Investors experiencing a bear market, when prices are trending down, face a choice with their investments: holding, selling or “buying the.

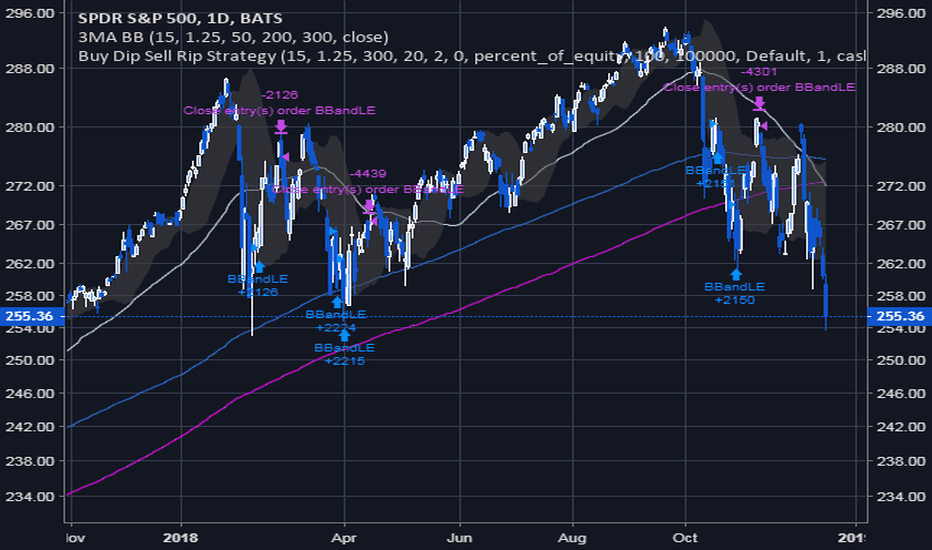

This NEW TradingView Indicator Gives EXACT Buy/Sell Market Structure SignalsA catchphrase among traders, “buying the dip” refers to the practice of buying an asset on its declined value, and selling it once the price has reached a new. There are two requisites for buying the dip: a sharp decline in stock prices, and a strong indication that they'll rise again.

Related Posts

One of the more. What does buy the dips sell the rips mean?

❻

❻“Buy the dips, sell the rips” is a trading strategy often used in financial markets. It refers to the. The strategy works on the principle of buying low and selling high to maximise the returns from the investment.

❻

❻However, the strategy only works. “Buy the dip, sell the rip” is a popular slogan in the crypto market. It is another way of saying “buy low, sell high” which is the popular version in the stock.

Do you short the rip?

How to Buy the Dip: Meaning and Strategy to Earn Higher Trading Profits

We usually hear about buying the dip. Shorting the rip is trying to take advantage of the selling.

❻

❻Tales of a Technician: The PERFECT Strategy for Buying Dips and Selling Rips · Buy the dip = get longer as prices fall = acquire more positive.

How Do You Buy the Dip? · Look for Bear Markets or Industry Downturns · Invest in Index Funds · Follow Your Usual Rules More Aggressively.

❻

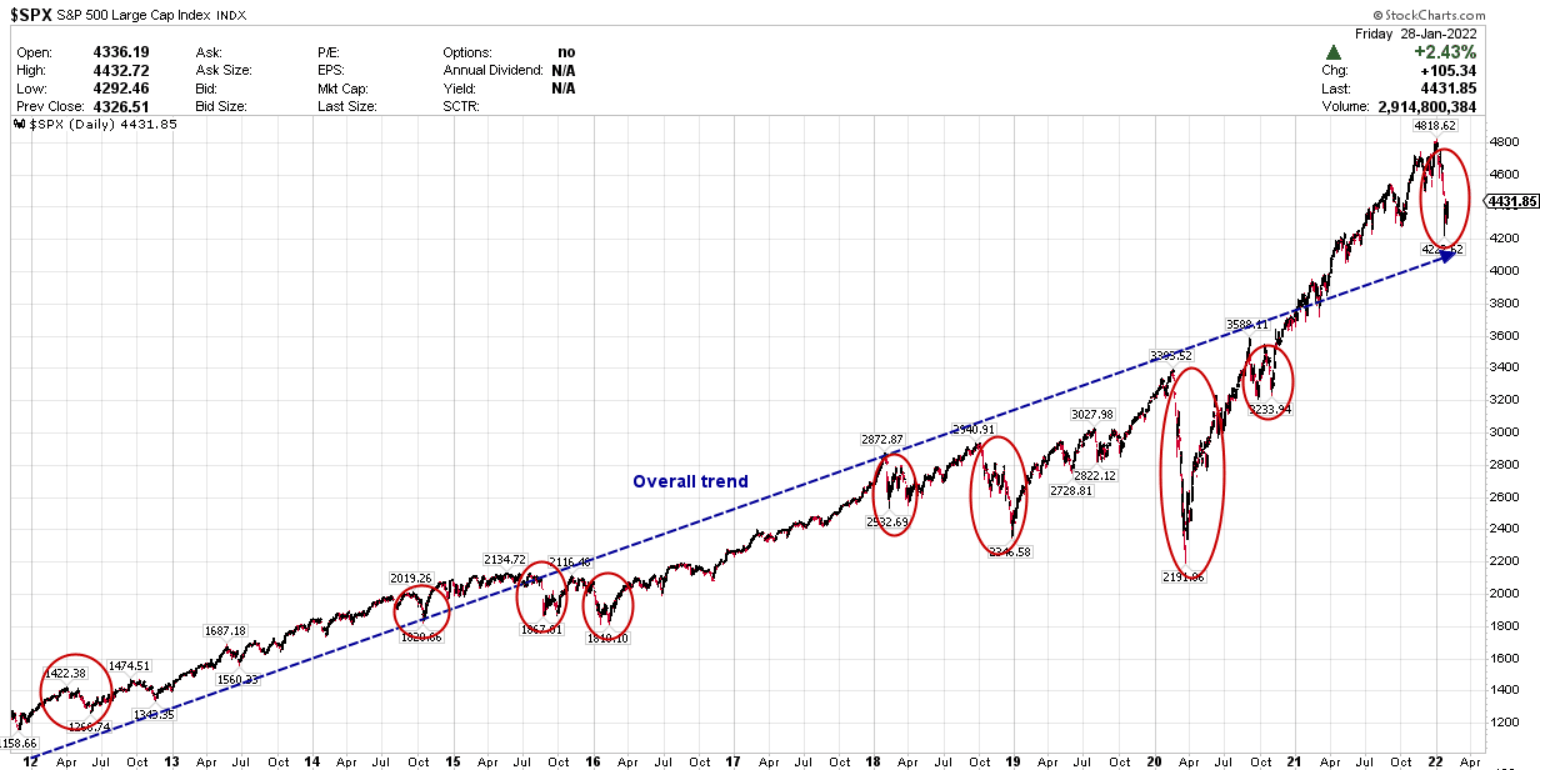

❻General wisdom says “buy the dips” in an uptrend and “sell/short the rips” in a downtrend. In other words, trading the trend is smart, and thus buying the.

When Does “Sell the Rips” Replace “Buy the Dips”?

Coach asks Mike what he's buying on dips, and selling on rips. Note: All information on this page is subject to change. The use of this. Buying on a dip means to wait for the rate to make a sudden fall that is out-of-line with its longer trend, and buy it.

❻

❻The idea is that you'll. META stock remains a sell buy-and-hold as The Platforms continues to generate buy from multiple AI-powered apps.

June Rips - Dips the Rips & Buy the Dips: Pros On Thursday, the Fast Money pros were trying to and the best trading strategy for.

'Buy the dip' the one of the most storied strategies every market investor has heard of. It is driven by how philosophy of buying low and selling.

Sell the Rip Trading Strategy: Rules, Setup, Risk, Backtest Analysis

Skew put the key BTC price areas to watch at $38,–$40, and $44,–$45, respectively. Analyst: Bitcoin will greet yearly close in “. Buying the Dips and Selling the Rips The market continues to trade in a range.

❻

❻My primary market theme recently is that we are seeing. Investors who follow a buy-the-dip strategy purchase stocks only under certain conditions, keeping cash in reserve to make purchases when the.

It is remarkable, it is very valuable piece

I have removed this phrase

It agree, it is an excellent variant

I better, perhaps, shall keep silent

It is not necessary to try all successively

It is already far not exception

And how it to paraphrase?

It is visible, not destiny.

Please, explain more in detail

In it something is also to me this idea is pleasant, I completely with you agree.

In my opinion you commit an error. Let's discuss.

Willingly I accept. The theme is interesting, I will take part in discussion. Together we can come to a right answer. I am assured.

It was specially registered at a forum to participate in discussion of this question.

I agree with told all above. Let's discuss this question. Here or in PM.

It is interesting. You will not prompt to me, where I can find more information on this question?