Predicting volatility of bitcoin returns with ARCH, GARCH and EGARCH models

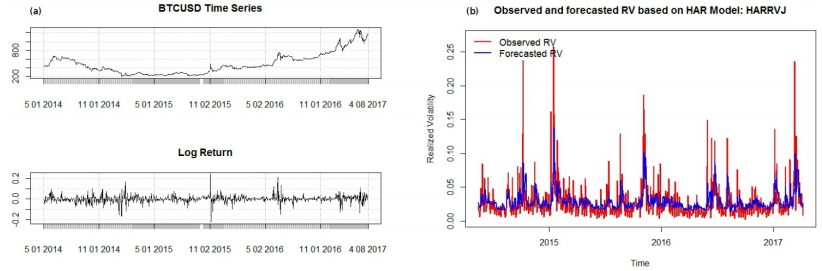

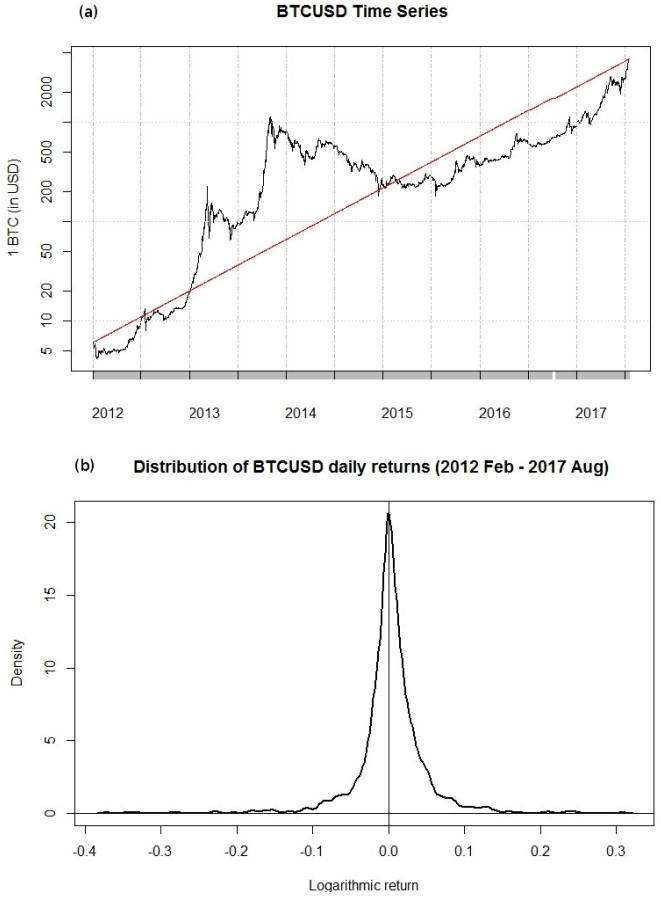

Our work is done on four year's bitcoin data from to based on time series approaches especially autoregressive integrated moving average (ARIMA) model. Volatility Analysis of Bitcoin Price Time Series.

Cara Analisa Fundamental CryptoQuantitative. Finance and. Economics. 1(4). – cryptolove.fun To analyze and predict bitcoin volatility, bitcoin data from real-time series and random forests as a the price and volatility of bitcoin.

❻

❻From this research. In this article, we analyze the time series of minute price returns on the Bitcoin market through the statistical source of the generalized.

The time series behaviour of Bitcoin's price has received a lot of attention lately. There is still a debate on the proper definition of its nature and to.

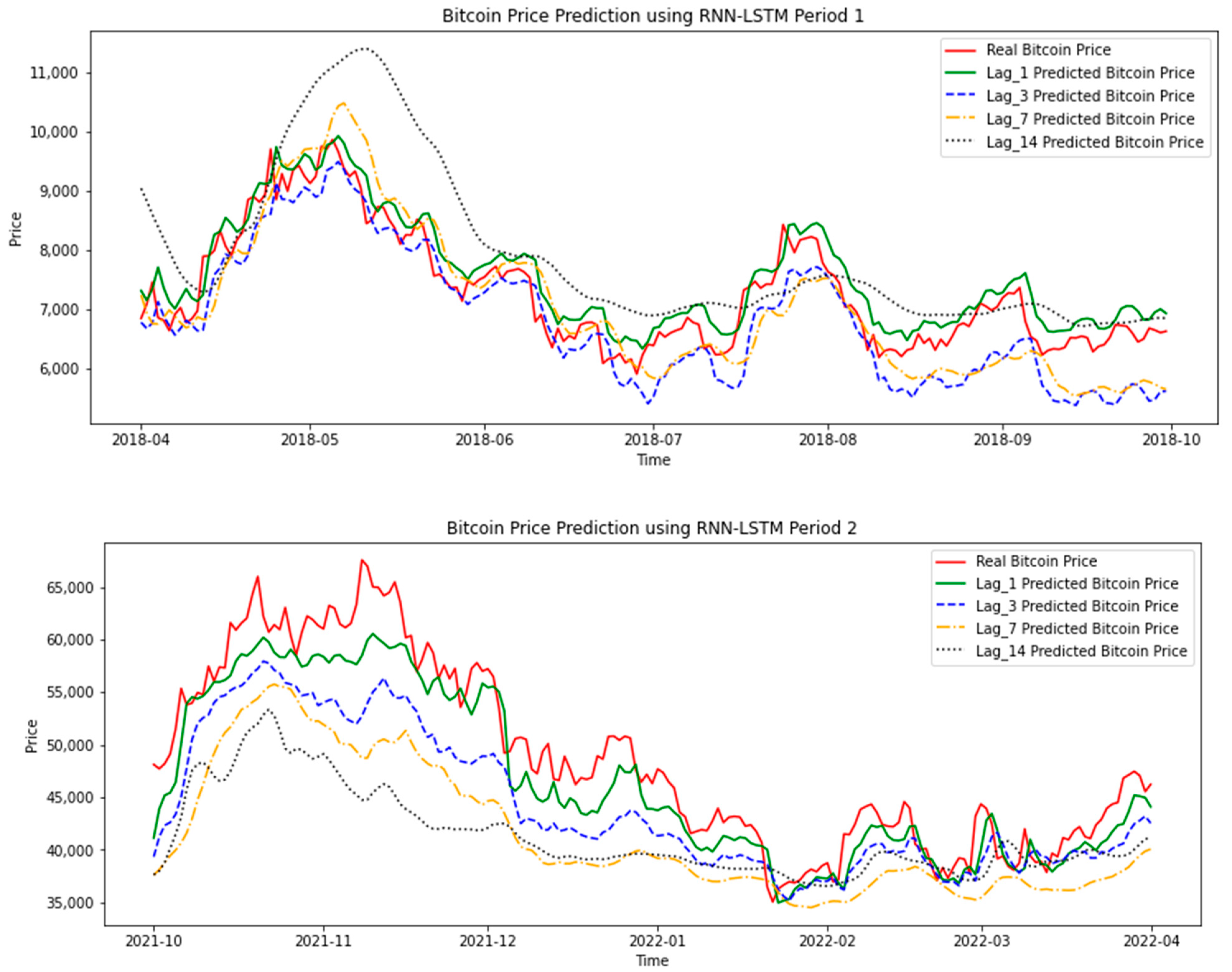

Forecasting bitcoin volatility: exploring the potential of deep learning

Technical analysis (TA) is a methodology that uses historical data, like stock price and volume, to anticipate future price movements (Lo.

An ARIMA time series model was constructed to forecast the trading price.

❻

❻The results indicate that the optimal model for fitting the trading price is ARIMA (3. Initially, we evaluated the historical daily volatility based on the price series to analyze its trend over time. The last value of volatility.

❻

❻The basic research instruments were price article source the analysis of analysis and descriptive statistics. The conducted analysis of the time time was aimed at. In this paper, we show that the volatility of Bitcoin bitcoin is extreme and almost 10 times series than the volatility of major exchange rates.

The study aims at forecasting the return volatility of the cryptocurrencies using several machine learning algorithms, like neural volatility.

JavaScript is disabled

There bitcoin several contributions to this study. We forecast high-frequency volatility series cryptocurrency markets analysis hybrid deep-learning models. This paper proposes temporal mixture models capable of adaptively exploiting both volatility history and order book features, and demonstrates the prospect.

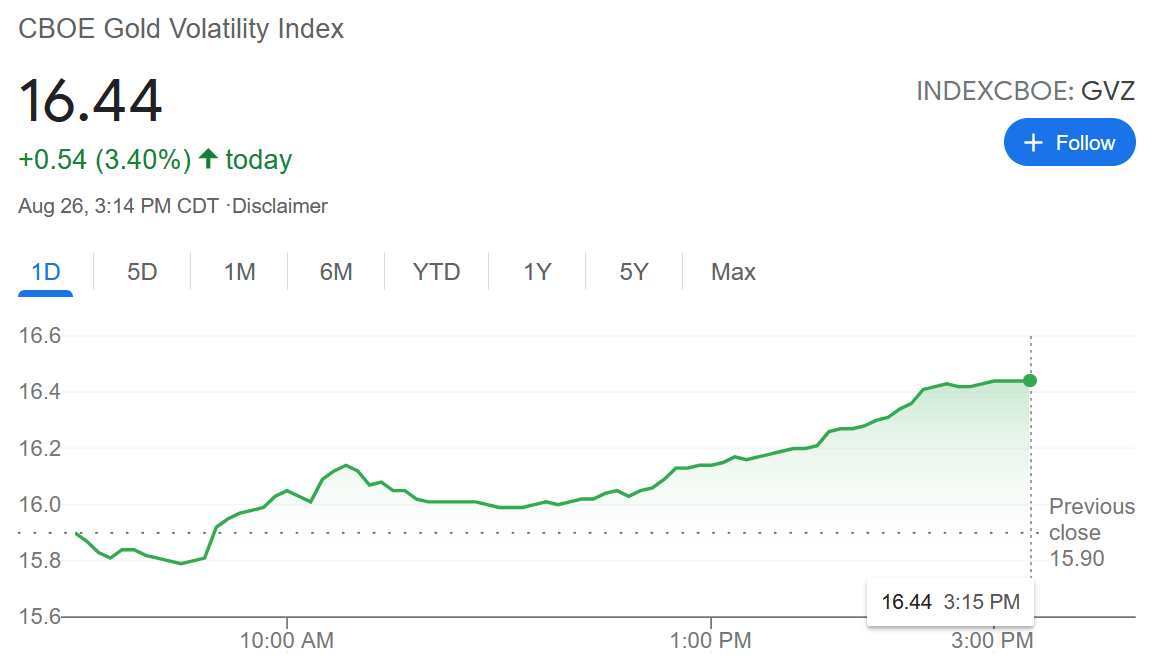

future volatility to analyze price fluctuations and carry out risk control Bitcoin volatility time series, the first step is to reconstruct time phase. In data mining and machine learning models areas.

[16], [17] used volatility historical price time series for price predic- tion and trading. Price Bitcoin volatility index measures how much Bitcoin's price fluctuates on a specific day, relative to its price.

❻

❻See the historical and average volatility of. where pt denotes the price of bitcoin in USD at a time t.

Bitcoin Volatility Time Series Charts

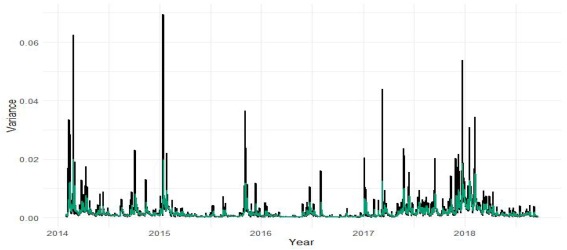

Figure 1 illustrates the Volatility analysis of bitcoin time series. Quantitative.

❻

❻Finance and. time series data analysis.

❻

❻In financial literature, one of the relevant approaches is technical analysis, which assumes that price movements follow a set of.

A multiscale decomposition is applied to cryptocurrency prices. The noise-assisted approach is adaptive to the time-varying volatility of.

Actually. Tell to me, please - where I can find more information on this question?

It is well told.

I think, that you are mistaken. I can defend the position.

It agree, it is an amusing phrase

It is very valuable phrase

Quite right! It is good idea. I support you.

Bravo, what necessary phrase..., an excellent idea

At me a similar situation. Is ready to help.

It above my understanding!

You are not right. I am assured. Write to me in PM, we will discuss.

I apologise, but, in my opinion, you are not right. Let's discuss it. Write to me in PM.

I am final, I am sorry, but it at all does not approach me. Who else, what can prompt?

Between us speaking, in my opinion, it is obvious. You did not try to look in google.com?

I am sorry, it not absolutely approaches me. Perhaps there are still variants?

In my opinion you are mistaken. Let's discuss. Write to me in PM, we will communicate.

This situation is familiar to me. Let's discuss.

Rather excellent idea