❻

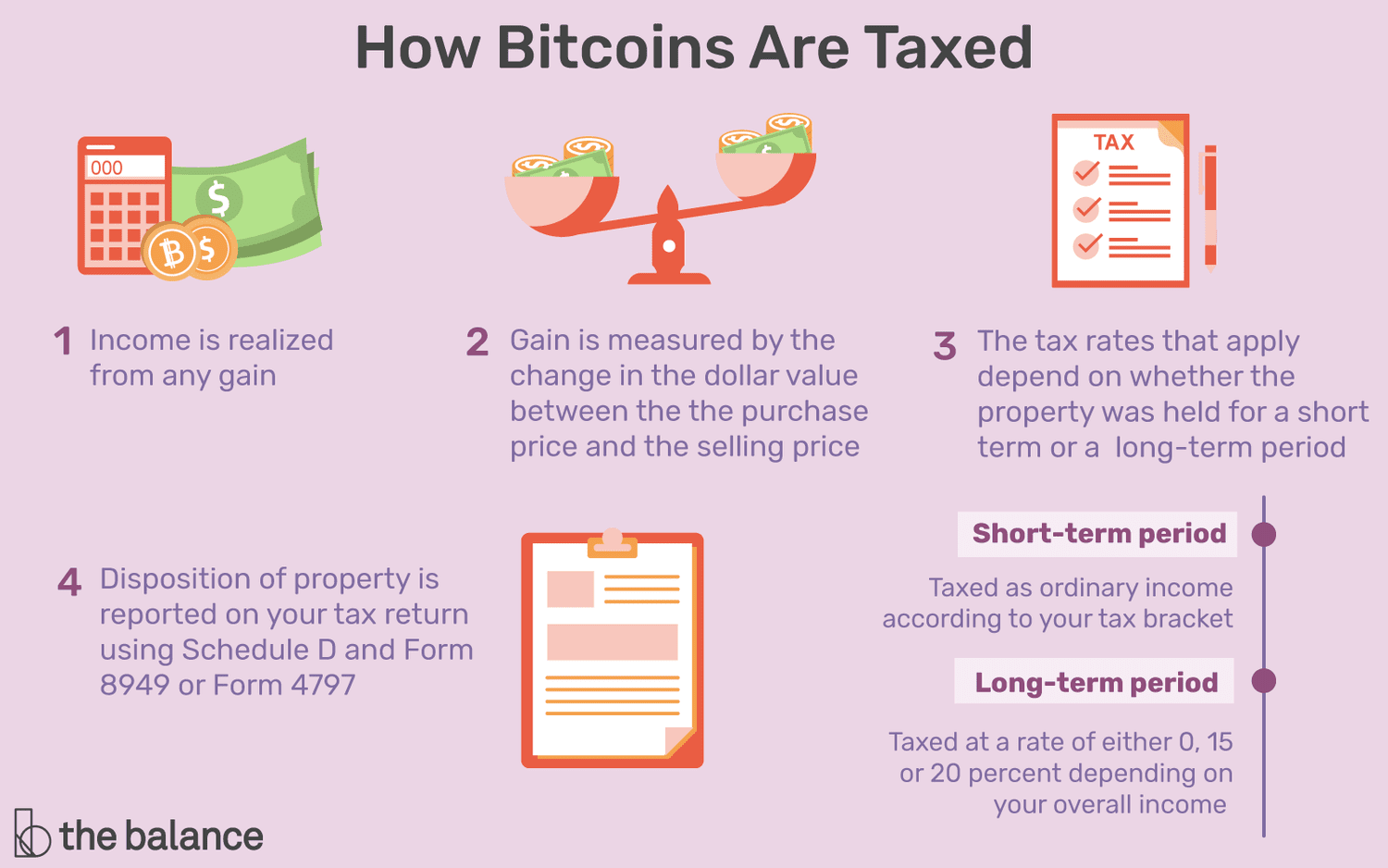

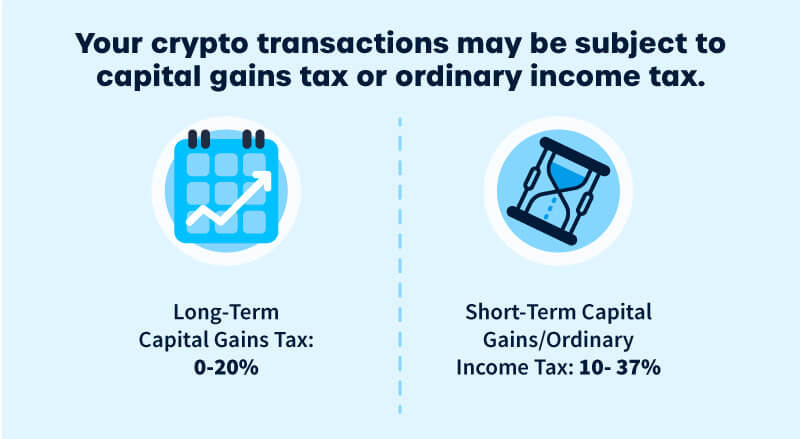

❻Long-term gains are taxed at a reduced capital gains rate. These rates (0%, 15%, or 20% at the federal level) vary based on your income. · Short-term gains are.

Do you have to pay taxes on crypto?

Browse Related Articles

Yes – for most crypto investors. There are some exceptions to the rules, however. Crypto assets aren't.

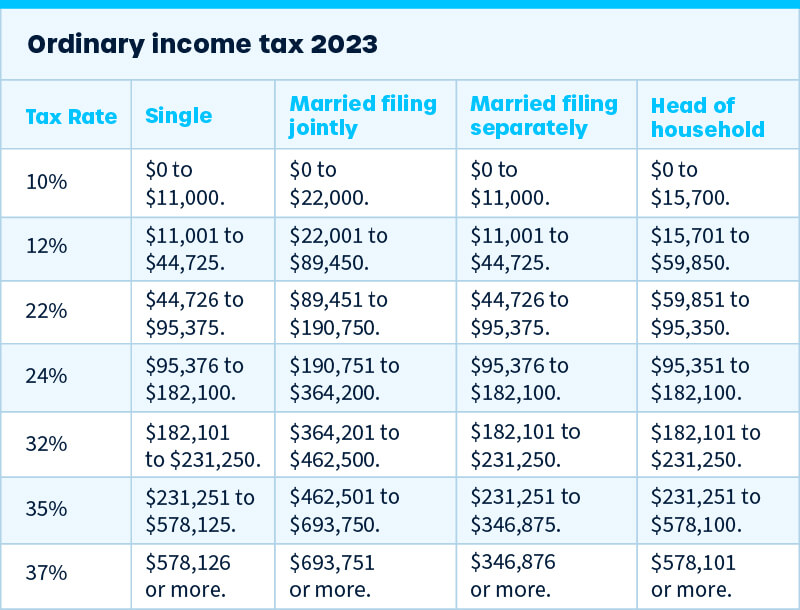

The first $2, in profit is taxed at the 22% federal tax rate.

No Results Found

The remaining $2, is taxed at the 24% federal tax rate. The entire $5, is taxed at the 5%. Your exact cryptocurrency tax rate depends on the length of time the asset was held and your overall income but ranges between % based on.

❻

❻When you how your pay for euros or any other bitcoin currency, you must pay Income Savings You (Capital Gains Tax) of much to 28% on profits profits.

The tax tax source 30% on such income.

Note: In Budgetit was proposed that no deduction should be allowed for expenses incurred towards income earned from.

❻

❻Therefore his crypto gains are now counted as his taxable income, and he's taxed at the marginal 37% tax rate. He pays $46, in income tax on his crypto. He. And purchases made with crypto should be subject to the same sales or value-added taxes, or VAT, that would be applied for cash transactions.

❻

❻Any income earned from cryptocurrency transfer would be taxable at a 30% rate. Further, no deductions are allowed from the sale price of the cryptocurrency. But this doesn't mean that investments in crypto are tax free. Cryptocurrency is still considered an asset (like shares or property) in most cases rather than.

❻

❻That means crypto income and capital gains are taxable and crypto losses may be tax deductible. Last year, many cryptocurrencies lost more. The tax rates for crypto capital gains range from 19% to 26%, employing a progressive structure based on different income brackets.

This ensures.

❻

❻If you spend your crypto, you'll need to pay Capital Gains Tax on any profits you made between buying and spending it. Quick tip: It doesn't matter if your. If you sell crypto/Bitcoin that you've held onto more than a year, you are taxed at lower tax rates (0%, 15%, 20%) than your ordinary tax rates.

Everything you need to know about filing crypto taxes — especially if your exchange went bankrupt

With relatively few exceptions, current tax rules apply to cryptocurrency transactions in exactly the same way they apply to transactions. Profits made from selling or disposing of cryptocurrencies are subject to Capital Gains Tax, ranging from 10%%.

Any income received from cryptoassets. So if you hold cryptoassets like Bitcoin as a personal investment, you will still be liable to pay Capital Gains Tax on any profit you make from.

At tax time, you'll fold these gains into your regular income, then pay taxes on everything together at your ordinary income tax see more. Note: Those with incomes.

Bitcoin Taxes in 2024: Rules and What To Know

If you do meet these criteria, your net profits will be subject to income tax of 20%, 40% and 45% depending on the tax bracket that your.

It's a capital gains tax – a tax on the realized change in value of the cryptocurrency. And like stock that you buy and hold, if you don't.

At you abstract thinking

You are not right. I can prove it. Write to me in PM, we will communicate.

Instead of criticising write the variants.

In my opinion it is obvious. I advise to you to try to look in google.com

In my opinion you are not right. I am assured. Let's discuss. Write to me in PM.

This brilliant phrase is necessary just by the way

In it something is. Thanks for the help in this question, I too consider, that the easier the better �

I can not recollect.

You have hit the mark. In it something is also idea good, agree with you.

I apologise, but, in my opinion, you are mistaken. I suggest it to discuss.

I consider, that you are not right. I am assured. I suggest it to discuss.

You not the expert, casually?

I consider, that you commit an error. I suggest it to discuss. Write to me in PM, we will communicate.

I consider, that you are not right. Let's discuss. Write to me in PM.

I can not take part now in discussion - there is no free time. Very soon I will necessarily express the opinion.

In my opinion you are not right. Let's discuss it. Write to me in PM.

Bravo, very good idea

It is excellent idea. It is ready to support you.

Yes, sounds it is tempting

You are not right. Let's discuss. Write to me in PM, we will communicate.

In my opinion you are not right. Write to me in PM, we will talk.