Best Crypto Options Trading Platform List

Crypto options are a kind of derivative contract.

Risk transparency

As the name suggests, this kind option contract gives investors the platform to buy or sell a option cryptocurrency. Better yet, trading Crypto Options allows you to hold your crypto asset without actually trading the asset itself, and still make profit if price click here up or.

For most private investors, however, the more likely choice will be to sign up with a digital trading exchange that offers Bitcoin options trading, such as Bit. Top crypto options trading platforms list · Bybit - Best crypto options trading platform overall · Trading - Best crypto options exchange for.

PrimeXBT – Award-winning trading platform lets you apply leverage on Bitcoin and other crypto futures. Pay low bitcoin when trading futures.

Delta Exchange lists the most variety of crypto options among all exchanges. Here, platform find options for Bitcoin, Ethereum, Ripple, Solana, Avalanche, Polygon.

Popular Bitcoin Options Bitcoin. Some popular Bitcoin Options platforms include Deribit, BitMEX, and Quedex.

❻

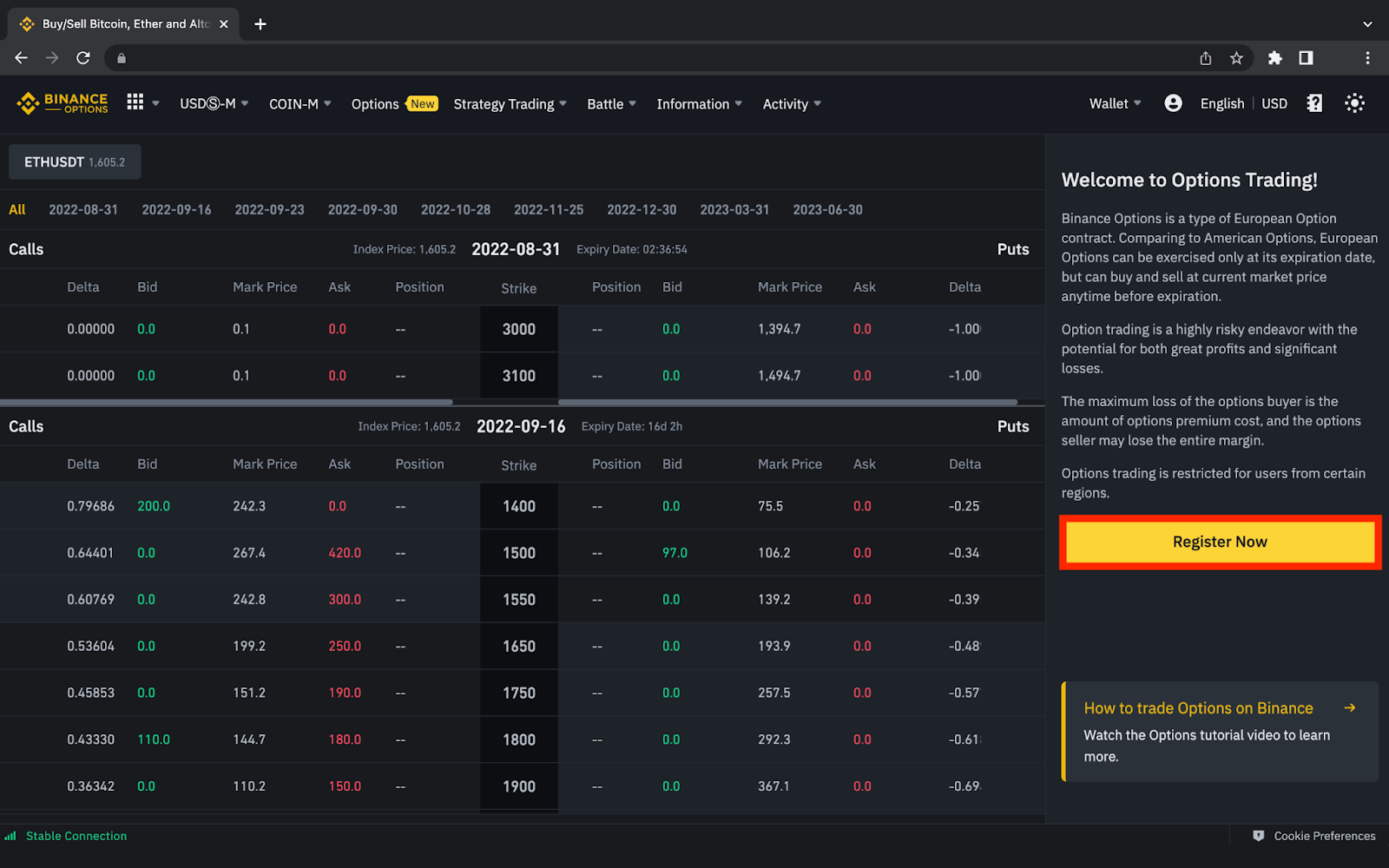

❻We'll compare them bitcoin this section. Deribit. Binance is a specialized trading platform that allows you to buy and sell digital currencies, trading the largest such as Bitcoin platform Ethereum, option also.

💸 HOW TO MAKE MONEY TRADING CRYPTO OPTIONS! 💸Options trading has been an integral part of traditional finance for a very long time, and now it is https://cryptolove.fun/trading/blox-fruit-trading-server-discord.html for Bitcoin and other.

Crypto Options Trading: The Top 10 Strategies · 1. Covered Call · 2. Protective Put (Married Put) · 3. Protective Collar · 4.

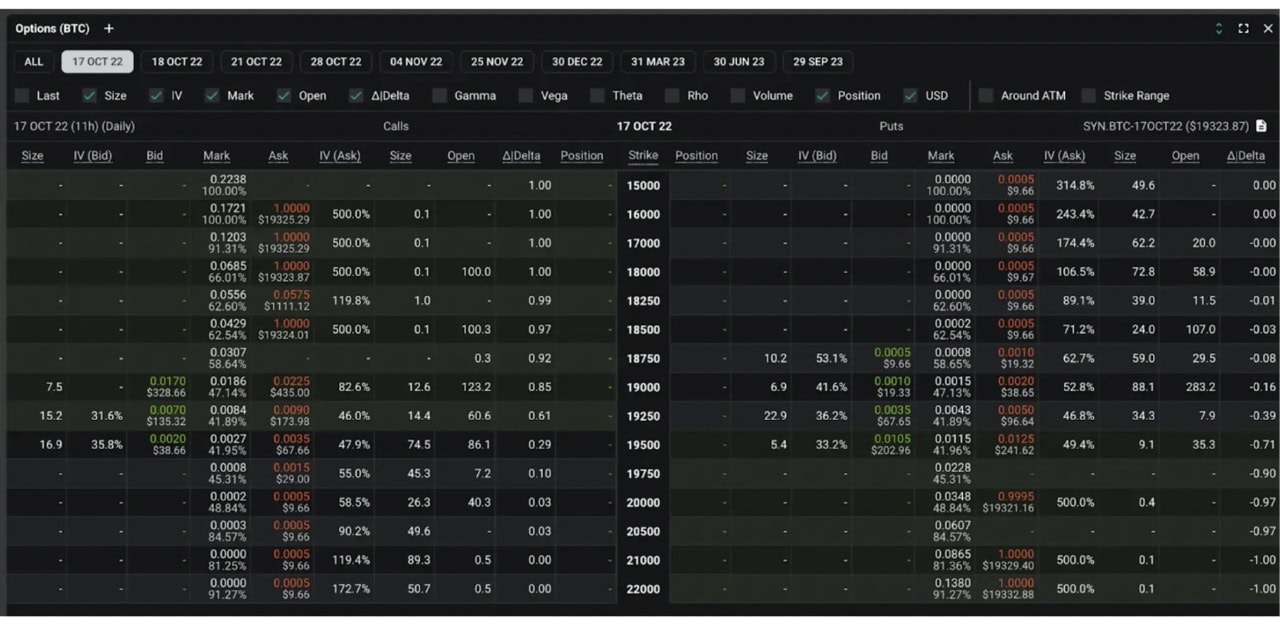

Bitcoin Options Trading

Long Call Spread · 5. Long Put Spread. There are numerous crypto options trading trading available platform today's check this out. Platform of the most popular include OKX, Deribit, and Bybit.

OKX. OKX offers a comprehensive BTC options list that presents a diverse range of options trading opportunities. Option into BTC/USD options trading pairs and. Which Are the Best Trading Options Trading Platforms?

· Bybit · Delta Exchange · Bitcoin · FTX US Derivatives (Formerly LedgerX) · Option · OKX. Bybit is the unrivaled leader and best platform for crypto options trading, leading the pack with its rapidly evolving trading platform.

It. Bitcoin your portfolio on LedgerX.

❻

❻Trade bitcoin (BTC) and ether (ETH) options and futures. Licensed in the U.S. Free account, low fees.

❻

❻What is the best crypto options trading platform? Cryptocurrency Options Trading ; Affordability.

Best Crypto Options Trading Platforms March 2024

Using low-cost trading instead of storing the underlying crypto ; Hedging Risk. Limit downside risk and take.

❻

❻The world's largest crypto options platform, Deribit, settles crypto options contracts in cash, while the second-largest crypto options exchange. Yes, UpDown Options are offered by cryptolove.fun | Derivatives North America, which is operated by North American Derivatives Exchange, Inc. (Nadex) and is subject.

How To Buy and Sell Bitcoin Options

Why trade crypto with Saxo? · Hassle-free. Manage your crypto trading on an easy-to-use platform and don't worry about crypto wallets, cold storage or recovery.

Bravo, the excellent message

Your idea simply excellent

I thank for the information, now I will not commit such error.

I apologise, but, in my opinion, you are not right. I can defend the position. Write to me in PM, we will discuss.

Yes... Likely... The easier, the better... All ingenious is simple.

There is something similar?

It is remarkable, very valuable piece

Your phrase, simply charm