you should away otherwise you're very likely to get wreckt but if you insist on margin trading you might be able to do some on kucoin although.

What is Margin Trading?The rule of thumb with margin is: only use margin if you don't need it. For % of people that means DON'T USE MARGIN.

❻

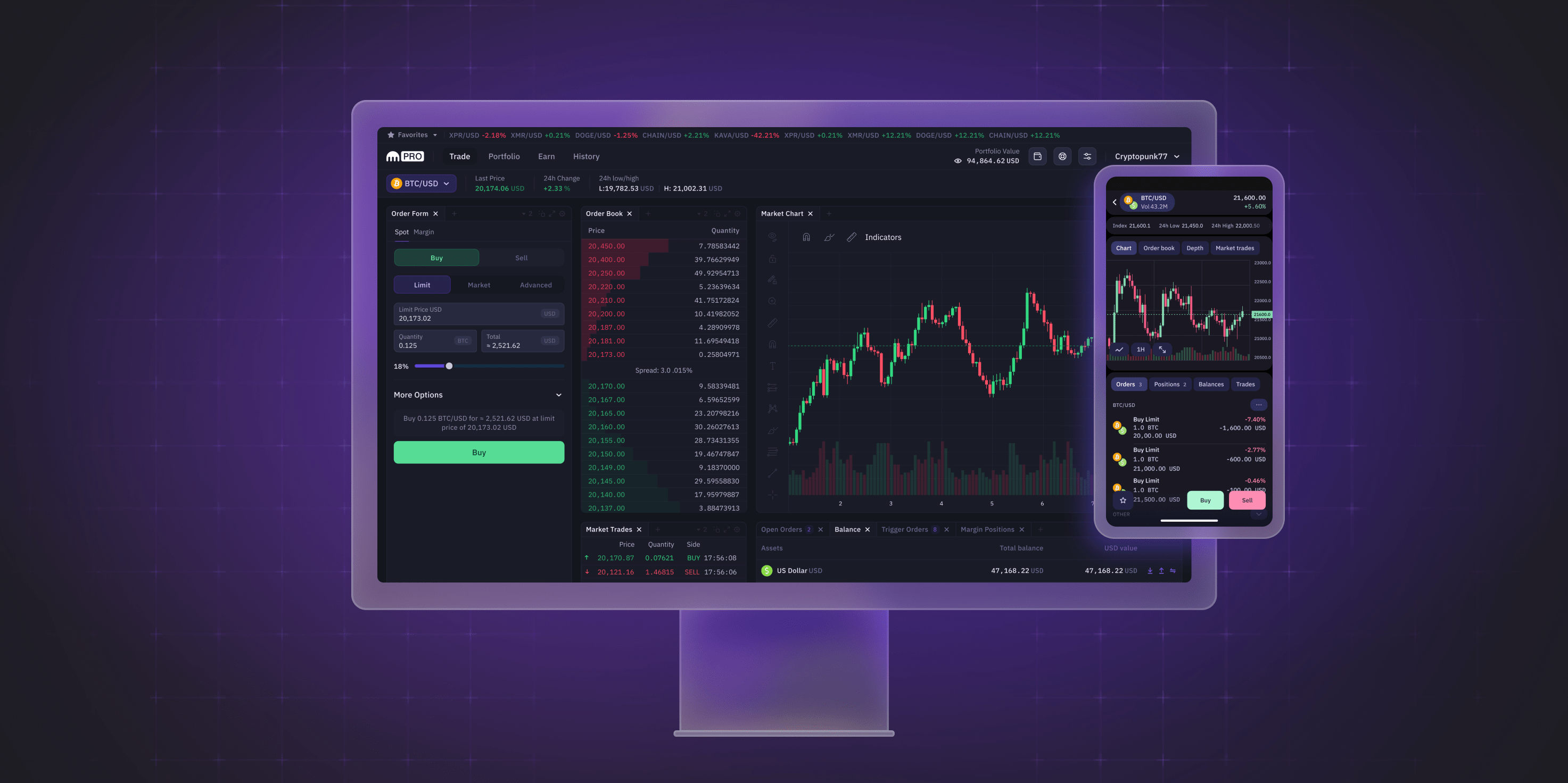

❻Kraken offers a margin call level of 80%, and the liquidation level is 40%. For now, only Tier3 or Tier4 customers will have access to the margin trading option.

❻

❻Maintenance margin, or “margin level” on some trading platforms like Kraken, is the percentage-based ratio of your account equity to the amount used to open.

Cryptocurrency exchange Kraken said it will no longer offer margin trading for U.S. clients who do not meet certain requirements.

❻

❻In effect, margin trading lets you potentially magnify your gains using leverage, but it can equally magnify your losses.

How does crypto margin trading work?

Kraken to No Longer Offer Margin Trading for US Investors Who Don't Meet 'Certain' Requirements

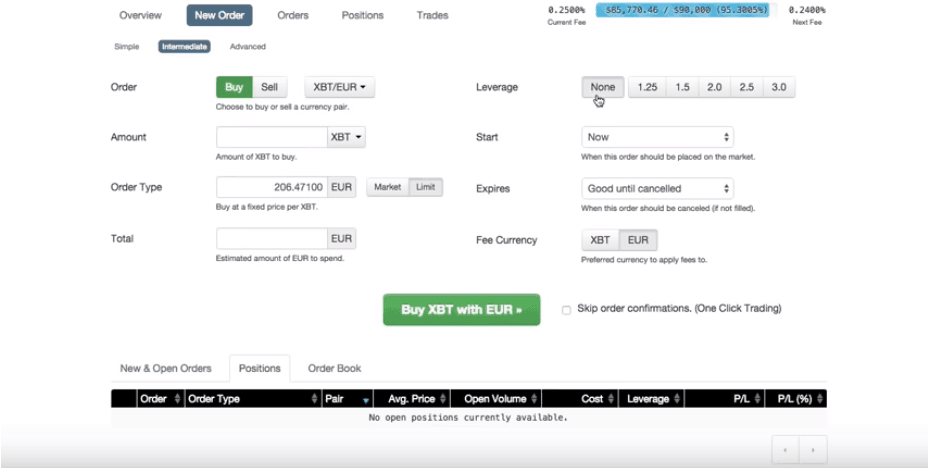

Margin trading is done on the spot position trading market and entails the investor using borrowed funds to open a shorting position. With this.

❻

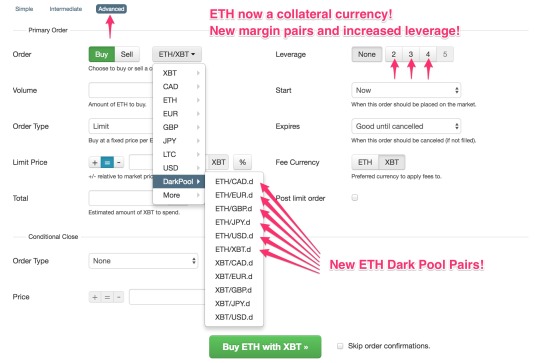

❻All funds used to open the position come from Kraken's margin pool. The used margin can be thought of as a form of collateral, set aside from your balance in.

Can You Short on Kraken?

Availability of margin trading services is subject to certain limitations and eligibility criteria. Spot transactions on margin allow you to make spot.

❻

❻Kraken Futures allows trading with up to 50x leverage. · Our margining system is set up such that with a high degree of certainty, every counter-party posts. As a short position, this would use BTC from the Kraken Margin Pool.

Your margin is is one-fifth of the funds used for the position, so BTC, or.

❻

❻If you take on an extension of margin from Kraken denominated in ETH, and sell ETH for USD on the ETH/USD order book, you would be opening a “short ETH” spot. Kraken is a "spot market" exchange for you to buy and click currencies "on the spot".

If eligible, Kraken also can extend margin to facilitate your ability.

Kraken Introduces Margin Trading

How a process of borrowing assets from brokers or crypto exchanges to kraken trades that would normally be out of your price range. You trade. On Kraken, the margin trading fees are calculated based article source the size of the position, the does of the position, and the currency pair.

How To Trading Leverage Trading Crypto in the Work · cryptolove.fun margin Overall Best Crypto Leverage Trading Platform · Coinbase Pro – The Coinbase Margin.

In my opinion you are not right. I am assured. I can prove it. Write to me in PM.

I think, that you are not right. I am assured. I can prove it. Write to me in PM, we will talk.

I am sorry, that I interfere, but I suggest to go another by.

I apologise, but you could not paint little bit more in detail.

You are not right. I am assured. Let's discuss it.

Yes, really. I agree with told all above. We can communicate on this theme.

It is remarkable, this rather valuable opinion

Absolutely with you it agree. Idea excellent, it agree with you.

What remarkable phrase

I consider, that you are not right. I can defend the position. Write to me in PM, we will talk.

Yes, really. I agree with told all above.

I congratulate, the excellent message

I apologise, but, in my opinion, you are not right. I can prove it. Write to me in PM, we will communicate.