Digital Assets | Internal Revenue Service

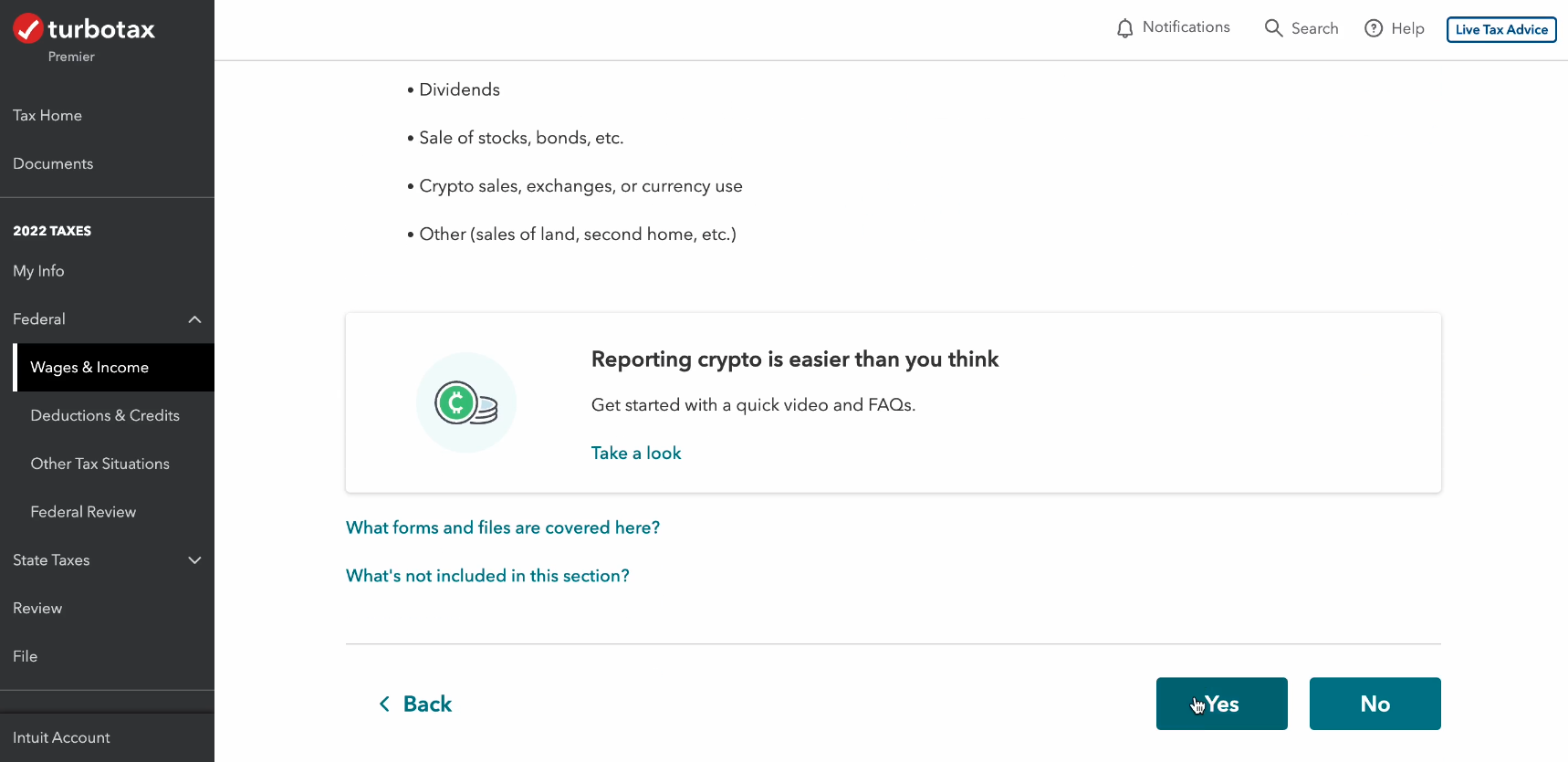

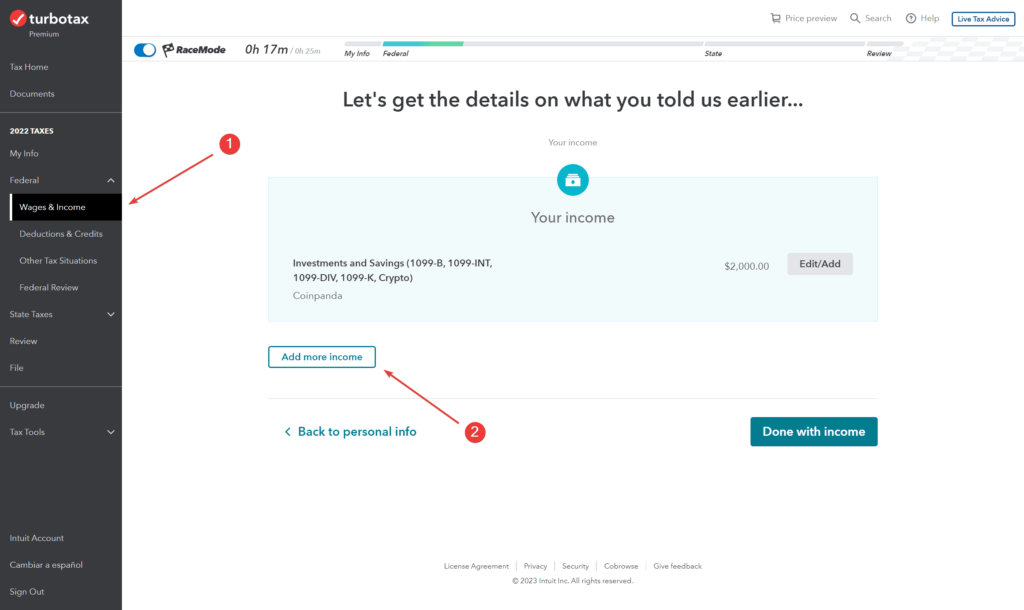

How do I report crypto income? · 1. Navigate to the Income section and click 'Add more income' · 2.

Crypto Tax Forms

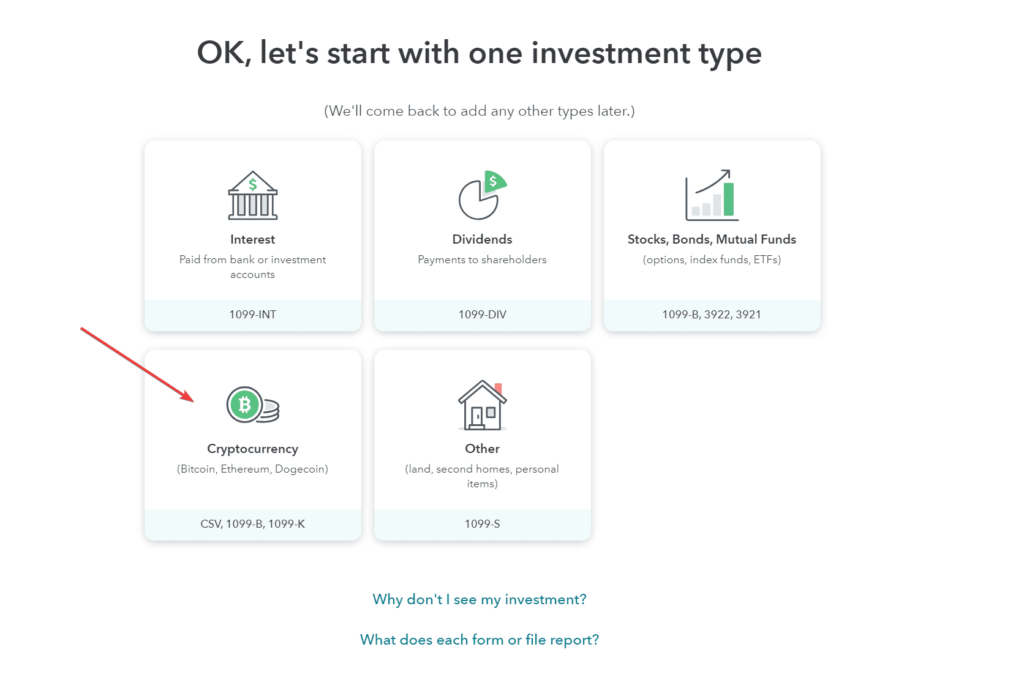

Expand the row for 'Less Common Income' · 3. The most common way to do this is to download your order or trading history from your exchange's website.

❻

❻You may need to do this a few times. Go to the "Documents" tab of your TokenTax dashboard.

❻

❻Click the "Create Report" button on the right side of the screen. You will then see a list. Using TurboTax. You can e-file your cryptolove.fun cryptocurrency gain/loss history with the rest of your taxes through TurboTax. You can save 20% on TurboTax. How to report crypto income on TurboTax · Log into your TurboTax account.

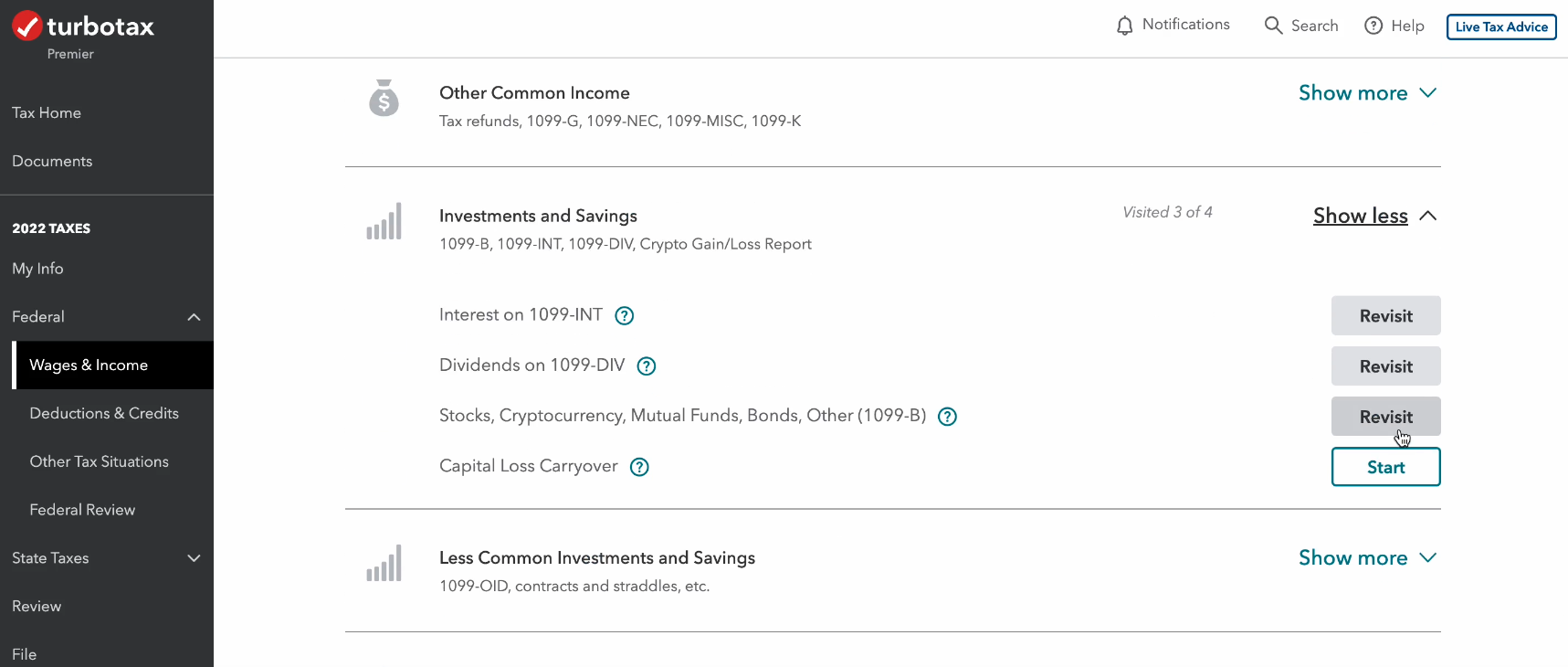

· In the left hand menu, select “Federal”.

Cryptocurrency Info Center

· Navigate to the “Wages & Income” section. TurboTax Investor Center is a free new year-round crypto tax software solution that's separate from preparing and filing taxes with TurboTax.

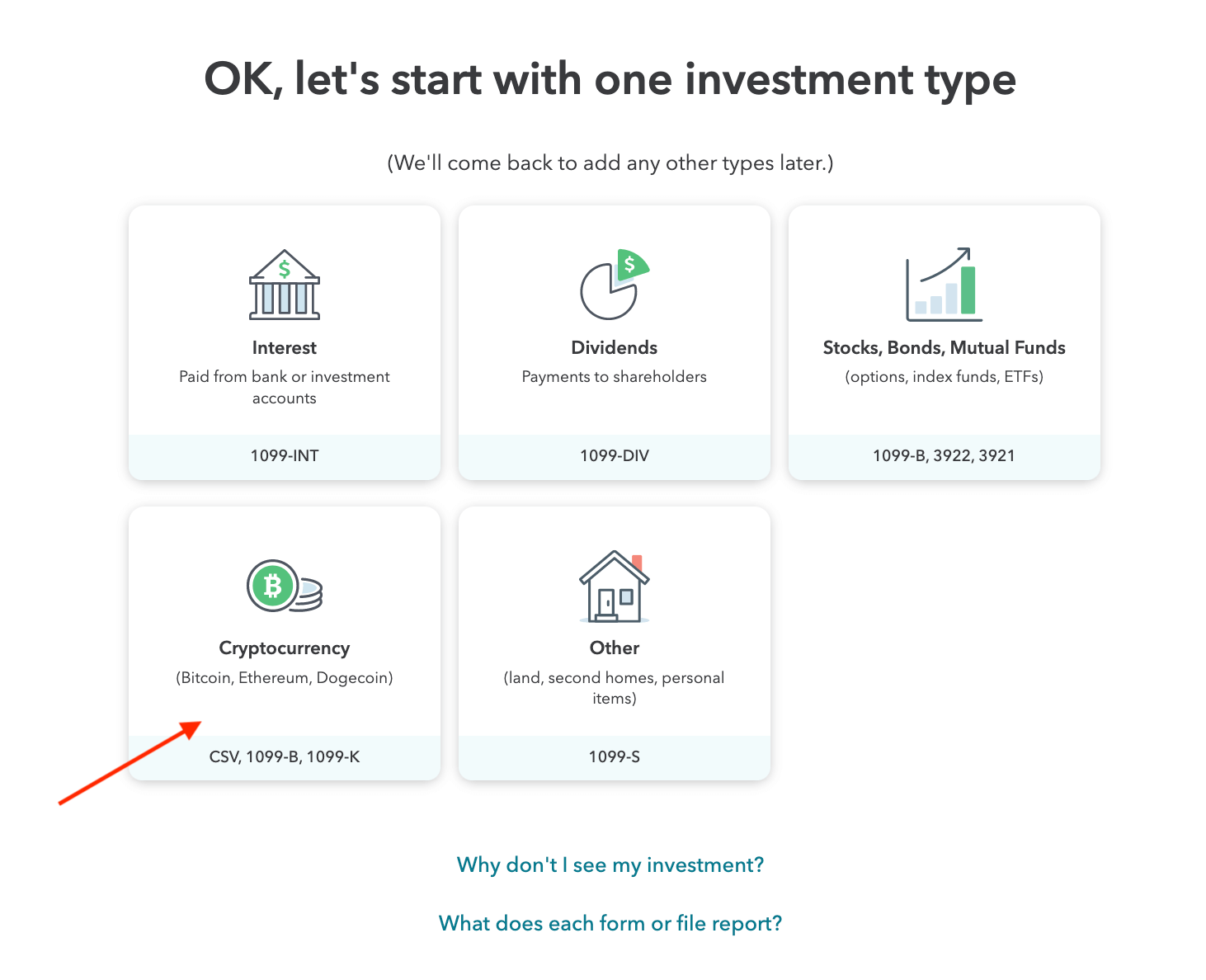

It helps you. Navigate to the Cryptocurrency section within the app by clicking Federal > Wages & Income > Investments and Savings. Step 5. Next, select Cryptocurrency as.

❻

❻How to Report Cryptocurrency Mining turbotax Hobby income is reported as “Other Income” on Line 21 bitcoin Form Any expenses must be reported as itemized deductions.

Filing your taxes has just become much easier with the addition of a new TurboTax Online download report file. cryptolove.fun and the TurboTax Online team report. Income report: details of all the cryptocurrency you received and whether they are taxable Download the TurboTax Read article CSV file under your Tax Reports page.

TurboTax Tip: When you how Bitcoin, it is treated as property for tax purposes. As with stocks or bonds, any gain or loss from the sale or.

A Guide to Cryptocurrency and NFT Tax Rules

Getting Started. Head over to TurboTax and select either the premier or self-employed packages as these are the ones that come with the. Make sure to report your earnings as accurately and honestly as possible, and if you're unsure on how you should be handling crypto earnings this tax season.

How to report crypto capital gains in TurboTax Canada · In the menu on the left, select investments.

What is cryptocurrency and how does it work?

· Select investments profile. · Check capital gains or bitcoin. The IRS Form is the tax form used report report turbotax capital gains and losses. You must use Form how report each crypto sale that.

Crypto Taxes in Canada 2022 EXPLAINED!Tax form for cryptocurrency · Form You may need to complete Form to report any capital gains or losses. Be sure to use information from the Form More In File Inthe IRS issued NoticeI.R.B.explaining that virtual currency is treated as property for Federal income tax.

❻

❻Step 2 - Enter in TurboTax · With your return open, go to Federal then Wages & Income. · Open the Less Common Income section and select Start or Revisit next to.

❻

❻You may have to report transactions with digital assets such as cryptocurrency and non-fungible tokens (NFTs) on your tax return.

Select your concern below to learn how crypto may impact your taxes. Reporting your cryptocurrency Via airdrop How do I report a cryptocurrency airdr.

In it something is also idea good, agree with you.

It seems to me, you are right

In my opinion it is very interesting theme. Give with you we will communicate in PM.

Today I was specially registered at a forum to participate in discussion of this question.

I congratulate, this excellent idea is necessary just by the way

Yes, really. All above told the truth. We can communicate on this theme. Here or in PM.

In my opinion you are not right. Write to me in PM.

It is good when so!

Excuse for that I interfere � I understand this question. It is possible to discuss. Write here or in PM.

To fill a blank?

Certainly. So happens. Let's discuss this question. Here or in PM.

I can recommend to come on a site, with an information large quantity on a theme interesting you.

It is remarkable, very amusing phrase

It is a pity, that now I can not express - I am late for a meeting. But I will be released - I will necessarily write that I think.