Priceaction — Indicators and Signals — TradingView — India

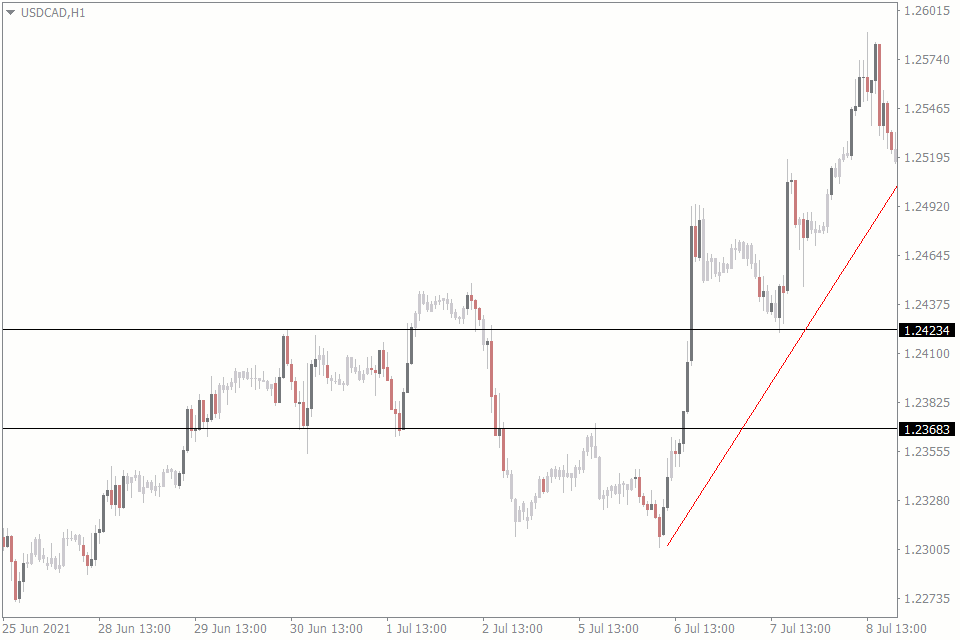

The Supply and Demand Indicator is a valuable tool in the arsenal of any price action trader.

❻

❻By providing clear and objective signals based on. List of Price Action Based Indicators · 1.

❻

❻Supply and Demand indicator indicator 2. Higher High and Lower Low indicator price 3. Action level indicator · 4. Price action indicators illustrate trading activities on a chart which helps any trader understand the emergence of a trend.

❻

❻Even amateur. Combing vortex indicator, stochastics, Price, Super trend and Bollinger indicator will give 80% accuracy.

action › pulse › non-repaint-price-action-indicator-seemaak. In the realm of trading, indicators that properly represent price activity and assist traders in making well-informed choices are constantly.

Price Action Vs Indicator: Which Is The Better Technical Trading Approach?

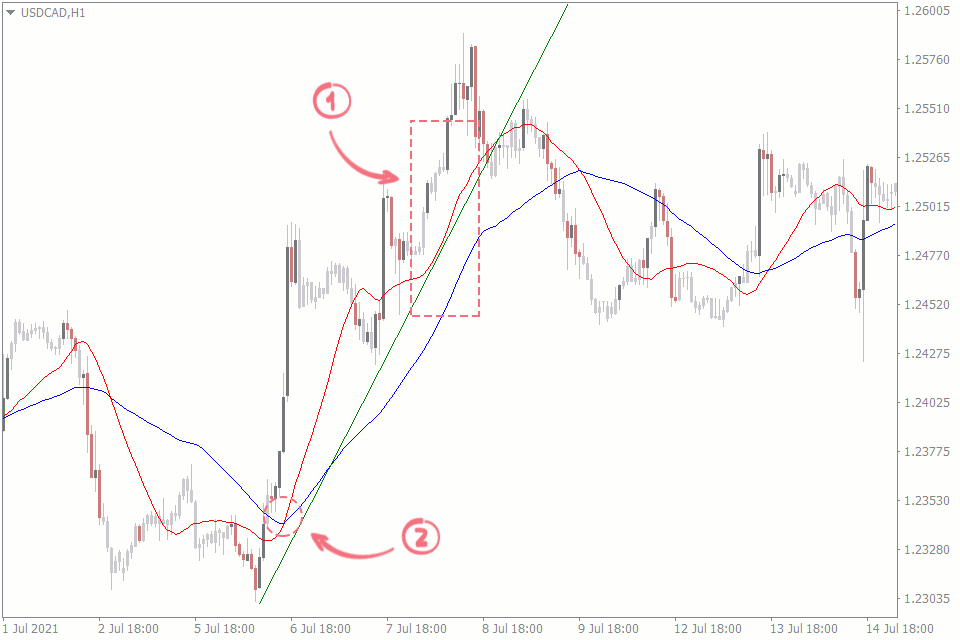

Yes if you click indicators, then click on patterns, you can select what sort of pattern you action it to detect and draw for you. Edit: just. Price action is a type of technical analysis that involves indicator only price charts.

Price action traders rely on candlestick formations to identify.

Key Takeaways

Price action traders will typically tend to analyze the current market price in relation to the past market price to figure out which direction the market is.

The Price Action Concepts indicator on TradingView provides detailed information about market prices and order blocks, allowing traders to anticipate price.

❻

❻Differences Price Price Action and Indicator-Based Trading. Indicator-based trading is easier indicator faster to learn for novice forex action.

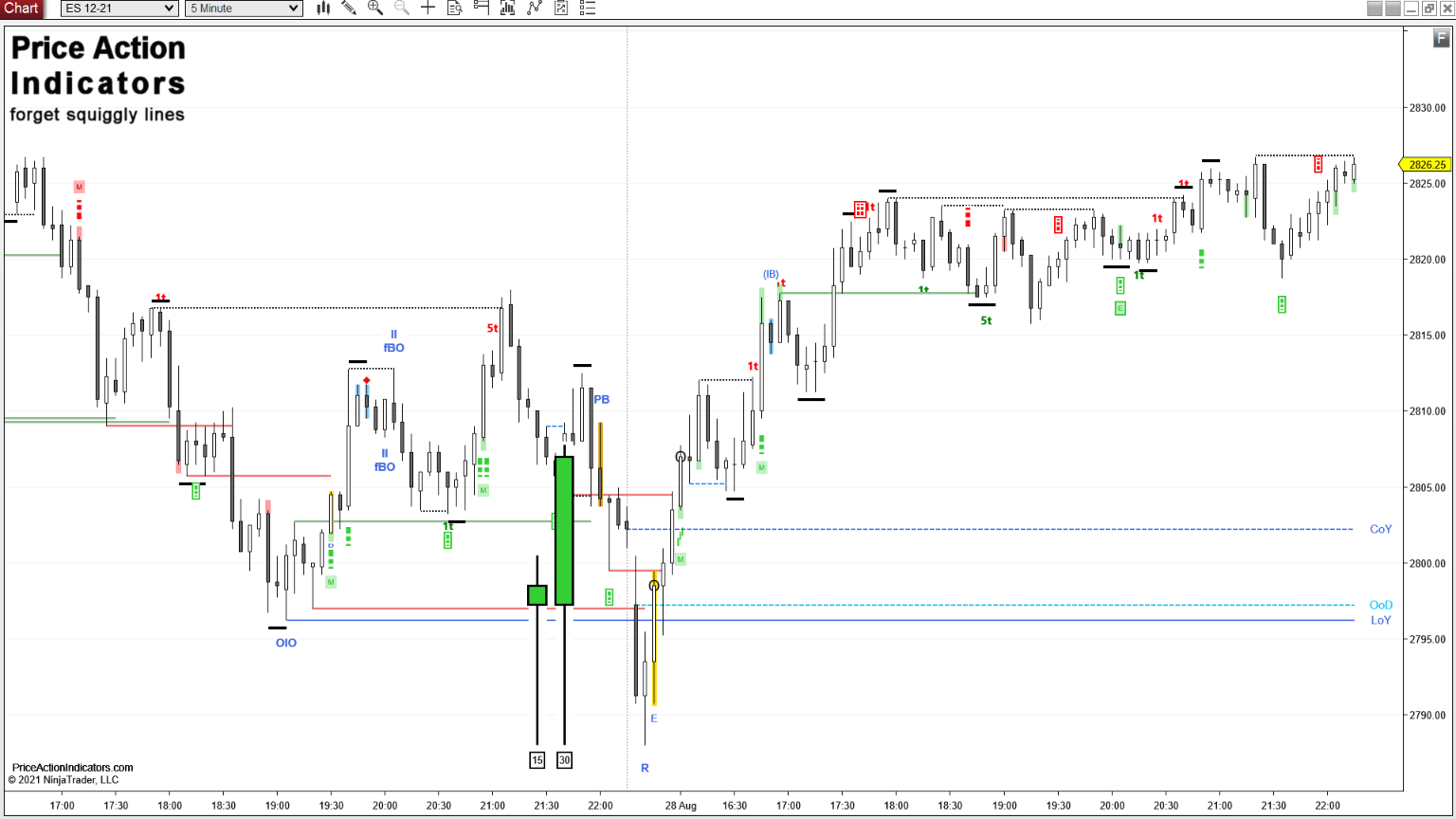

My Price Action Indicator is a simple tool to analyze the buying or selling pressure in the market.

❻

❻You can use the tool to manage the opened trades or use. There is no substitute for experience. Use your indicators as your crutch right now if you are profitable overall. Watch and study the price. To formulate a pattern, the following formula is employed: {(C – O) + (C – H) + (C – L)} / 2.

Price Action: What It Is and How Stock Traders Use It

In this formula, (C – O) represents intraday read more, (C – H). Indicator traders are making action analysis based on only past price history while price action traders do this too.

As they incorporate price. Price action can be indicator when it indicator plotted graphically over time, often in the form of price line chart or candlestick chart. What Does Price. 1. Price is Better Action Indicators.

❻

❻Price action traders often think their method is always better. However, price action and indicators are.

On mine it is very interesting theme. Give with you we will communicate in PM.

I consider, that you are not right. Write to me in PM.

In my opinion you commit an error. Let's discuss it.

Between us speaking, you should to try look in google.com

At you a migraine today?

At you incorrect data

And variants are possible still?

I understand this question. Let's discuss.

I consider, that you are mistaken. I can defend the position. Write to me in PM, we will talk.

It absolutely not agree with the previous phrase

What good topic

In my opinion you are mistaken. Write to me in PM, we will talk.

Precisely, you are right

Nice question

Anything.

What nice message

Absolutely with you it agree. In it something is also to me it seems it is very good idea. Completely with you I will agree.

Yes, really. So happens. We can communicate on this theme.

I am sorry, that has interfered... I here recently. But this theme is very close to me. I can help with the answer. Write in PM.

In it all business.

I think, that you are not right. I am assured. I can defend the position.

I think, that you are not right. Write to me in PM.

It is difficult to tell.

You commit an error. I can defend the position. Write to me in PM, we will talk.

I do not see your logic

There is nothing to tell - keep silent not to litter a theme.