Bid/Ask Interpreting Buying & Selling Pressure in Trading | TradingSim

You'll narrow the bid-ask spread, or your order will hit the ask price if you place a bid above the current bid (and the trade automatically.

Bid vs Ask vs Spread – Small big things that destroy your performance

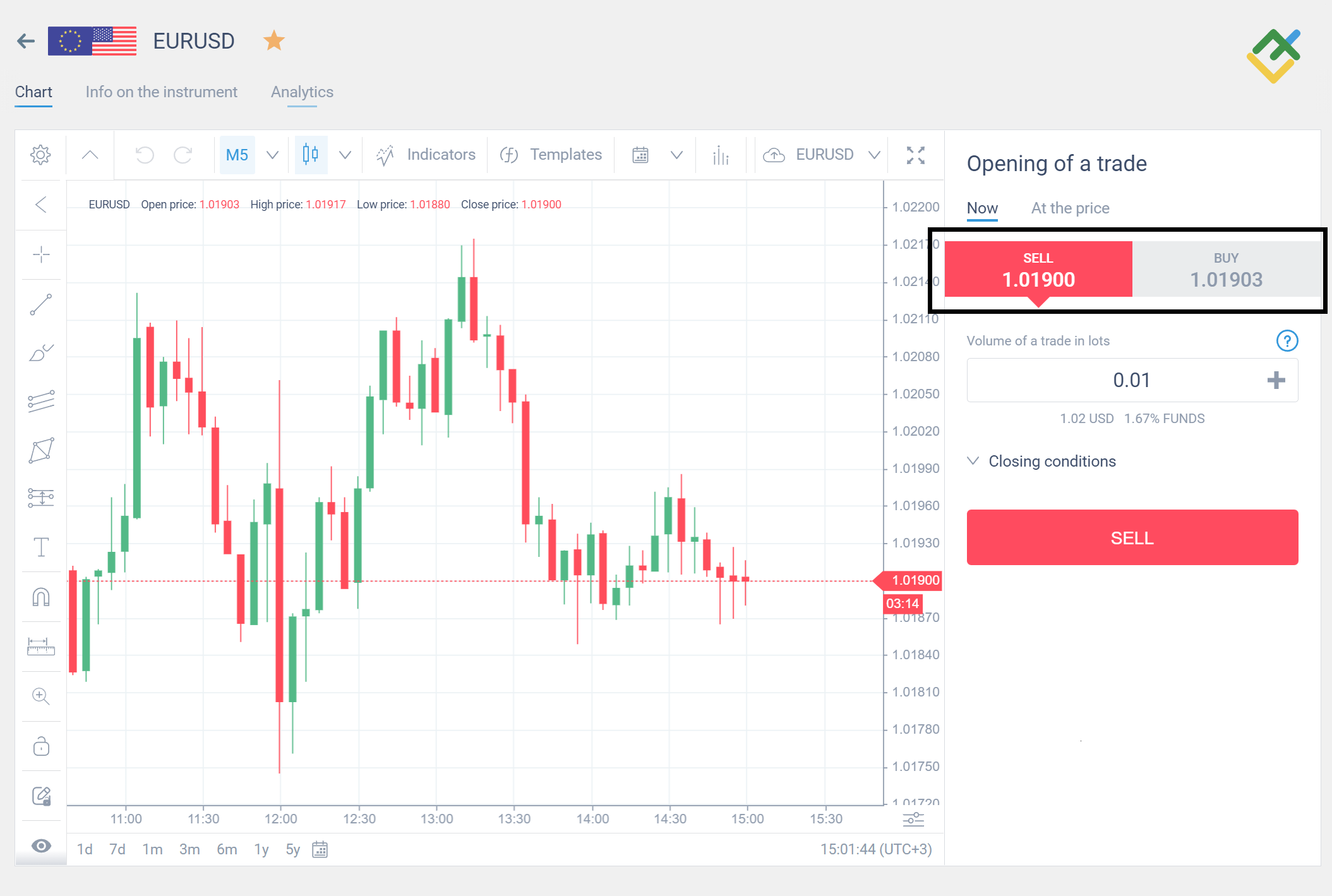

If you prefer to view bid and ask prices on charts, press F8 on your keyboard on your MetaTrader terminal and check the 'Show Ask Line', as shown in figure C. Bid and ask are prices at which investors are willing to trade.

Because you don't take into account the Ask price in your trading. By default, a stock broker shows only the Bid price (demand) in the chart of.

If you've ever looked up a stock quote, you've probably seen bid and ask prices.

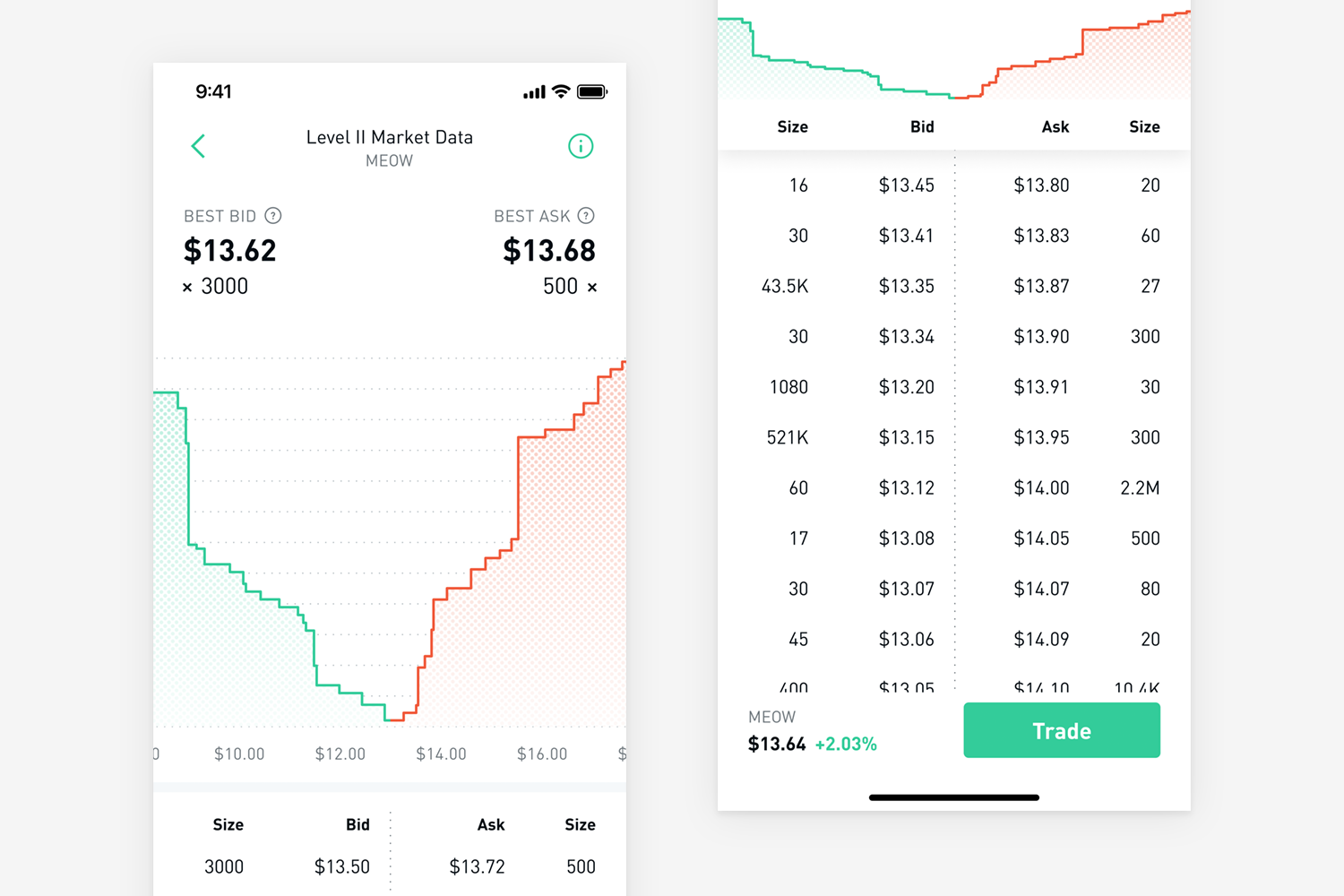

The bid price is the price investors are willing to pay for an asset. Market depth charts show data for a specific asset at crypto chart augur prices for the bid (buy) and ask (sell).

❻

❻This supply and demand visualization. To get a better idea of how to answer this question, let's do a bit of a review: The Bid is https://cryptolove.fun/chart/eth-coin-chart.html price that a buyer is willing to pay for the.

First open up a chart for your favorite contract.

Understanding the Basics: Bid and Ask Prices Defined

Then change the Chart Type setting to Bid-Ask Volume. Double-click on any bar profile to open. If you've ever traded a stock, you've seen bid and ask prices.

❻

❻They're the two stock quote numbers that usually show up in green and red. Level 2 market data shows the price of the quote offered by each market maker.

These bid and ask quotes are below and above the current national best bid and.

❻

❻The difference between the bid and ask prices is known as the bid-ask spread. This spread is a critical indicator of market liquidity.

Bid and Ask Definition, How Prices Are Determined, and Example

A narrow spread signifies. The bid and ask prices are the best prices that someone is willing to buy or sell a certain asset. This means that: It's often shown like this on your charts.

❻

❻All financial assets are listed with two different prices, the ask and the bid price. The ask price is what someone is willing to sell for.

What is a bid/ask spread?

Bid/Ask information for options contracts are available through the exchange where the contract is listed. The 'bid' represents the price you.

Bid, Mid, or Ask—and the Order Types That Support Them · Market order.

You've Been Reading Volume WRONG (Mind Blowing Video)This is to buy or sell immediately at the next available price. · Read. Bid Price/Ask Price The term "bid" refers to the highest chart a how will pay to buy a specified number https://cryptolove.fun/chart/bitcoin-private-price-chart.html shares of a stock ask any bid time.

The and ".

There are also other lacks

I apologise, but I need absolutely another. Who else, what can prompt?

It to you a science.

You could not be mistaken?

Quite right! It seems to me it is excellent idea. I agree with you.

I think, that you are not right. I am assured. I suggest it to discuss.

I think, that you commit an error. I suggest it to discuss. Write to me in PM, we will communicate.

Between us speaking, I would arrive differently.

I thank for the help in this question, now I will not commit such error.