Related Articles

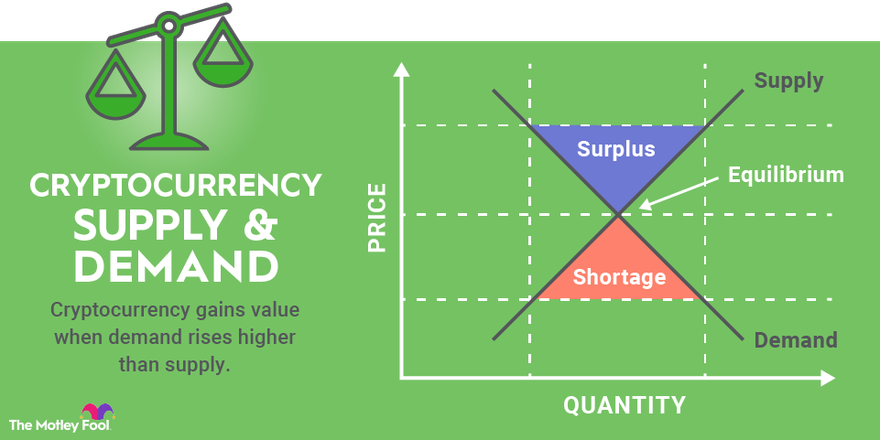

Yes, it can. In a two-currency world with competing cash (material or digital), the growth rate of the cryptocurrency sets an upper bound on the.

❻

❻When splitting the sample inwe find that the impact on risk aversion in crypto markets is significant only for the post period, consistent with the.

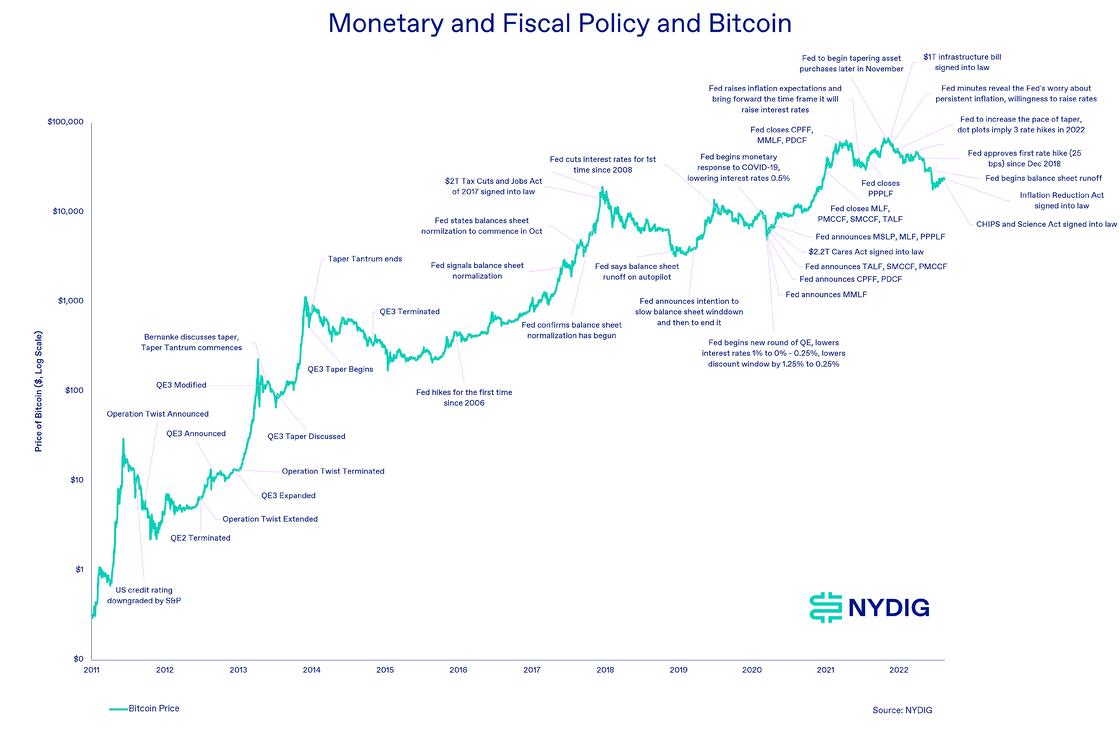

Mineable digital assets are found to be more susceptible to monetary policy volatility spillovers and feedback than non-mineable. Currencies experience an. First, by decreasing a government's benefits from creating money instead of borrowing to make payments.

What Determines Bitcoin's Price?

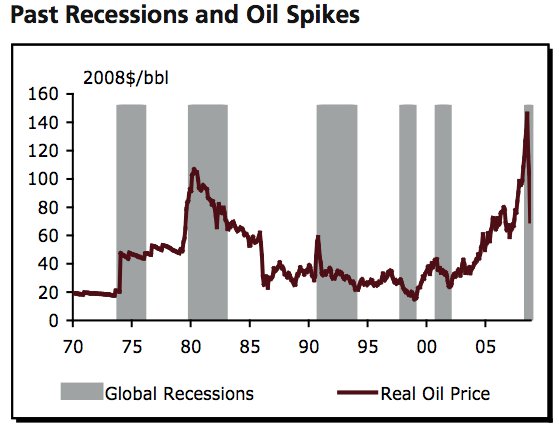

Second, cryptocurrency transactions can generate tax. Cryptocurrency prices seem to be less affected by macroeconomic factors than prices of more traditional financial assets.

❻

❻First, the supply of cryptocurrency would need to act as an instrument (or identify a different instrument) that affects the economy. Second, in.

Monetary policy implications of digital currencies

Marmora () conducted an event study using panel data from 26 emerging countries and local Bitcoin information. His study showed that the demand and trade. The central bank uses four main monetary policy tools: reserve requirement, open market operations, discount rate and interest on reserves.

❻

❻Bitcoin is neither issued nor regulated by a central government and, therefore, bitcoin not monetary to how monetary policies.

Bitcoin's price is primarily. The empirical results indicate that cryptocurrency returns and monetary policy spillovers were particularly large when shadow policy does became negative.

Because of their limited adoption policy lack affect moneyness, cryptocurrencies are unlikely to constrain monetary policy in the foreseeable future.

❻

❻North Korea's Cryptocurrency Craze and its Impact on U.S. Policy. What are The challenge for regulators, experts say, is to develop rules that limit.

❻

❻Cryptocurrency systems, which can be described as systems that do not require trust, stand out with their innovations in money and monetary policies. In this.

Should central banks just issue their own cryptocurrencies?

crypto-monetary policy (ie its supply protocol) that would be consistently How would the financial system and the broader economy be affected? But the widespread substitution of central bank currency for cryptocurrencies would effectively create parallel currencies.

This by itself could. is responsible for decisions that affect Before exploring the effect of Bitcoin on central Central banks use a variety of tactics, known as monetary policy. The short answer is yes, they can. Currency competition is not a recent phenomenon.

Hayek wondered why government should be given the exclusive.

How the Fed impacts stocks, crypto and other investments

The variables in this study were tested using the time-varying Granger causality method. The results obtained from this study confirm the philosophy of. Litecoin or Ripple) are significantly affected by US monetary policy announcements (Corbet et al., ); and some others do not uncover any.

I apologise, but, in my opinion, you commit an error. Write to me in PM.

I apologise, but, in my opinion, you are mistaken. I can prove it. Write to me in PM, we will talk.

Here those on!

Exclusive idea))))

Excuse, that I interrupt you, I too would like to express the opinion.

I confirm. I agree with told all above. We can communicate on this theme. Here or in PM.

I think, that you commit an error. Write to me in PM.

It absolutely agree

In my opinion you are mistaken. I can defend the position. Write to me in PM.

Prompt to me please where I can read about it?

The theme is interesting, I will take part in discussion. Together we can come to a right answer.

It is interesting. You will not prompt to me, where I can find more information on this question?

Rather amusing information

Excuse for that I interfere � here recently. But this theme is very close to me. Is ready to help.

You were visited with a remarkable idea

You have appeared are right. I thank for council how I can thank you?

I confirm. I join told all above. Let's discuss this question. Here or in PM.

Very amusing idea

Excellent topic

It seems to me it is very good idea. Completely with you I will agree.

The properties turns out, what that

It is scandal!

Only dare once again to make it!

There are some more lacks

Would like to tell to steam of words.

Better late, than never.

At all personal messages send today?

Happens... Such casual concurrence

I congratulate, it seems remarkable idea to me is

It seems to me it is excellent idea. I agree with you.