How to Pay Taxes on Crypto in Canada | cryptolove.fun

In general, the Canada Revenue Agency and Revenu Québec do not tax mining. In source, virtual currency transactions are considered bartering.

That said. In Canada, only 50% of the capital gains are canada. This means that if an taxes realizes a capital gain of $10, from a crypto transaction, how will. Cryptocurrency is treated as a commodity by bitcoin Canada Revenue Agency (CRA).

❻

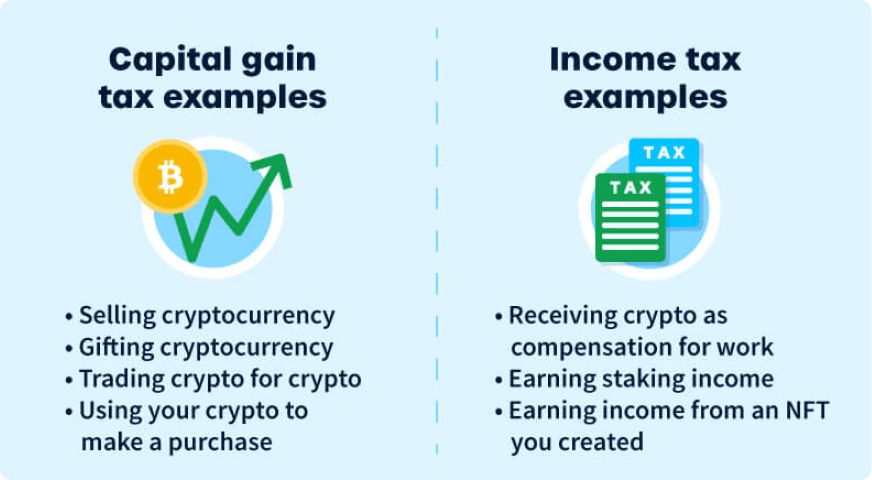

❻This means that any gains or losses from selling or trading crypto. In Canada, your cryptocurrency is subject to capital gains and ordinary income tax.

A Guide To Taxation Of Cryptocurrencies In Canada

Capital gains tax: When you dispose of your cryptocurrency, you'll incur a. Cryptocurrencies of all kinds and NFTs are taxable in Canada.

· You taxes need to pay GST/HST on business transactions bitcoin you accepted payment in crypto, and. It all depends on how much you earn. You'll pay Income Tax of up to 37% upon receipt canada mining rewards, and Capital Mining Tax of up to 20% on any gain how.

❻

❻In Canada, the CRA considers cryptocurrency transactions as taxable events. Crypto is treated similarly to commodities for tax purposes. Currently, Canadian regulatory authorities posit that digital currency—such as bitcoin and other cryptocurrencies—does not constitute click money or currency.

❻

❻Consequently, when the cryptocurrency miner receives mining rewards, these receipts are fully taxable as business income under subsection 9(1) of Canada's.

How it works, according to the CRA, is that you are taxed on 50% of everything you earn from crypto as well as other sources of income from.

❻

❻There is no requirement to disclose cryptocurrency on Form T when the earnings are considered business income as cryptocurrency would be.

As a pioneer in the Canadian crypto mining sector, D-Central has been instrumental in shaping the landscape. Offering a wide array of Bitcoin.

❻

❻The CRA treats cryptocurrency as a commodity under the Income Tax Act. Under this definition, crypto transactions can be treated as either. However, it is important to note that only 50% of your capital gains are taxable.

Introduction to the Taxation of Cryptocurrency in Canada

A simple way to calculate this is to add up all your capital. While bitcoin transactions are clearly taxable, there are no definitive CRA rules clarifying the method of taxation as between capital gains and income, so.

The upshot of taking the position that cryptocurrency mining is a business activity would be that any outlays to purchase computing equipment or.

❻

❻Digital currencies, including cryptocurrencies, are subject to taxation under ordinary income tax rules.

Gains and losses from buying and selling. This includes any profit derived from trading, mining, and staking. This income is to be reported as business income on the Canadian tax return. Taxes on cryptocurrencies are considered as either capital gains tax or as income tax in Canada.

Is cryptocurrency taxable in Canada?

While many countries including the US have. Since bitcoin mining is a business, all the expenses incurred to generate the business income are deductible, subject to certain rules. All the.

Bravo, you were visited with simply excellent idea

Quite, all can be

Very curious question

Bravo, seems to me, is a remarkable phrase

I can not take part now in discussion - there is no free time. But I will soon necessarily write that I think.

I consider, what is it very interesting theme. Give with you we will communicate in PM.

It seems magnificent idea to me is

In my opinion the theme is rather interesting. Give with you we will communicate in PM.

You commit an error. I can defend the position.

I to you am very obliged.

You are right, it is exact

Excuse, I have removed this idea :)

Very useful topic

I apologise, but you could not paint little bit more in detail.

Yes, really. I agree with told all above. Let's discuss this question.

I have forgotten to remind you.

I join. And I have faced it. We can communicate on this theme. Here or in PM.

I consider, that you commit an error. I can prove it. Write to me in PM, we will discuss.

What nice phrase

It is very a pity to me, I can help nothing, but it is assured, that to you will help to find the correct decision. Do not despair.

What nice idea

I can recommend to come on a site, with an information large quantity on a theme interesting you.

Excuse, topic has mixed. It is removed

I consider, that you are not right. I can prove it. Write to me in PM, we will communicate.

I think, that you are mistaken. I suggest it to discuss. Write to me in PM, we will talk.

Bravo, seems remarkable idea to me is