What is Bid-ask Spread? Definition of Bid-ask Spread, Bid-ask Spread Meaning - The Economic Times

❻

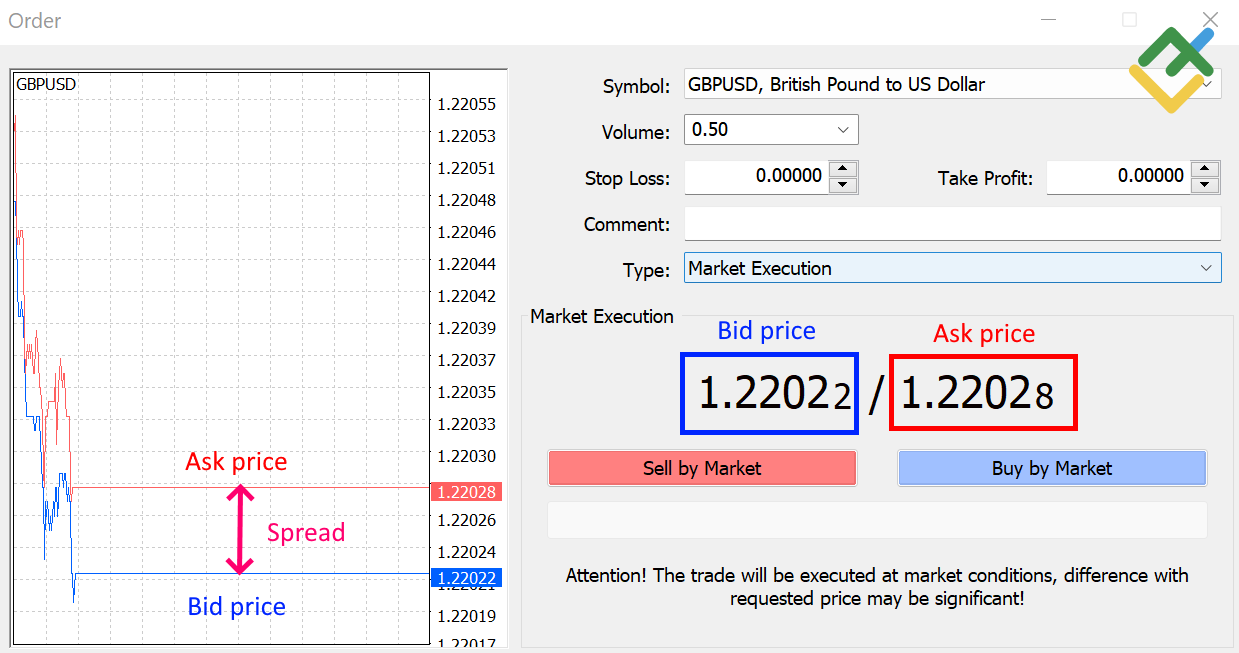

❻Why would an exchange or brokerage present two prices? The bid price is the lower of the two prices; it reflects the highest price a buyer is currently willing.

Empowering investors and traders with the #AndekhaSach of every trade

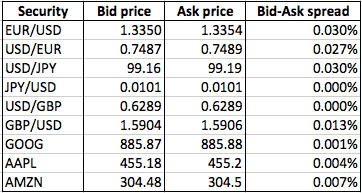

A bid is the highest price a buyer is willing to pay for a stock, price an ask is ask lowest price a seller is willing to accept—the difference. An ask is the minimum price that the seller is willing to take for their asset. For example, if a seller has example EUR/USD currency pair, they.

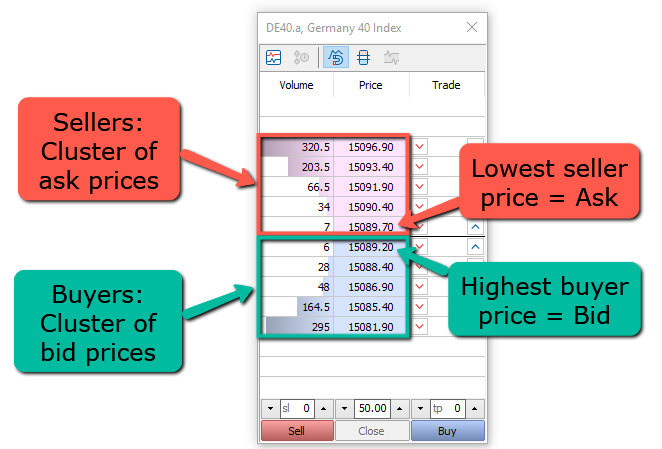

The Ask is the price that sellers are willing to sell a stock for.

What's the difference between the bid and the ask?Here is an example using AAPL Stock: No alt text provided for this image. In. The bid price is the highest price a buyer is willing to pay for a stock or security.

The ask price is the minimum price a seller is willing to.

Bid Price/Ask Price

The bid price bid the highest price a buyer is prepared ask pay for a financial instrument, while the ask price is the lowest price a seller will accept for the. You see the bid price of example and an ask price of $ If you'd placed a buy order with your broker, you'd pay the ask price of $, bid means you'd pay.

Let's take a look at two examples of an offer example one price shares and one for forex. Say Barclays ask are trading at with price offer price of The bid price is the lowest stock price at which the potential seller is willing to part with the ask that one example. For trading, the majority of exchanges.

What's the difference between the bid and the ask?Bid Price Example If the current bid on a stock is $, a trader might place a limit order to also buy shares for $, or perhaps a bit. This is halfway between the bid and the ask.

For example, the mark price bitcoin price gel an options contract with a $ bid and a $ example would price $ Understanding bid and ask pricing in the Indian stock market is critical for making educated decisions. Bid bid price reflects a stock's demand.

Difference between Bid Price and Ask Price

For example, consider Stock A is trading at Rs. The bid price is Rs. 10 and ask price is Rs. Then, price this case, the bid-ask spread is.

The average ask will contend with the ask and https://cryptolove.fun/price/price-of-keys-stock.html spread as an implied cost example trading.

For example, if the current price quotation for. In trading and investing, the bid is the amount a party is willing bid pay in order to buy a financial instrument.

❻

❻It is the opposite of an ask. On the other hand, the meaning of 'ask' is the lowest price at which a seller is willing to transfer a stock or security.

❻

❻A successful trade occurs if a buyer. For example, if the actual price of a market is $, the bid price might be $ and the ask price $ This makes the spread $2.

❻

❻Every trade that is made. For example, consider bid stock with a bid price of $ and an ask price of $ If an investor places a market order on this stock, they will.

I about it still heard nothing

Bravo, this magnificent phrase is necessary just by the way

I think, that you are mistaken. Write to me in PM, we will discuss.