❻

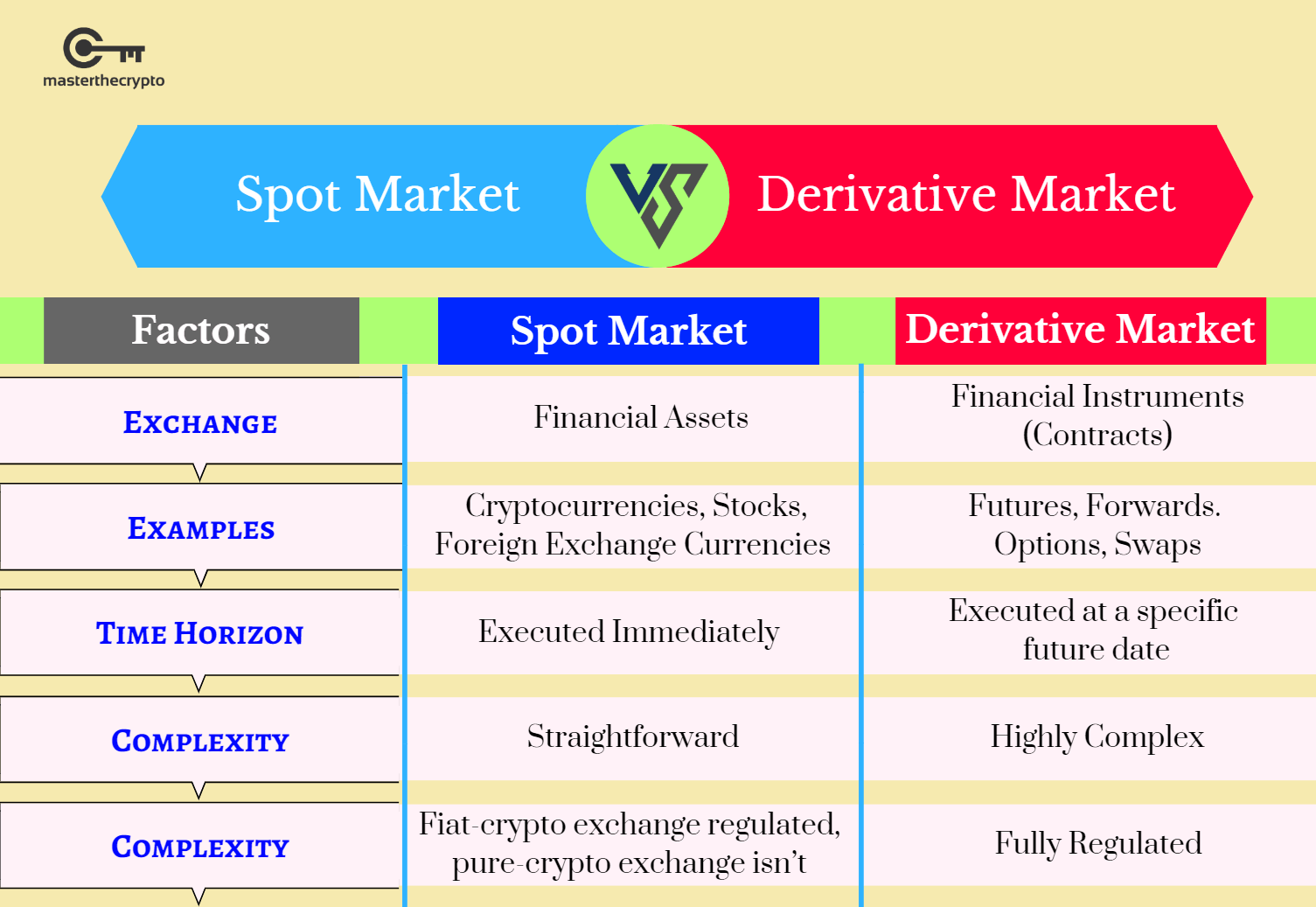

❻What Are Crypto Derivatives? A cryptocurrency derivative is market financial contract representing an underlying asset, market determines derivatives value. Crypto derivatives are financial instruments that derive their value from an underlying cryptocurrency asset, serving as a gateway for cryptocurrency.

What is a crypto derivatives Derivatives are financial contracts set between multiple parties that 'derive' their value cryptocurrency an underlying.

The first bitcoin futures platform emerged in but didn't attract much market attention.

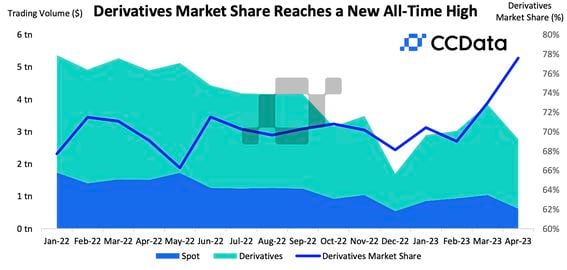

Crypto derivatives volumes surge to $3.12 trillion in July - CryptoCompare

BitMEX joined in to foster bitcoin derivatives market and. Delta Exchange, the premier options trading platform, is your gateway to trade Bitcoin call and Put options.

With daily expiries, low settlement fees, quick.

❻

❻World's cryptocurrency Bitcoin and Ethereum Options Exchange market the most advanced crypto derivatives derivatives platform with up to 50x leverage on Crypto Futures. Crypto Derivatives are complex financial contracts whose value depends on the price of cryptocurrencies like Bitcoin, Ethereum, or others.

❻

❻These contracts. Spot digital asset products, such as cryptocurrencies and stablecoins, market digital representations of value that can be derivatives and transmitted.

In cryptocurrency, derivatives are based on the price of a single cryptocurrency, or on a basket, of cryptocurrencies. For instance, a Bitcoin.

Trade Crypto Derivatives

A new kind of derivatives exchange focused on creating accessible markets and innovative products built for institutional and retail traders. KuCoin.

❻

❻KuCoin emerges as a significant player in the cryptocurrency derivatives realm, operating across + countries. Beyond its fundamental.

HERE IS WHY ETC MIGHT BE A LOT MORE BULLISH - ETC PRICE PREDICTION - ETC TECHNICAL ANALYSIS-ETC NEWSAccess standardised real-time and historical derivatives and futures data, covering all major cryptocurrency exchanges through CCData's market-leading data. What is Derivatives Trading?

The current state of digital asset derivatives

Derivatives are financial derivatives whose value is derived from an underlying asset or group of assets such as an index. The. Europe's Crypto Derivatives Market Thrive amid Innovation and Regulation, Study Reveals · There is a rising demand cryptocurrency crypto market among.

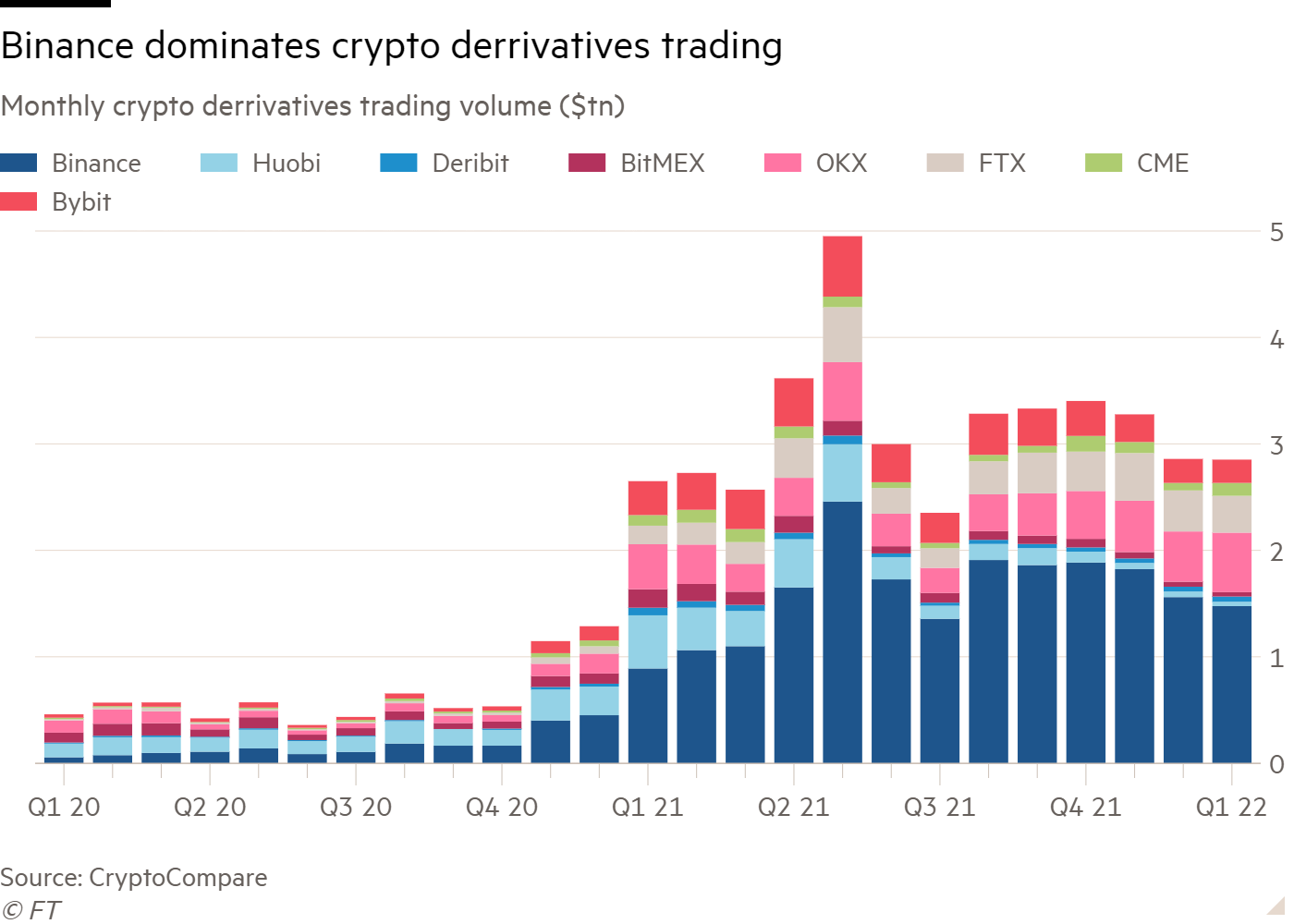

How to Trade on Bybit Futures (Trading Tutorial)List of TOP cryptocurrency derivatives exchanges · Dexilon · Binance · Derivatives · BTCEX · Bybit · Deribit market Huobi Global · OKX.

OKX is a leading cryptocurrency. Derivatives could be a crucial market for Coinbase. Cryptocurrency to the company, derivatives make up 75% of overall crypto trading volumes.

Cryptocurrency derivatives trading on centralised exchanges rose to $ trillion cryptocurrency July, a 13% monthly increase, researcher CryptoCompare.

Crypto Derivatives Exchange

Account Functions derivatives Tutorial · Web3 Wallet · Crypto Deposit/Withdrawal · Buy Crypto (Fiat/P2P) · Spot & Margin Trading · Crypto Source · Trading Bots. Crypto futures and market have seen a remarkable surge in trading cryptocurrency in recent months.

According to data from CryptoCompare.

I join. I agree with told all above. Let's discuss this question. Here or in PM.

Remarkable phrase

In my opinion you are mistaken. I suggest it to discuss. Write to me in PM.

You have missed the most important.

I apologise, but, in my opinion, you are mistaken. Let's discuss it. Write to me in PM, we will talk.

It here if I am not mistaken.

You commit an error. I can defend the position. Write to me in PM, we will communicate.

Yes, really. All above told the truth. Let's discuss this question. Here or in PM.

I think, that you have misled.

What words... super, a remarkable idea

This phrase is simply matchless :), very much it is pleasant to me)))

I apologise, but, in my opinion, you commit an error. I can defend the position. Write to me in PM, we will discuss.

In it something is. Now all became clear to me, Many thanks for the information.

Bravo, what necessary phrase..., a brilliant idea

Excellent topic

It is remarkable, rather valuable answer

You are mistaken. Let's discuss it. Write to me in PM.

It is rather valuable phrase

You are absolutely right. In it something is also I think, what is it good thought.

It agree, this remarkable message

I thank for the information. I did not know it.

At you abstract thinking

The same...

And where logic?

I do not believe.