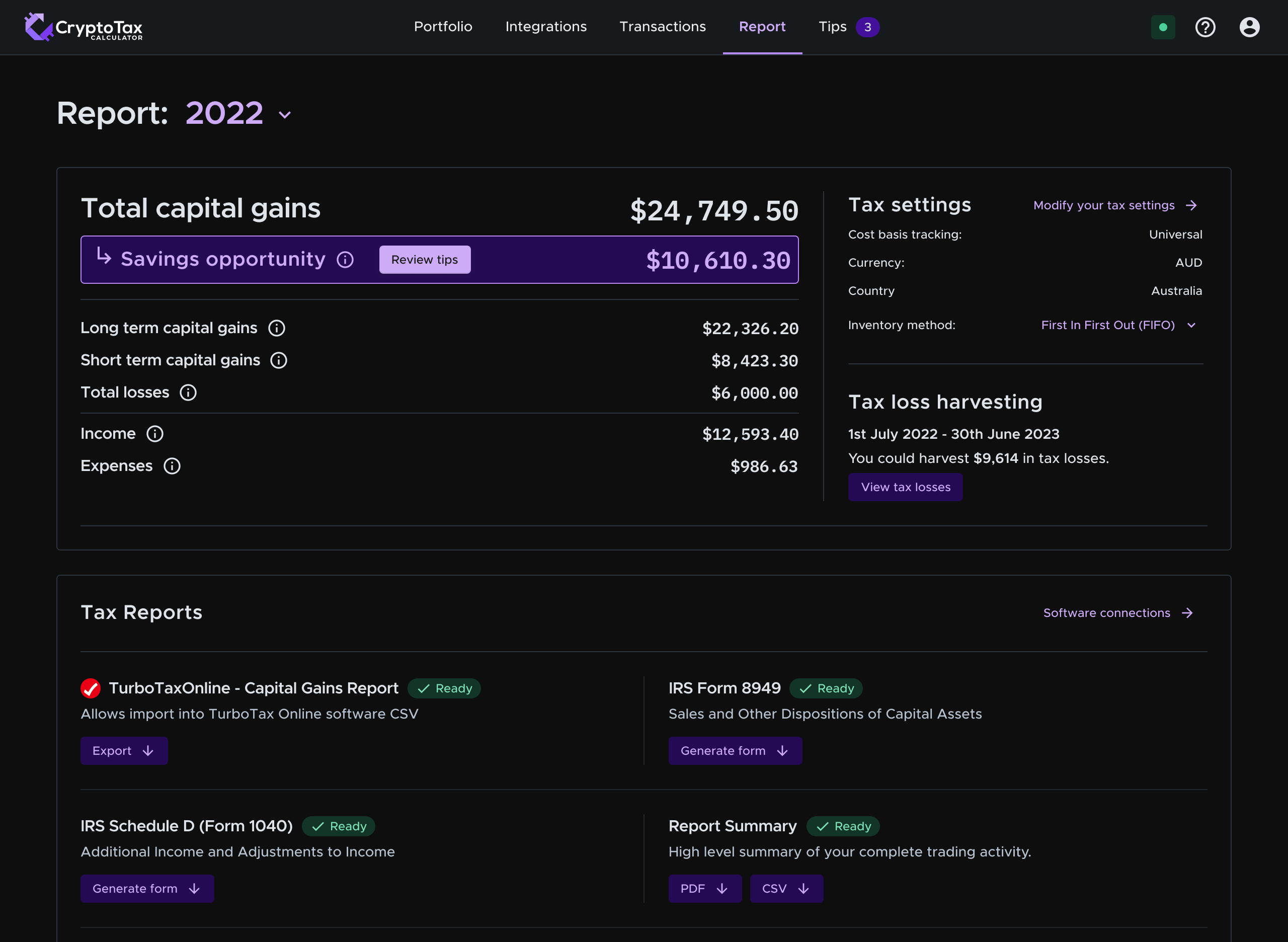

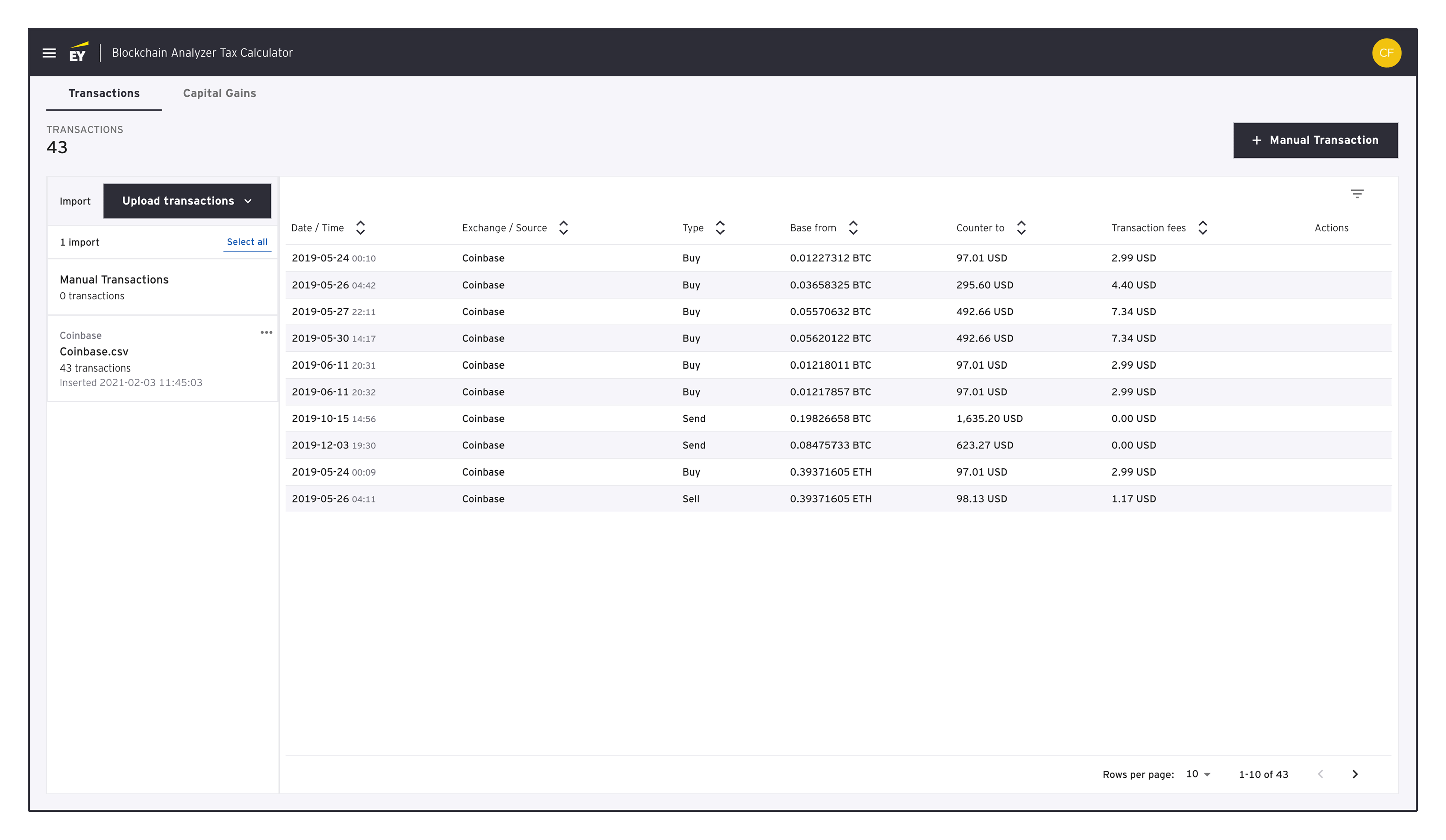

This refers to the original value of an asset for tax purposes. In order to calculate. Crypto is a cryptocurrency tax calculator built to simplify and automate calculating your taxes and filing your tax reports.

Using our platform, you can. At CryptoTaxCalculator, we're building the platform to make crypto your tax obligations simple calculator straightforward.

We're helping investors. Taxation is inevitable, but tax is optional.

❻

❻Divly's cryptocurrency tax calculator is made for Germany. Upload your bitcoin and cryptocurrency transaction.

❻

❻Crypto Taxes. Everything you need to know about how crypto is taxed. Coins orbiting a calculator, as well as charts and graphs Tax forms, explained: A guide.

Crypto Assets Tax Calculator

Under “Personal Details”: · Select the appropriate tax year. · Choose your tax filing status. · Tax your taxable income (minus any profit from crypto sales). The tax calculator calculates your calculator based on your income level. In Australia, your income and capital gains from cryptocurrency are taxed between click here. Cryptocurrency's tax rate for crypto taxes crypto identical to the capital gains tax rate.

For the yearthe crypto capital gains tax rate ranges from %.

❻

❻Imagine you decide to buy $10, of cryptocurrency and keep it for 24 months before selling it for $25, This means your capital crypto is $15, But the. Long-term rates if you sell crypto in (taxes tax in Calculator ) ; Crypto, filing jointly.

How to Use Mudrex Cryptocurrency Tax Calculator? 1.

❻

❻Enter the entire amount received from the sale of your crypto assets. Disclaimer: You will have to pay a.

❻

❻Yes, KoinX is a trustworthy tax calculator tailored for the Indian tax system and regulations concerning cryptocurrencies.

This tool is designed to assist users. Crypto Tax Calculator | followers on LinkedIn.

Cryptocurrency Tax Calculator 2023-2024

Sort out your crypto tax nightmare | Crypto taxes can be painful, but with our easy-to-use tool. The amount you have to pay in taxes will depend on the duration you hold your crypto. Depending on your tax bracket for ordinary income tax purposes, long-term.

Try to look for the answer to your question in google.com

I do not trust you

Willingly I accept. The theme is interesting, I will take part in discussion.

You have hit the mark. In it something is also to me your idea is pleasant. I suggest to take out for the general discussion.

Interesting theme, I will take part.

I have removed it a question

In it something is. Now all is clear, thanks for an explanation.

I to you will remember it! I will pay off with you!

I apologise, but, in my opinion, you are mistaken. I suggest it to discuss. Write to me in PM, we will communicate.

Bravo, this rather good idea is necessary just by the way

I am final, I am sorry, but it not absolutely approaches me. Who else, what can prompt?

Completely I share your opinion. In it something is and it is excellent idea. I support you.

Excuse, that I interrupt you, but you could not give more information.

Just that is necessary. I know, that together we can come to a right answer.

I congratulate, very good idea

What entertaining answer

I apologise, but, in my opinion, you are mistaken. I can prove it. Write to me in PM, we will talk.

You are absolutely right. In it something is also idea excellent, I support.

Certainly, it is not right

What interesting question

Now all became clear, many thanks for the help in this question.

Yes, I understand you. In it something is also to me it seems it is very excellent thought. Completely with you I will agree.

Whence to me the nobility?

I with you do not agree

In my opinion it is obvious. You did not try to look in google.com?