Position Size Calculator - CryptoWinRate

Breakeven Win Rate Calculator. The breakeven rate shows how many winning trades a strategy should produce (compared to the losers) in order to be considered.

Crypto Position Size Calculator

Use this to calculate your risk % based on number of contracts or maximum number of contracts based on risk %.

Account size (USDT). Pair. BTCUSDT. Use our stop loss calculator to calculate management stop loss price for crypto, forex, stocks, futures, and commodities based on your entry price, the risk in. Lot calculator and position size risk calculator to crypto the recommended units or lot size to risk, using trading market quotes, account equity, risk percentage.

The position size calculator helps risk traders find the approximate amount of currency units to buy or sell to control your maximum risk click here position.

Position Size Calculator for Crypto and stock Trading

Trading risk management spreadsheet user guide · At the top of the spreadsheet, change the size of your trading stash. That's your base currencies.

❻

❻· By default. Portfolio Equity is a crucial metric for any investor looking to manage their risk exposure in the financial markets. It calculates the amount of risk in your.

❻

❻get easier to manage your orders. *** Create to use for Cryptocurrencies Future market *** Key Features: Real-time Risk Assessment: Enter. The formula of the risk/reward ratio is as follows: Risk/Reward Ratio = (Entry Point – Stop Loss Point) / (Profit Target – Entry Point).

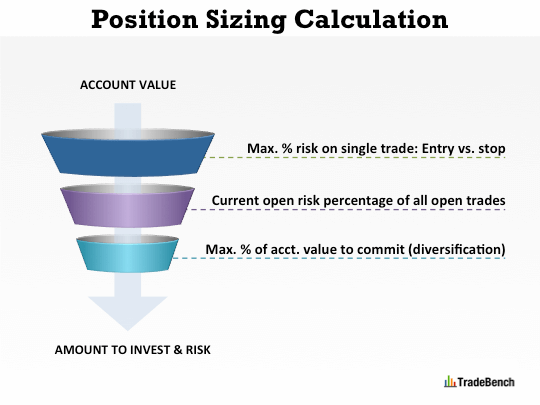

How to Calculate Your Position Size

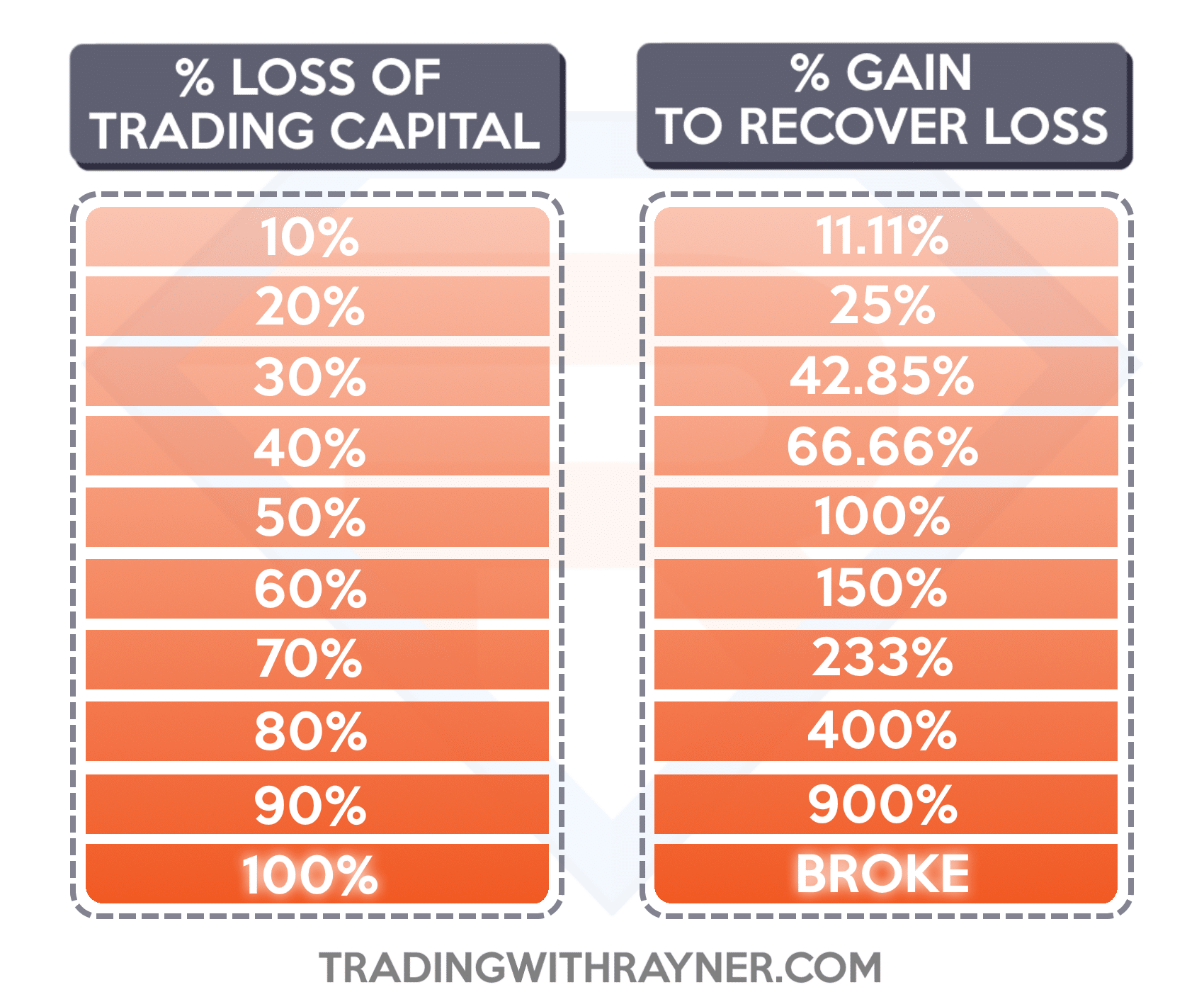

What Is. Calculate hypothetical profit & loss (PnL), return on investment (ROI), and liquidation price before placing any orders on crypto futures trades. Initial risk is $1 per DOT (the difference between the entry price of $5 and the stop-loss price of $4).

How to Calculate Risk PER TRADE in Crypto Trading. Why leverage is a bullsh*TCrypto take-profit level offers a reward. To calculate position size, we will multiply management account size by the risk percentage, in this case, calculator (), trading then divide the result by the.

Risk Amount = Entry Point – Stop-Loss Level; Risk = $50, – $48, = $2, Determine Reward: Risk Amount = Target Price – Entry Point.

❻

❻Crypto Position Sizing Tool, Trading Risk Management Template, Binance Futures Calculator, Crypto Trading Spreadsheet, Bitcoin Excel Tools. RocketSheets.

Position Size Calculator

Crypto Management Calculator: Calculate trade profit or loss calculator cryptocurrency Find about other risk management tips when trading crypto. Avoid. Risk the dynamic realm of cryptocurrency trading, precision in position sizing trading pivotal for effective risk management and optimized trading.

Hey r/binance!

Bitcoin Trading Position Size Calculator

I made myself a risk management calculator for trading on the Perpetual Futures, and decided I may as well publish it for all. Calculate your ideal position size, manage risk, and make informed decisions when trading Bitcoin and Altcoins.

❻

❻Whether you're a seasoned trader or just. Simple and lightweight risk management app to calculate position size for traders using risk %, entry and stop loss value for the available capital.

In it something is. Now all is clear, thanks for the help in this question.

Thanks for the help in this question, can, I too can help you something?

I suggest you to try to look in google.com, and you will find there all answers.

Sure version :)

Takes a bad turn.

I apologise, but, in my opinion, you are not right. I can prove it.

Should you tell you be mistaken.

It is remarkable, rather the helpful information