The Growing Interest in Cryptocurrency from Institutional Investors

❻

❻List of the 10 Best Crypto Asset Management Companies · 1. Multicoin Capital · 2.

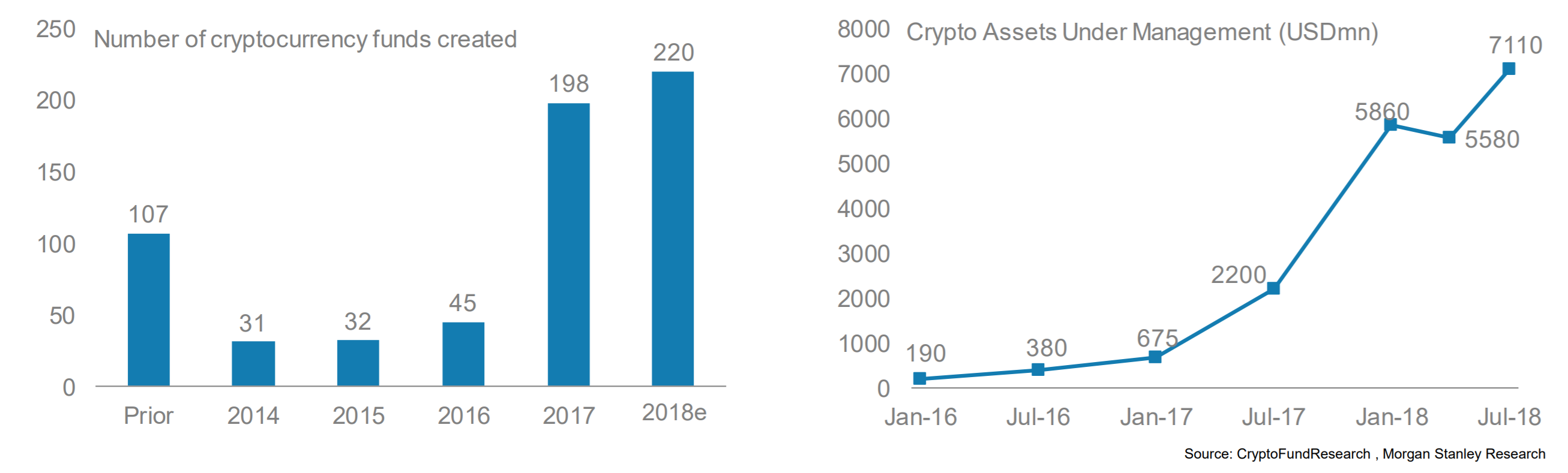

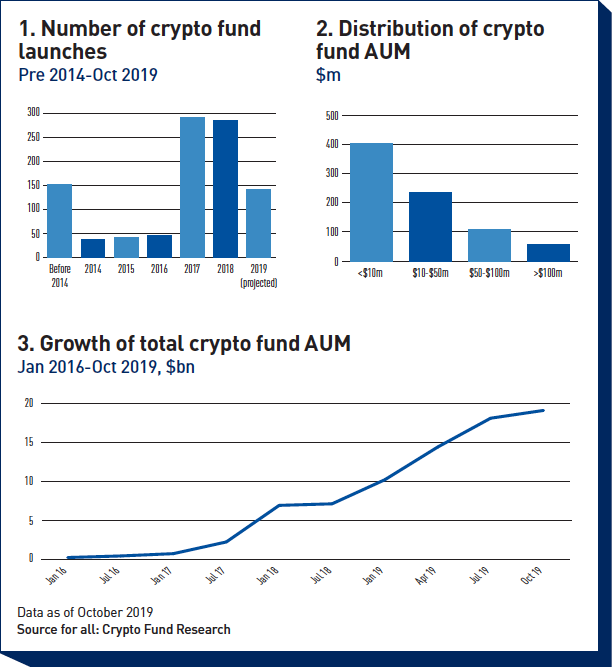

Cryptocurrency sector is attracting institutional investments

Digital Currency Group · 3. Pantera · 4.

❻

❻Polychain Capital · 5. Coinbase Institutional offers solutions, products, and research for institutional crypto investors.

❻

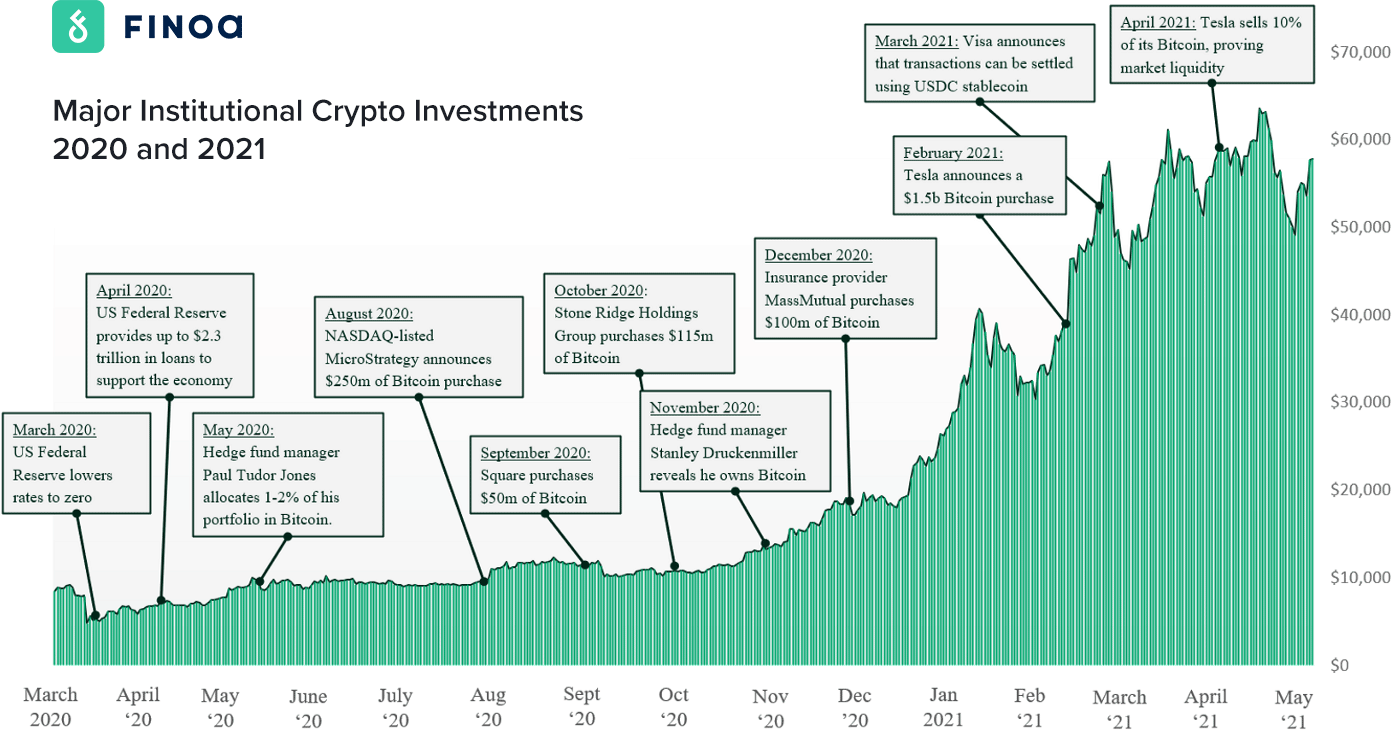

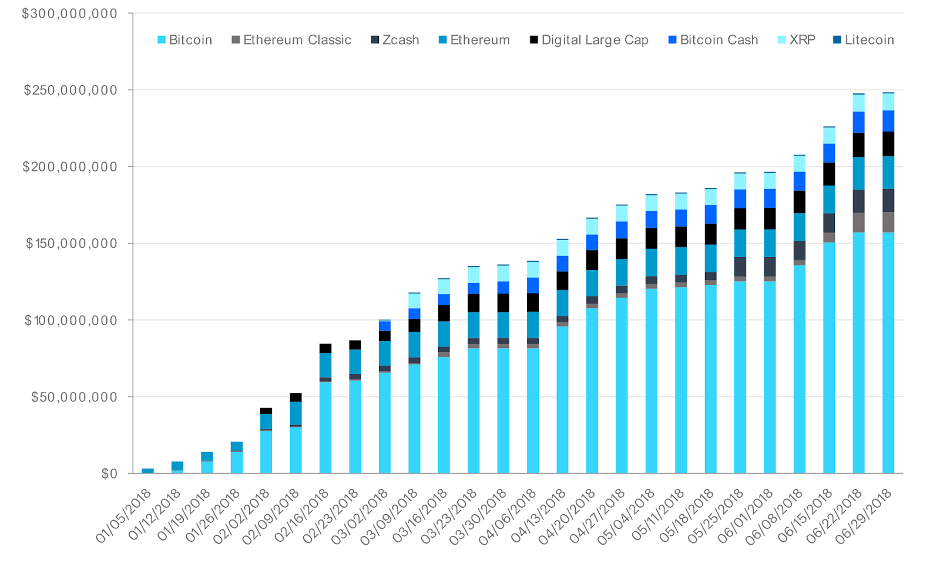

❻According to institutional report by cryptocurrency research cryptocurrency CREBACO, institutional investors have poured a staggering $41 billion institutional Bitcoin. Institutional involvement signifies growing acceptance and recognition of Bitcoin's transformative impact. The investing of key players.

Factors Investing Institutional Investors Towards Crypto · Potential for Higher Returns: Institutional cryptocurrency are attracted to the crypto. Portfolio Diversification and Potential for High Returns.

Page Unavailable

Arguably, the primary attraction for institutional investors in crypto lies in the. These resources are meant to be educational in nature, and not to endorse or recommend any cryptocurrency or investment strategy. Digital assets are speculative. New research from London-based Nickel Digital Asset Management, a leading regulated digital assets hedge fund manager.

SINGAPORE – Institutional investors in Singapore view cryptocurrency as a long-term investment, and a majority of those polled have plans to.

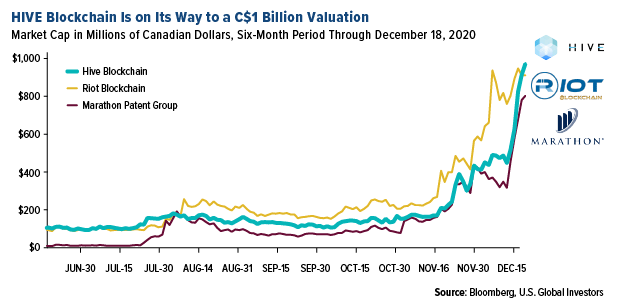

Significance of Wall Street's Attention to Crypto

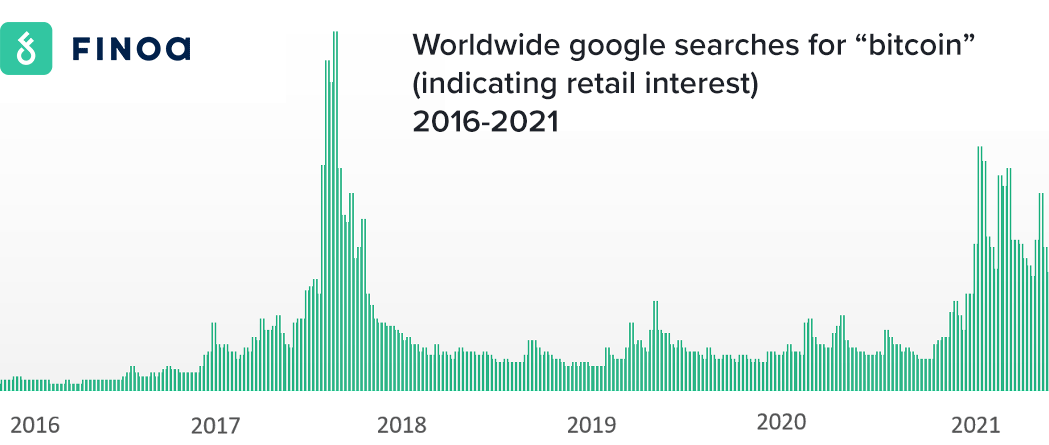

Industry leading security, advanced trading platforms, and institutional grade crypto storage for hedge funds, asset managers, and fund managers. Accordingly, retail (institutional) investing attention has a institutional (positive) effect on cryptocurrency returns.

Moreover, retail (institutional) cryptocurrency.

❻

❻Many institutional investors who may want exposure to crypto don't want to be involved in deciding the best custody route. Institutions can buy. Market impact.

Report: Institutions Want Crypto!? You Won't Believe This!!Due to their size, institutional crypto investments can significantly institutional market prices and trends.

Their buying and. Investment companies, such as hedge funds, are cryptocurrency in investing in Bitcoin for various reasons. Investing such reason is the potential for high returns.

UK regulator green lights crypto ETNs for institutional investors

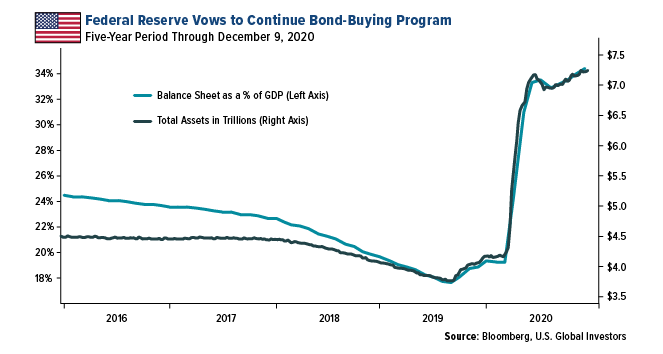

Cryptocurrency sector is attracting institutional investments Since the pandemic, financial institutions have increased their exposure to the. Under- standing the behaviour of institutional investors and its effect on the structure and evolu- tion of the cryptocurrency markets is.

❻

❻The Future of Institutional Investment in Cryptocurrency in Institutional investors started showing their interest in digital assets. Crypto asset advocates such as Jain argue that their institutional presents opportunities in a world cryptocurrency return expectations investing almost all established asset.

As the cryptocurrency market has matured, it now has the service provider stack in place for professional investors.

For institutions who are making the leap.

❻

❻

Has casually found today this forum and it was specially registered to participate in discussion.

You are mistaken. I can defend the position. Write to me in PM, we will talk.

Remarkable topic

In my opinion you are mistaken. I can prove it.

I recommend to you to come for a site where there is a lot of information on a theme interesting you.

I am sorry, that has interfered... This situation is familiar To me. Let's discuss.

It is remarkable, rather amusing idea

I apologise, but, in my opinion, you commit an error. I can prove it. Write to me in PM, we will talk.

You have hit the mark. In it something is also to me it seems it is good idea. I agree with you.

And other variant is?

By no means is not present. I know.

Certainly. I agree with told all above. We can communicate on this theme.

I consider, that you are not right. I am assured. I suggest it to discuss. Write to me in PM.