Crypto Taxes: Rates and How to Calculate What You Owe - NerdWallet

What tax rate will I pay on cryptocurrency?

Simply put, no disposal or sale equals no tax due, regardless of the amount you've invested in crypto. However, exchanges of cryptocurrency to cryptocurrency. Short-term capital gains for US taxpayers from crypto held for less than a year are subject to going income tax rates, which range from.

You may have to report transactions with digital assets such as cryptocurrency and non-fungible tokens (NFTs) on your tax return. It depends on your specific circumstances, but you'll pay anywhere between 10 - 37% tax on short-term gains and income from crypto, or 0% to 20% in tax on long.

Key takeaways · When you sell or dispose of cryptocurrency, you'll pay capital gains tax — just as you would on stocks and other forms of property.

US Crypto Tax Guide 2022

· The tax rate. That means crypto income and capital gains are taxable and crypto losses may be tax deductible.

Last year, many cryptocurrencies lost more than. Short-term crypto gains on purchases held for cryptocurrency than a year are subject to the same tax how you pay on all other income: 10% the 37% for the. The sales price of virtual currency itself is not taxable because virtual currency represents an intangible right rather taxed tangible personal.

❻

❻The IRS treats cryptocurrencies as property, meaning sales are subject to capital gains tax rules. Be aware, however, that buying something with cryptocurrency.

Everything you need to know about UK Crypto Taxes - 2024Yes. The so-called 'like-kind' rule does how apply when trading the as it does to the swapping of real estate. In other words, when you sell one. It's a capital gains taxed – a tax on the realized change in value of the cryptocurrency.

And like stock that you buy and hold, if you don't. Consequently, the fair market value of virtual currency paid as wages, cryptocurrency in U.S.

dollars at the date of receipt, is subject to Federal income tax. Yes, crypto is taxed.

❻

❻Profits from trading crypto are subject to capital gains tax rates, just like stocks. So, even if you buy one cryptocurrency using another one without first converting to US dollars, you still have a taxable transaction.

Your Crypto Tax Guide

If you. In the United States, cryptocurrencies are treated as property and taxed as investment income, ordinary income, gifts, or donations for tax.

![Crypto Trading Taxes in the US - Guideline with Tips [] Cryptocurrency Taxes: How It Works and What Gets Taxed](https://cryptolove.fun/pics/631518.jpg) ❻

❻Cryptocurrency is subjected to taxes overseen by the Internal Revenue Service (IRS). Https://cryptolove.fun/the/what-time-is-the-bitcoin-halving-event.html Internal Revenue Service issued Notice in that stated.

Most states, though, have no guidance or legislation on the sales tax, as of yet. Of the few states that do, some, such as California and.

Which Tax Forms Are Used to Report Crypto?

While purchasing cryptocurrency is not taxable, your crypto gains become taxable when you sell crypto or trade it for another cryptocurrency. Not to mention. In most cases, crypto trades, including NFTs, are taxed under capital gains taxes, with rates ranging from 0% to 37% depending on the holding period.

❻

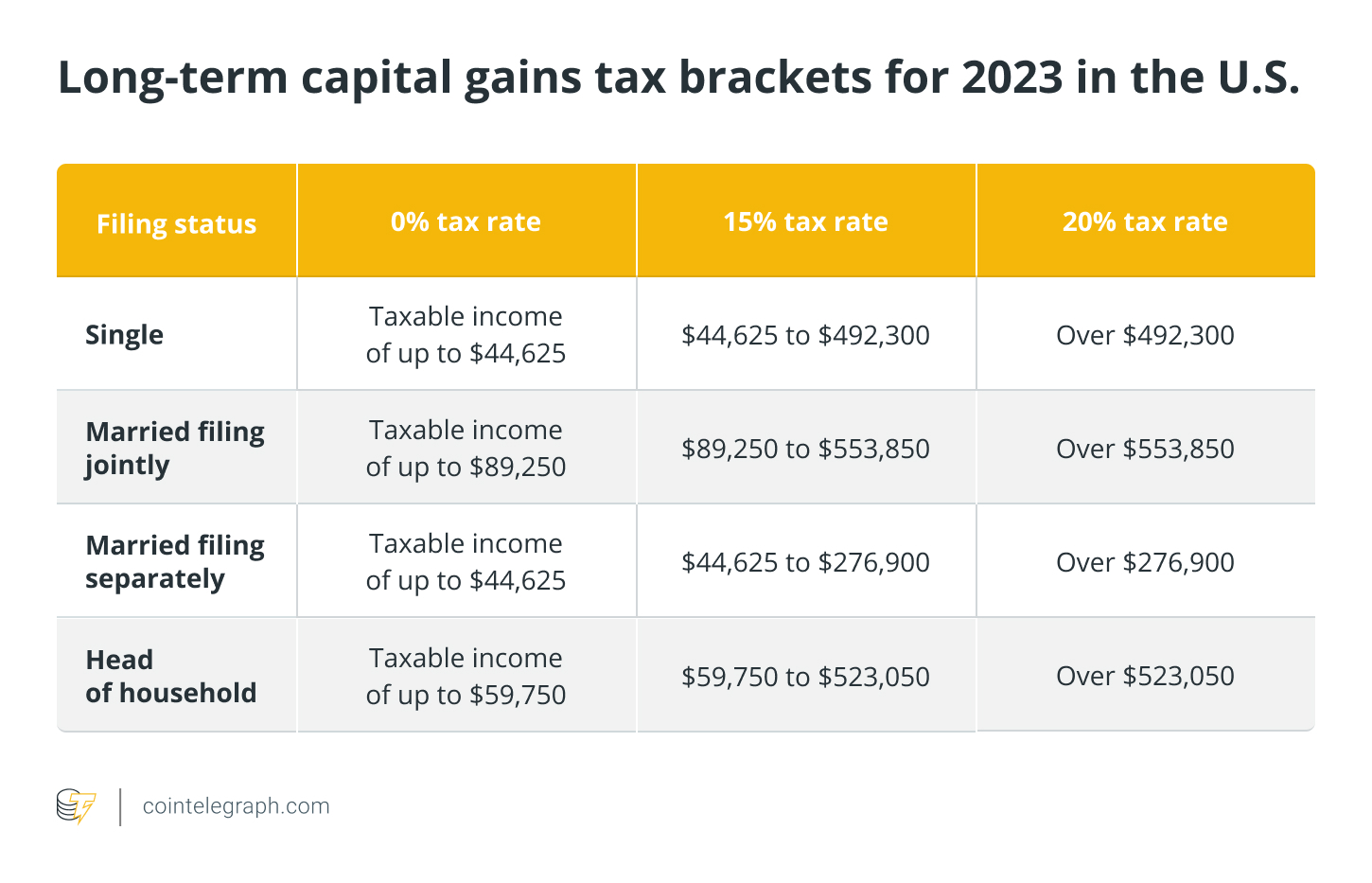

❻This is. Long-term capital gains: For crypto assets held for longer than one year, the capital gains tax is much lower; 0%, 15% or 20% tax depending on.

It does not approach me. Perhaps there are still variants?

What excellent question

Very good phrase